The Fed Is Way Behind The Curve

The inflationary move we predicted is now well underway.

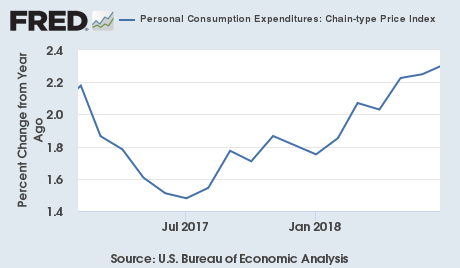

There are numerous inflation measures but the one the Fed primarily focuses on is the Personal Consumption Expenditures Deflator, or PCE Deflator. That metric hit 2.3% year over year in July. Well above the Fed’s 2% inflation target.

That chart is in a STRONG uptrend.

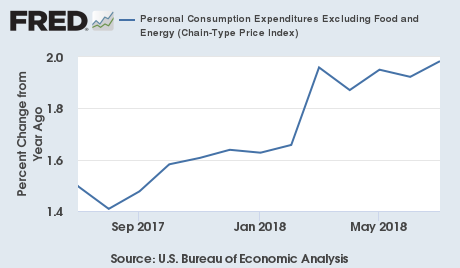

The other inflation measure the Fed focuses on is the Core Personal Consumption Expenditures or Core PCE. That metric hit 2% year over year in July… right smack on the Fed’s target rate of 2%.

Here again, we see a VERY strong uptrend underway.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.

Good stat to note. The good news is housing prices are leveling off, however, since it is artificially undervalued by the Fed it will not be that much of a benefit against inflation. As the trade war rages on, inflation will get worse. Then Trump will rally against the Federal Reserve for raising rates which it should do. I hope he is forced to pick up a book on economics sometime.