The Fed Assumes A Soft Landing In 2022

“What would it take to knock the U.S. recovery off course and send Federal Reserve policymakers back to the drawing board? Not much — and there are plenty of candidates to deliver the blow. From one direction: U.S. debt-ceiling deadlock, China property slump or simply an extension of Covid caution could hit growth and jobs — taking the Fed’s proposed taper of bond purchases off autopilot and pushing its first interest-rate increase back to 2024 or later. From the other: Sustained supply-chain snarl-ups could keep inflation stubbornly high and unmoor inflation expectations — forcing an acceleration of the taper, and an early rate liftoff in 2022.” (Bloomberg, September 22, 2021)

“The tone of Powell’s press conference (September 22) was more hawkish than the statement itself. The Fed Chair revealed that, in his view, the substantial further progress test that they’d been looking for in order to taper asset purchases has been “all but met”. Moreover, “many” on the committee think it already has been met.” (Taylor Schleich and Warren Lovely, National Bank Financial, Sept. 22, 2021)

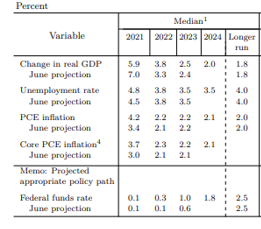

The Federal Reserve’s ambitious soft-landing scenario is highlighted in its recent “median” set of projections of US economic growth.

As of the fourth quarter of each year, real GDP growth (year over year calculations) is projected to expand at 5.9% in 2021, 3.8% in 2022, and 2.5% in 2023.

Fed officials also estimate that the American economy will still grow at a rapid 5.9% pace this year, even though the economy slows in the second half of the year as the benefits from previous declining social distancing fades away. Nonetheless, the Fed officials see growth gradually slipping lower to 3.8% in 2022, 2.5% in 2023, and to 2% by 2024.

The latter year economic growth rate projections are still slightly above the estimated longer-term potential of the US economy. In other words, with monetary policy still assumed to be supportive, real GDP growth though slowing over the next couple of years, will mostly exceed the estimated benchmark rates of expansion.

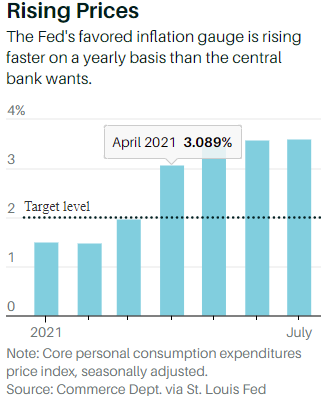

The Fed’s near-term outlook for inflation may still seem somewhat higher than the markets are comfortable with, with the PCE inflation rate reaching 4.2% in the fourth quarter of 2021, though inflation is projected to trend down to 2.2% over the next two years. Fed officials continue to believe that the recent spike in inflation is only transitory.

The US unemployment rate is projected to average about 4.8% at the end of this year and slowly trend down to about 3.5% by the end of 2023.

The federal funds benchmark rate is assumed to remain quite low over the entire forecast horizon, averaging 0.1 % at the end of 2021, 0.3% at the end of 2022 and 1% at the end of 2023.

Nonetheless, despite the low policy rate scenario, recent Fed policy statements acknowledge that it will soon begin moderating the pace of its asset purchases.

In other words, the FOMC has clearly set the stage for tapering down its bond purchases, and its somewhat rosy inflation and economic outlook scenario is certainly consistent with the tapering outlook.

Indeed, Fed Chairman Jerome Powell’s soothing message to the financial markets have been deliberately calibrated to avoid spooking the markets.

It should be recalled that back in 2013, the Fed surprised the Wall Street by announcing that it was starting to curtail bond purchases. Because of the surprise announcement of QE tapering, investors poured out of the bond market and yields rose sharply.

The sharp spike in yields during the summer of 2013, an event that lasted about 4 months, became know as the taper tantrum of 2013.

So when Fed officials signaled at the Sept 21-22 policy meeting that interest rates could begin to move up faster and earlier than previously expected, they hoped to avoid a tapering panic of 2021 and 2022. That is, “If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.”

Up to recently, the Fed has been purchasing $120 billion of monthly Treasury and mortgage-backed securities to support the recovery from the Covid-19 economic downturn.

In closing, the soft-landing scenario very much depends upon the US achieving broad immunity to COVID-19 by the end of 2021. Any unexpected problem in this area, for example, a new viral variant, could torpedo the dream of a soft economic landing.

![]()

Note most of the Fed’s macro projections are based on fourth-quarter over fourth-quarter rates of change. The unemployment rate projections are for the average in the fourth quarter. The fed funds rates are as of year-end.

The policies of the federal reserve bankers have been helping those who really don't need the heap and hurting those who are the most suscepable to being hurt. Incomes are rising for those who were already doing well, and this is in turn raising prices for those who were already marginalized. Does anybody else see a problem with that process? What it has been doing for a very long time is assuring that the rich get richer and the poor get the worst of the dregs. There needs to be arather fundamental adjustment in policy.

What will it take to make that happen?? Probably a bit of unpleasantness worse than what we have seen thus far, but I hope not.