This Isn’t Exciting - It’s Exactly The Point

Image Source: Unsplash

In a world where flashy tech stocks rise and fall with headlines, this REIT quietly does what it’s always done—collect rent, pay dividends, and keep cash flowing.

This isn’t about rapid growth or reinvention. It’s about reliability, diversification, and a business model designed to weather storms. This is a name worth knowing.

Concrete & Contracts: The Core of NNN REIT’s Business Model

NNN REIT, formerly National Retail Properties, operates one of the most straightforward and effective business models in the REIT world: it buys and leases single-tenant retail properties under long-term triple-net leases.

These leases shift most property expenses—like taxes, insurance, and maintenance—to tenants, providing predictable, low-volatility income.

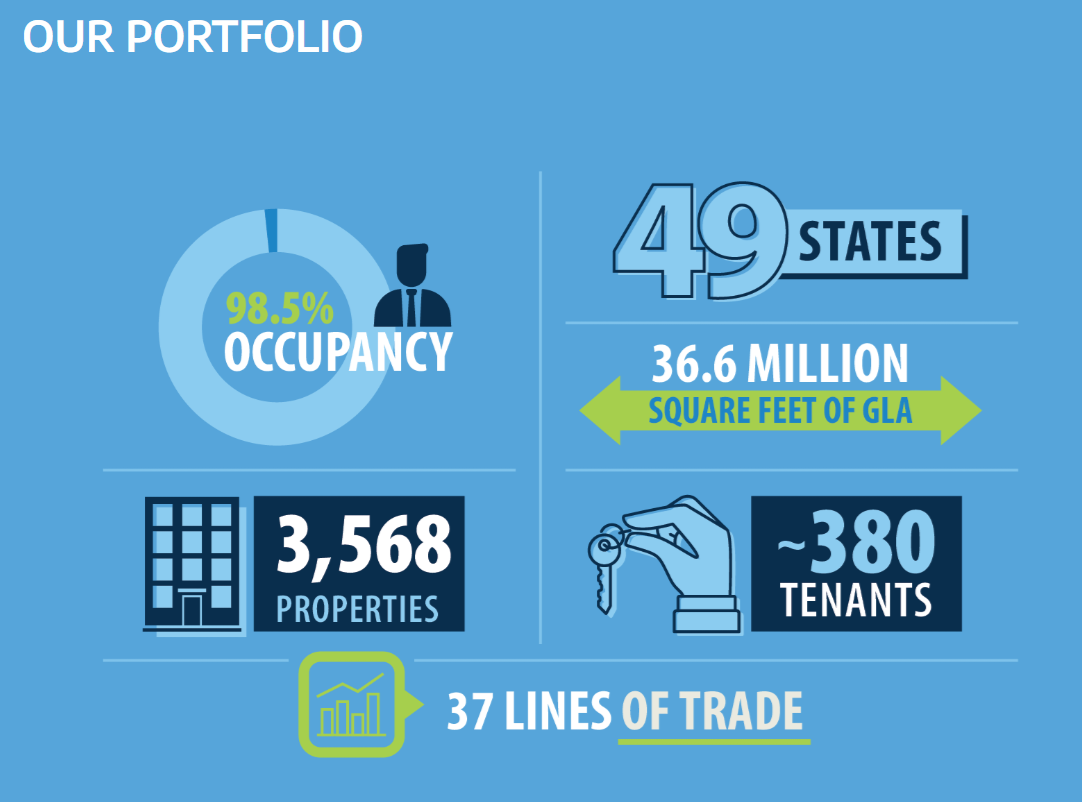

NNN owns 3,568 properties across 49 states, covering 36.6 million square feet. Its portfolio spans more than 370 tenants in 37 industries, including:

- Convenience stores (7-Eleven, Circle K)

- Quick-service restaurants

- Automotive service and parts

- Health & fitness centers

- Drugstores and medical services

- Pet supplies, home improvement, and entertainment venues

Its largest tenant (7-Eleven) accounts for just 4.4% of rental income. That’s diversification by design—and it helps explain NNN’s historical occupancy rate north of 98%.

NNN portfolio summary graphic. Source: NNN REIT.

The Bull and Bear Case for NNN

Bull Case: Diversified and Durable

NNN’s superpower is risk-spread simplicity. With thousands of tenants across dozens of industries—and no tenant dominating the rent roll—NNN has constructed a portfolio that practically hums with consistency.

- Occupancy? A rock-solid 98.5% as of Q4 2024.

- Exposure? Necessity-based businesses like gas stations and food services dominate.

- Volatility? Low, thanks to long-term leases with built-in rent escalators.

Even as retail real estate evolves, NNN’s mix of service-oriented tenants makes it less vulnerable to e-commerce disruption. Add to that a conservative balance sheet and well-managed acquisitions, and you’ve got a REIT that earns its income stripe.

Bear Case: Growth Pains and Market Sentiment

NNN hasn’t won the market’s heart lately for all its strengths. Its stock price still trails pre-pandemic highs, and growth remains modest—more crawl than sprint.

Revenue growth is slow, and AFFO (Adjusted Funds From Operations) has remained relatively flat. Rising interest rates make debt refinancing more expensive, eating into margins. And like many REITs, NNN is unlikely to deliver explosive capital gains—it’s mostly about income, not appreciation.

The bottom line? If you’re looking for growth, this REIT might feel more like a bond proxy than an equity rocket.

What’s New? Steady Income, Flat Growth—and a Look Ahead

NNN REIT’s most recent quarterly update, released on February 20, 2025, reflected another stable but unremarkable performance. Revenue rose by just 1%, with flat AFFO per share, mirroring the impact of higher interest rates and limited organic rent growth. The modest top-line increase came primarily from strategic property acquisitions, while NNN maintained its strong 98.5% occupancy rate across its portfolio.

Notably, the company released five properties during the quarter, highlighting its disciplined approach to asset management. Looking ahead, NNN provided guidance for 2025, projecting Core FFO between $3.33 and $3.38 per share and AFFO in the range of $3.39 to $3.44—signaling expectations for steady cash flow despite market headwinds.

And of course, the dividend kept rolling in—reliable as ever.

More By This Author:

Canadian Banks Ranking 2025 – Which Bank To Hold?

Quiet Giant: OZK Builds Wealth From The Ground Up

Paint It Green: Why Sherwin-Williams Keeps Brushing Up Gains

Lower highs and lower lows for years now.