The Elephant In The Room – March Dividend Income Report

In 2016, I made a life-changing decision: I took a sabbatical, put my family in a small RV, and drove to Costa Rica.

Upon my return in 2017, I officially quit my job as a private banker at National Bank and started working full-time on my baby: Dividend Stocks Rock. I also decided to manage my pension account held at the National Bank. I’ve built this portfolio publicly since 2017 to make a real-life case study. I decided to invest 100% of this money in dividend growth stocks.

In August 2017, I received $108,760.02 in a locked retirement account. This means I can’t add capital to the account, and growth is only generated through capital gains and dividends. I don’t report this portfolio’s results to brag about my returns or to tell you to follow my lead. I just want to share how I manage my portfolio monthly with all the good and the bad. I hope you can learn from my experience.

I will wait for the Tariffs…

Waiting because you are unsure about the market is advantageous when everything goes down. You feel good about your decision to stay on the sidelines.

We all hate losing money, so not investing when the market is down 10% is a smart move.

The problem arises immediately: when do you invest? When will the bloodbath end?

Let’s discuss the elephant in the room this month!

Performance in Review

Let’s start with the numbers as of April 2nd, 2025 (in the morning):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $287,538.61

- Dividends paid: $5,148.90 (TTM)

- Average yield: 1.79%

- 2024 performance: +26.00%

- VFV.TO= +35.24%, XIU.TO = +20.72%

- Dividend growth: +12.22%

Total return since inception (Sep 2017 – March 2025): 164.38%

Annualized return (since September 2017 – 89 months): 14.75%

Vanguard S&P 500 Index ETF (VFV.TO) annualized return (since Sept 2017): 15.49% (total return 190.90%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 10.72% (total return 112.80%)

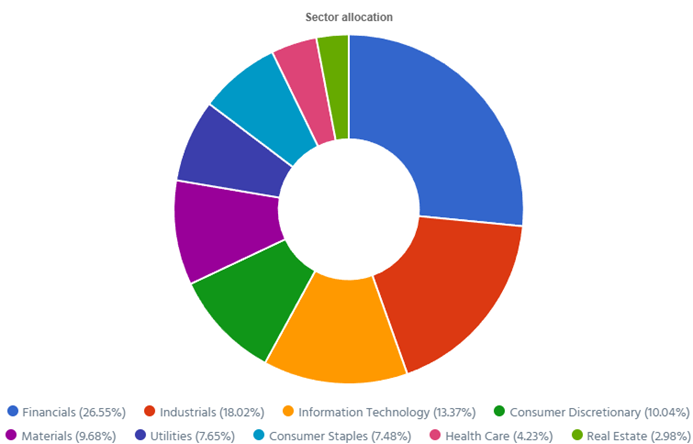

Dynamic sector allocation calculated by DSR PRO as of March 4th 2025.

The Elephant in the Room

I was happy to finish writing this newsletter on April 2nd. After all, I didn’t see the importance of waiting for the tariff announcement since we had already discussed tariffs way too many times over the past four months. However, after seeing the U.S. market drop by 10% in two days last week, I thought I should revisit the tariff war one more time before sending the finished version to you today.

I recall that during our last private webinar, Don, a DSR member, stated he would wait until April 2nd before investing. I teased him as I would my friends, over a cold beer.

Why not wait until April 2nd at 2:30 pm? I laughed. Or April 14th?

The point was to highlight that timing the market wasn’t an exact science and nobody knows when it’s the right time to invest. Plus, tariff announcements have been chaotic, to say the least, over the last two months. Trump said everything and the opposite a dozen times already.

Nonetheless, Don was darn right to wait.

He earned the bragging rights of waiting until we knew more about tariffs. But here’s the kicker…

What’s next?

Waiting because you are unsure about the market has an advantage when everything goes down. You feel good about your decision to stay on the sidelines.

We all hate losing money, so not investing when the market is down 10% is a smart move.

The problem arises immediately: when do you invest? When will the bloodbath end?

I woke up on Monday the 7th and market futures were pointing toward another big decline. I’ve seen -4%, -5% for some indices before the market opens. That was a lead for a third consecutive day, indicating a mid-single-digit decline in the market. That’s huge!

Then, at market close on Monday, the S&P 500 was about flat and the TSX down about 1%. Nothing to write home about.

So, all that fear for a -10% and then you can get back in the market? Or will it continue tomorrow? Or the week after?

I don’t have the answer for that. That’s why I remain 100% invested at all times. I don’t have to think about getting out or getting into the market.

In February, I wrote a newsletter for DSR members offering a game plan to tariff-proof your portfolio.

This game plan was built around three principles:

- Volatility & Risk management (know which kind of roller coaster you want to ride)

- Diversification (if you diversify, you don’t have to be right all the time)

- Putting metrics before the story (numbers are speaking facts, but the thesis could turn into fairy tales or nightmares).

If you’d like a simple 5-step process to protect your portfolio against Tariffs and other threats, tune in to the episode below.

We may indeed see the world’s economy change in the coming months or years. But twice in this newsletter, I wrote “companies and consumers will adapt to the new realities, and you must adapt as an investor as well.”

I will do nothing in the meantime

At the end of each year, I review my portfolio following a simple set of rules.

- Review my portfolio to ensure I am well-diversified across many sectors

- Identify weaker-rated stocks and make sure I still want to hold them

- Trim overweight positions

- Optimize my holdings with better-rated stocks using the DSR PRO replacement list

Since I just completed those steps a few months ago, I’m more than happy to keep my portfolio as is. While the storm hits my windows, I’m comfortably seated with a glass of wine, enjoying a good book.

Another edit (!!!)

On Wednesday, Trump announced a pause of 90 days to negotiate with several countries (almost all but not with China). The market jumped back up by some crazy numbers. That’s just one more reason to not try to figure out what will or will not happen in the coming months!

I have shared my thoughts on this new update in the Moose on the Loose episode below:

Smith Manoeuvre Strategy Update

It’s time for a little bit of spring cleaning for my Smith Manoeuvre. If you have been reading this chronicle for a while, you know I don’t trade much. I typically do two to four trades per year. I even went through an entire year without making any tweaks. However, I intend to be a lot more active with my SM portfolio.

My Smith Manoeuvre portfolio strategy is slightly different.

While I focus on the same strategy of investing in companies with robust dividend triangles who increase their dividends each year, I’m more aggressive in my stock selections and trading habits. Each month, I now borrow $750 from my Home-Equity Line of Credit (HELOC) to add capital to this portfolio.

The goal is to use leverage to my advantage over the next 30 years or more! Slowly, but surely, I transfer my existing mortgage into a tax-deductible debt through this process.

I can’t stress this enough: the Smith Manoeuvre strategy involves leverage, and it’s not for everyone. In fact, it’s probably only right for a very small percentage of the population.

Why low yield, high dividend growth wins the race

As you will see, I’ve sold some higher-yielding stocks and reduced my portfolio yield in March. The goal was to get closer to my core strategy of investing only in companies with low dividend yields, but high dividend growth potential. While my portfolio yield decreased from 4% to 3.5%, my 5-year CAGR dividend growth rate went from 8% to 11%.

I explained in the Dividend Income For Life guide that companies with the ability to increase their dividend by more than 5% per year, often show a unique set of robust financial metrics and tend to greatly outperform the market and higher yielding stocks. The experience continues!

Smith Manoeuvre Update

Slowly but surely, the portfolio is taking shape with 12 companies spread across 8 sectors. My goal is to build a portfolio of thriving companies with a solid dividend triangle (e.g. with positive revenue, EPS and dividend growth trends). The current portfolio yield is at 3.58% with a 5-year CAGR dividend growth rate of 11.02%.

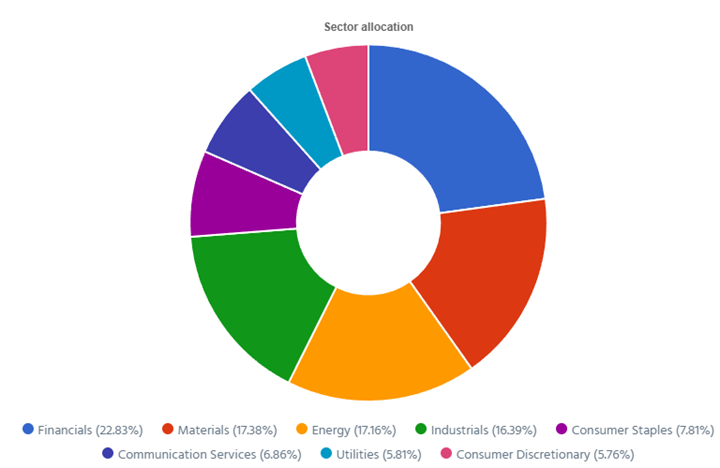

Dynamic sector allocation was calculated by DSR PRO.

I Sold Capital Power (CPX.TO) and TD Bank (TD.TO)

I sold both holdings at a profit and I still believe Capital Power and TD Bank are great companies. Please note that I am not suggesting I dislike those companies or that you should be alarmed by these trades. Keep in mind that CPX and TD were just a tiny portion of my overall assets (less than 0.5% each).

The idea with CPX is that I have another company in my portfolio with a similar profile (stable business model with a high yield), but with higher dividend growth prospects. As for TD, I already have sizeable positions in National Bank and Royal Bank. I wanted to diversify my portfolio with another company in the financial sector and get rid of a small position in a third bank.

Here’s my SM portfolio as of April 2nd, 2025, 2025 (in the morning):

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.TO | Consumer Staple | $1,441.00 |

| Brookfield Infrastructure | BIPC.TO | Utilities | $1,055.80 |

| Canadian National Resources | CNQ.TO | Energy | $3,116.05 |

| Canadian Tire | CTA.A.TO | Consumer Disc. | $1,048.60 |

| Exchange Income | EIF.TO | Industrials | $1,607.36 |

| Franco-Nevada | FNV.TO | Materials | $2,243.40 |

| Great-West Lifeco | GWO.TO | Financials | $972.40 |

| National Bank | NA.TO | Financials | $1,310.65 |

| Nutrien | NTR.TO | Materials | $921.70 |

| Telus | T.TO | Communications | $1,238.91 |

| Waste Connections | WCN.TO | Industrials | $1,397.75 |

| TMX Group | X.TO | Financials | $1,893.60 |

| Cash (Margin) | $42.72 | ||

| Total | $18,289.94 | ||

| Amount borrowed | -$16,000.00 |

I Bought Canadian Natural Resources (CNQ.TO) and TMX Group (X.TO)

I used the proceeds from the sale of CPX and TD on top of a fresh $750 to buy more of CNQ and TMX Group. CNQ has been beaten up as of late while the company continues to show an incredibly stable business model and it is profitable as long as the price of oil trades above $35 per barrel and rewards shareholders with generous dividend increases each year.

I have wanted to add TMX Group to my portfolio for a long while. What better opportunity to start a small position in my SM portfolio! TMX enjoys strong barriers to entry and benefits from a strong recurring revenue base. As long as there are lots of transactions on the market, X will generate solid cash flow!

Let’s look at my CDN portfolio. Numbers are as of April 2nd, 2025 (in the morning):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD.B.TO | Cons. Staples | $21,492.12 |

| Brookfield Renewable | BEPC.TO | Utilities | $10,405.14 |

| CCL Industries | CCL.B.TO | Materials | $13,455.96 |

| Fortis | FTS.TO | Utilities | $11,296.26 |

| Granite REIT | GRT.UN.TO | Real Estate | $8,435.20 |

| National Bank | NA.TO | Financials | $14,411.10 |

| Royal Bank | RY.TO | Financial | $10,550.80 |

| Stella Jones | SJ.TO | Materials | $14,148.45 |

| Toromont Industries | TIH.TO | Industrials | $14,112.44 |

| Cash | $1,134.77 | ||

| Total | $119,422.24 |

My account shows a variation of -$749.59 (-0.62%) since March’s income report.

Despite much uncertainty, the Canadian stock market has remained relatively strong since the beginning of the year. In fact, if you look at the iShares S&P TSX 60 (XIU.TO) between Jan 1st and April 2nd, the Canadian ETF is slightly positive (+2% including dividend).

When you put everything into perspective, it’s not a bad market after all (yet).

Here’s my US portfolio now. Numbers are as of April 2nd, 2025 (in the morning):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Apple | AAPL | Inf. Technology | $8,972.88 |

| Automatic Data Processing | ADP | Industrials | $11,586.96 |

| Brookfield Corp. | BN | Financials | $18,278.15 |

| Home Depot | HD | Cons. Discret. | $11,025.25 |

| LeMaitre Vascular | LMAT | Healthcare | $8,499.50 |

| Microsoft | MSFT | Inf. Technology | $17,946.95 |

| Starbucks | SBUX | Cons. Discret. | $9,304.59 |

| Visa | V | Financials | $17,253.50 |

| Waste Connections | WCN | Industrials | $14,655.02 |

| Cash | $0.00 | ||

| Total | $117,522.80 |

My account shows a variation of -$5,765.99 (-4.68%) since March’s income report.

The U.S. market has been more affected by the threat of tariffs than the Canadian market! The S&P 500 is down approximately 4% (including dividends) since the start of the year. Again, when I hear people talking about a “market drop”, I think it’s a big word. It is true that the SP 500 is flirting with the word “correction” these days, but it’s far from being the end of the world.

By definition, a market correction is when the index declines by 10% from its previous peak value. It happened in March, but we are staying around “-10%” depending on the day since then. It’s not good, but considering the S&P 500 just had two amazing years in 2023 and 2024, it’s only natural that adjustments will happen!

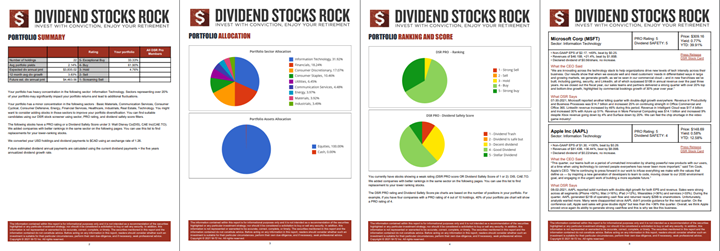

My Entire Portfolio Updated for Q1 2025

Each quarter, we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our special additional service, DSR PRO.

The PRO report includes a summary of each company’s earnings report for the period. I wanted to share my own DSR PRO report for this portfolio.

You can download the full PDF showing all the information about all my holdings. Results have been updated as of April 2nd, 2025.

DSR PRO Portfolio Report Example.

Download my portfolio Q1 2025 report.

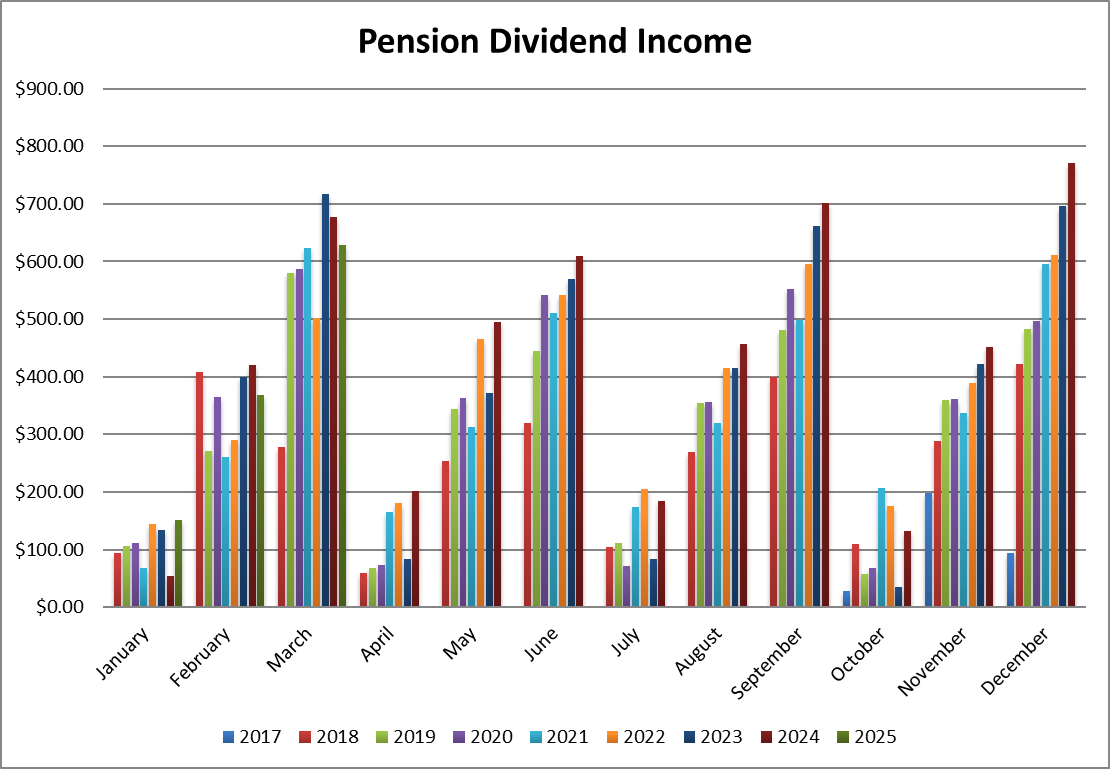

Dividend Income: $628.49 CAD (-7.2% vs March 2024)

Pension Dividend Income Month over Month since Inception.

While all my holdings increased their dividend vs. last year, my dividends are smaller (7%) vs. last year as I sold my shares of BlackRock and Magna International. On another note, I must highlight the huge USD/CAD jump (thanks to the tariffs!) for this month (+7% vs last year!).

| CDN DIVIDENDS: $324.79 | US DIVIDENDS: $212.30 |

| Granite REIT: $36.26 (+3.01%) | Home Depot: $69.00 (+2.2%) |

| CCL Industries: $44.42 (+9.4%) | LeMaitre: $20.00 (+25%) |

| Brookfield Renewables: $138.94 (+11.79%) | Microsoft: $39.01 (+10.67%) |

| Fortis: $105.17 (+4.24%) | Waste Connections: $23.92 (new) |

| Currency USD/CAD: 1.4305 (+6.9%) | Visa: $29.50 (+13.5%) |

| Brookfield: $30.87 (+11.65%) | |

| TOTAL DIVIDENDS RECEIVED: $628.49 (-7.2%) | |

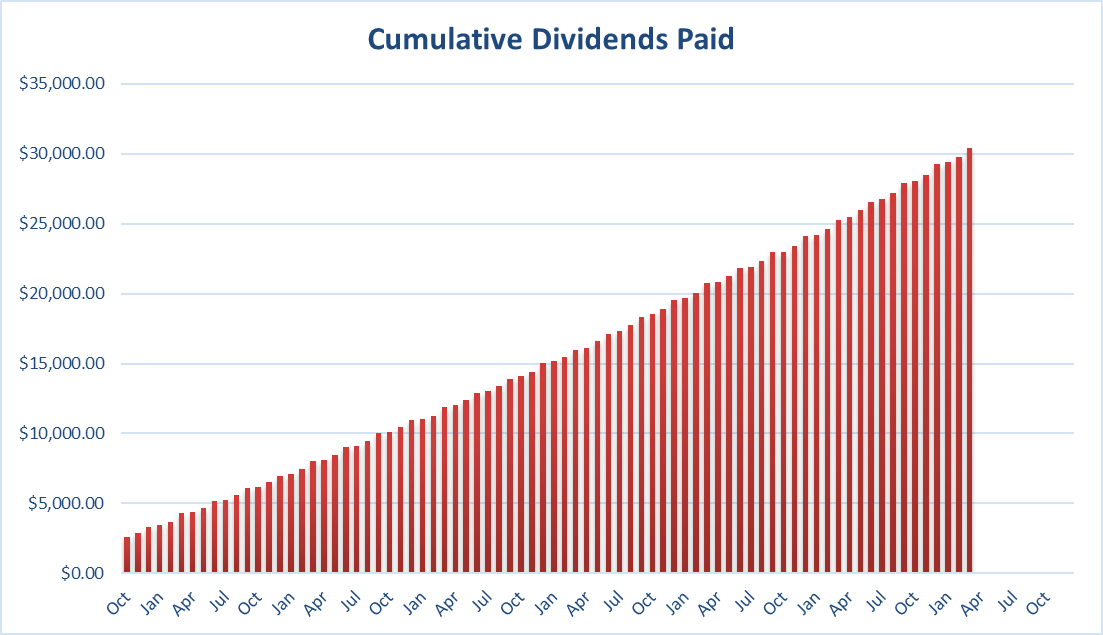

Since I started this portfolio in September 2017, I have received a total of $30,412.83 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Cumulative dividends paid since inception.

Final Thoughts

When I look at my portfolio, I’m ready to weather the storm in 2025! I don’t see any of my holdings that are likely to be in deep trouble over the coming months.

When the market declines, there is no place to hide if you want to stay invested. While your stocks go down, the dividend goes up and so does my conviction.

More By This Author:

This Isn’t Exciting - It’s Exactly The Point

Canadian Banks Ranking 2025 – Which Bank To Hold?

Quiet Giant: OZK Builds Wealth From The Ground Up