The Fed And Market: Unintended Tariff Consequence

Tariff Pass-Through To Prices And Inflation

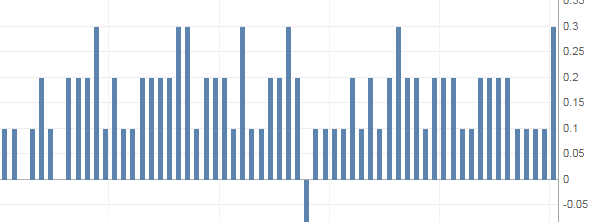

If anybody noticed the core-CPI that we pointed out in our last note, it jumped to its highest readout in more than a year. I think the main driver: Companies finally having to pass along tariff costs to customers. That's leading to rising prices and we are only one datapoint in. The Fed plans to cut rates at month's end but they have a PCE Price datapoint staring them down the day before. It appears there's more risk out there then the market is pricing in.

The Recent Inflation Pop

So far the Fed talked very little about this clear jump in inflation data. To me that's shocking. I've spoken with other economic experts and they also are stunned.

Next Inflation Event One Day Before Fed Decision

PCE-Price is the next inflation datapoint. PCE-Price is actually more important to the Fed historically than Core-CPI.

PCE-Price reports on July 30th.

The next Fed decision is on July 31st.

I don't think people are thinking about how big that number is.

If PCE-Price jumps like Core-CPI just jumped then that next Fed decision is going to get affected.

I would guess that the Fed probably cuts rates at this next meeting after all their previewing. If they don't cut they know they crash markets. But if there's a strong inflation read-out the day before I would guess they can change the language of their July 31st release. They'd put in language that this rate cut is more one-timish in nature and going forward they'll be data dependent.

(I don't expect them to literally use the term "one-timish." I'd love to see it though.)

In the recent meeting with Congress, Fed Chair Powell was very dovish, which makes investors think they plan multiple cuts this year.

A jump in inflation data should most-certainly change that.

Powell Hints Today That Piece Of Data Could Jump

In today's speech Fed Chair Powell hinted that the core PCE through June should be 1.7%. But core PCE through May was 1.6%. That tells you there's a chance for upside in that datapoint that comes the day before the Fed decides on rates and the language in their release.

I would say on the bullish side that means Fed Chair Powell is planning to cut rates even if short-term inflation looks up. Very strange setup. When does a Fed chair throw traditional models out the window to cut anyway?

The reaction can go either way, but if bonds get hit on that it takes away the lower rate support for markets.

I would think that if the Fed stays dovish in the face of stronger inflation, bonds get hit.

Why's Inflation Jumping? Tariff Pass-Throughs

I know that the last CPI print was only one datapoint. There is no way to get a trend from one datapoint.

That said, it was a one datapoint jump coincidently after a couple of months of increased tariffs.

There were tariff increases in May and June. I think it's fair to say that is starting to seep into corporate price lists and getting passed down the supply chain to consumers and customers. That's starting to hit end market pricing.

One category that saw a month-to-month jump in CPI prices was apparel. That sector is one of the more exposed to China sourcing. It's fair to think that some of the price increases are because of the tariff jumps on that merchandise sourced from China.

Inflation Impacts Rates which Impact the Stock Market

The Fed says their measure of inflation is running below 2% but core-CPI is running around 2%.

If tariffs are a near-term driver to the rate of inflation, inflation will drive Fed decisions. The market is at all-time highs due in large part to the Fed promising rate cuts at a time where jobs and inflation are fine.

Again that's very strange because jobs and inflation has always been the Fed's two primary pieces of data driving their decisions. They are ignoring their two main indicators.

The Wall Street Journal today also hinted that Powell is ignoring classic jobs and inflation data and instead looking to global growth to make decisions.

The WSJ said,

"...slowing growth abroad has likely set the stage for the U.S. central bank to cut interest rates despite strong labor markets and consumer spending at home."

In other words the Fed is ignoring their classic model. I don't love that. I can't believe that leads to good things.

If this Fed backs off from that rate cut plan (and they've wobbled back and forth many times) then I have to believe that takes support out of the market.

If they decide to get back to their classic models it would mean they step back from rate cuts.

Because this Fed has been extremely fickle I expect they can easily flip back and forth, this time to fewer cuts, or maybe none at all.

This week they are saying cuts. And next week? We have to stay tuned.

Tariffs And So Inflation Not Going Away So Fast

China just added a hardliner to their negotiating team. In response President Trump says the US-China negotiations have a "long way to go."

These tariffs and their impact on inflation data are only just beginning.

Inflation is a bond killer which means longer-term rates have the chance to finally surprise to the upside. That's a market risk pulling the low-rate support from markets.

Tariff-led inflation is a building bond and stock market risk.

Conclusion

The late 2018 market crash was due to Powell promising multiple hikes in 2019. The rally in early 2019 was because he backed off from that. This new high rally is because Powell implied he expects more rate cuts. If he backs off of that plan by simply getting back to the Fed's classic models, you tell me what's next.

Related Article: The Fed And The Market: Something's Not Quite Right

Ready to Nail Tech Earnings? Start your free trial today.

Disclaimer: Stocks reported by Elazar Advisors, LLC are ...

more