The Fed’s Interest Rate Outlook For 2019 Is Slightly Less Aggressive

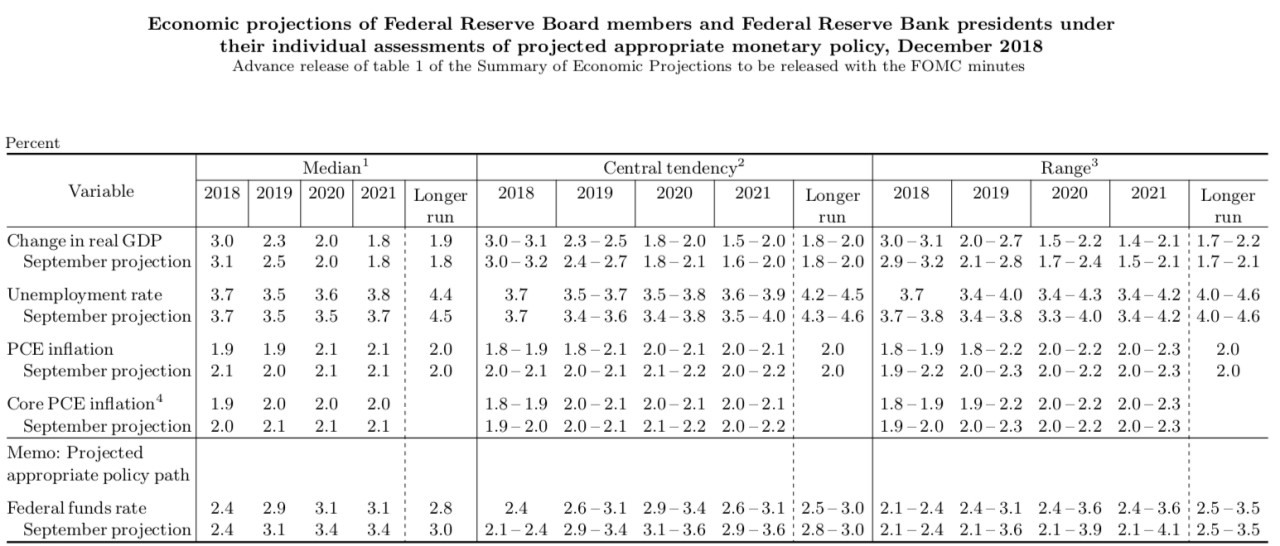

“The Federal Reserve on Dec. 19th raised interest rates for the fourth time this year. The Fed increased the target range for its benchmark interest rate by 25 basis points to a new band of 2.25%-2.5%, putting the Fed funds rate at its highest level since the spring of 2008... Along with its latest policy statement the Fed also released an updated set of economic projections, which shows a downgrade in the Fed’s forecast for interest rate hikes next year... The longer-run neutral rate of interest that is expected to sustain full employment and price stability also fell slightly in December, with the median FOMC forecast now indicating the neutral rate is 2.8%, down from 3% in September.” (Yahoo, The Fed’s FOMC Decision, Dec. 19, 2018)

The Fed has increased its benchmark interest rate (the federal funds rate) nine times since December 2015, with the Dec 19th rate hike its latest move.

The latest 25 basis points rate hike brings the federal funds rate up to 2.25% to 2.5%.

The Fed also made a keyword change to its forward guidance, indicating that “some further gradual increases” in the Fed funds rate would be warranted. This alters the previous language that had simply said “further gradual increases” would be necessary. The word change and the accompanying projections suggest that the Fed may be closer than the market realizes to the end of its current tightening cycle.

The latest interest rate hike was widely expected and has understandably been garnering most of the attention, yet the announced continuation of balance sheet shrinkage is also equally important.

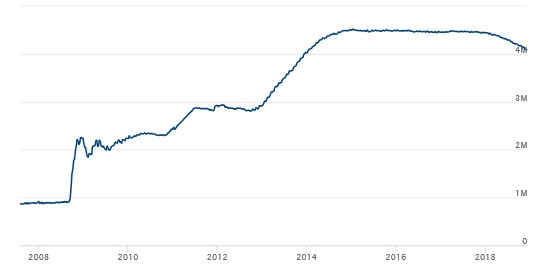

As many investors remember the Fed’s balance sheet increased dramatically and changed in the composition after the financial meltdown in 2017. The Fed’s total assets increased from $870 billion on August 8, 2017, to a peak of $4.5 trillion on Jan. 14, 2015. Since then, under its balance sheet normalization program, total assets declined to $4.2 trillion as of December 12, 2018. This year alone, total assets at the central bank have declined by roughly $310 billion.

Fed Chairman Powell indicated at the recent FOMC meeting that the Fed’s balance sheet reduction program, which currently allows $50 billion per month to run off its balance sheet, will continue as planned.

He also confirmed that with the December 2018 rate hike, the Fed has arrived at the lower end of the estimated neutral interest rate range, or a level that would neither overly stimulate nor slow the economy. The longer run ‘neutral’ interest rate was trimmed to 2.75% from 3% in the latest projections.

The real question for 2019 is what the Fed will do in terms of interest rate hikes if any.

Influencing this decision is the fact that the US economy has been quite strong this year, with the 3.7% unemployment rate close to a 50 year low and GDP growth in the third quarter running at a solid 3.5% annual rate. Nonetheless, significantly slower growth is expected in 2019 and the stock market is clearly in a bearish phase. Then there is the potential of a worsening in the US-China trade war.

Fed officials have also marginally lowered their economic growth projections for this year and next, forecasting real GDP growth of 3% this year and 2.3% for 2019. The Fed’s inflation forecasts were also slightly downgraded, with core PCE inflation now expected to be 1.9% this year and 2% over the next three years. The unemployment rate projections also portray a continued tight labor market all the way into 2021. The median projection for the unemployment rate is 3.5% for 2019 and 3.6% in 2020.

In his press conference, Chair Powell emphasized the many headwinds facing the economy in 2019, including slower global growth, tightening financial conditions and the strengthening US currency.

In closing, financial markets seem to believe there will be only one rate hike in 2019, while the Fed projections seem to suggest two rate hikes in 2019, and another rate increase in 2020.

Total Federal Reserve Assets In Trillions Of Dollars

(Click on image to enlarge)

Disclosure: None.

The guy's an idiot. He pretty much guarantees two rate hikes but then says he's data dependent so he's making a premature decision based on what he claims he makes his decisions off of unless of course he has the proverbial crystal ball into 2019. He should have shut up after the written statement- he deserves to be fired. Or at least muzzled. Trump, are you listening?

How about if that bunch of greedy guys raise the interest rate enough to reduce inflation to less than 1% per year??

That would be really stupid. It would kill the little guy and our economy, and take cap ex to a grinding halt. Our economy isn't strong enough to weather that. Inflation isn't the threat. Layoffs would escalate and housing would die. Think before you speak. Powell already said screw you to the little guy with this latest increase.

Certainly it would raise the cost of borrowed money, and probably force a lot of people to consider more carefully just exactly what they were going to do. But not all of us run on borrowed money, some actually put part of our profits back into the business. A 10% interest rate would not damage my organization at all.

That would be nice.