The Best Of Times, The Worst Of Times -- The Global Economy Is At A Perilous Cross Road

“There are three negative supply shocks that could trigger a global recession by 2020. All of them reflect political factors affecting international relations, two involve China, and the United States is at the center of each. Moreover, none of them is amenable to the traditional tools of countercyclical macroeconomic policy.” (Nouriel Roubini, The Anatomy of the Coming Recession, Project Syndicate, August 22, 2019)

“In an environment of secular stagnation in the developed economies, central bankers’ ingenuity in loosening monetary policy is exactly what is not needed. What is needed are admissions of impotence, in order to spur efforts by governments to promote demand through fiscal policies and other means. (Lawrence Summers and Anna Stanbury, Whither Central Banking, Project Syndicate, August 23, 2019)

The world’s macro economies are simultaneously experiencing both the best of times and the worst of times.

For the advanced countries, the best of times paradigm is exemplified by the strongest job markets in decades.

As well, the more than decade long recovery from the Great Recession, which was fueled by extremely easy monetary policy and some fiscal easing, has spread throughout the developed world.

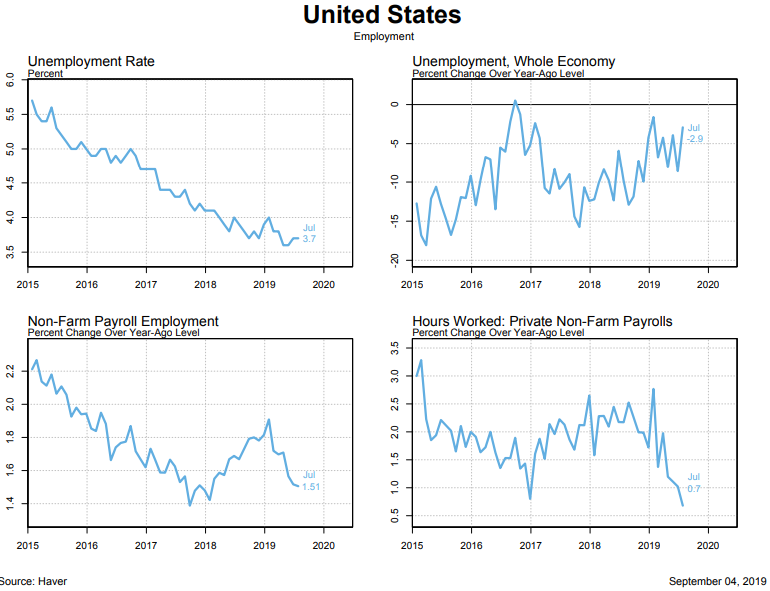

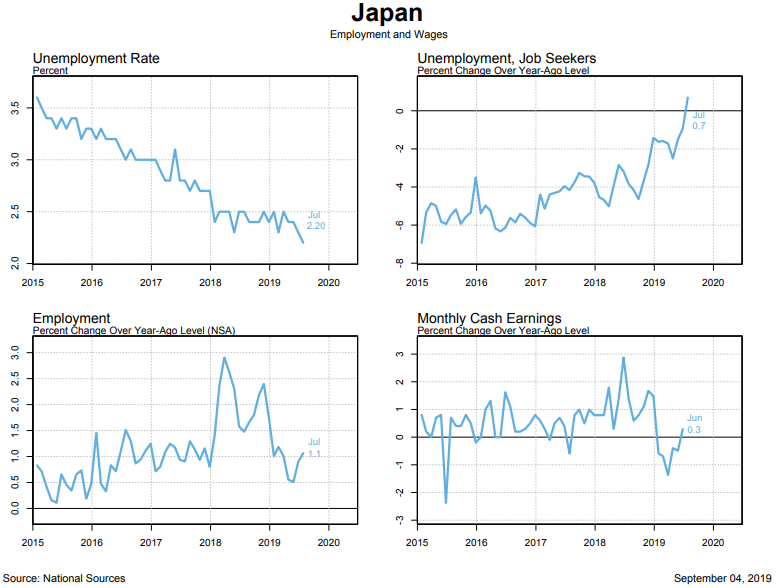

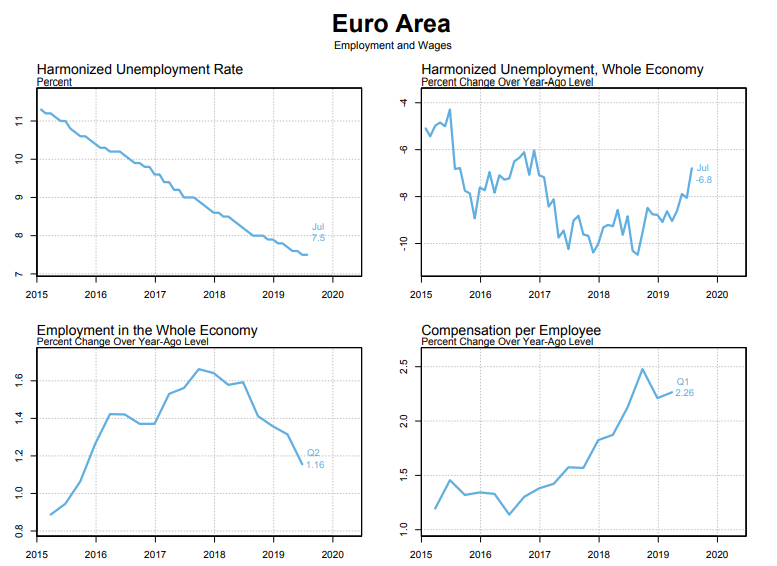

Nonetheless, the best of times signature accomplishment was the job market recoveries in the advanced economies, even though economic inequality and unusually low wages were also negative by products of the decade long global recovery. The job market recoveries were especially strong in the US, the UK, Germany, Japan, and even Canada.

The worst of times predicament centers on the fact that the international economy is slowing virtually everywhere. Financial markets are volatile, particularly the stock market, and the financial pundits are nearly universally predicting doom and gloom.

Global slowdowns and recession fears have already triggered some monetary policy easing at the major central banks (the US Fed, the European Central Bank, the Bank of Japan, etc.). Canada ‘s central bank will also reluctantly soon join the easing trend.

The worst of times outlook is composed of many layers – including the US-China trade war and its implications for weaker investment and slower growth spreading widely.

Then there is the related battle for primacy in technology between China and the US which has negative short and long-run implications, and of course the bizarre situation that has emerged around the Brexit dilemma.

Everything seems very gloomy because of the trade war between China and the US. As a result, capital investment spending is slipping in most of the advanced economies. Moreover, global employment, albeit still unusually strong, is also sending out signs of peaking. Indeed, global employment has been slowing for about a year now.

The gloom is compounded by the fact that we don’t really have a handle on how the Brexit will finally end? A harsh Brexit will be distressing since it will deepen the chances of the UK falling into recession in 2020. Brexit is also a negative factor for the European economies.

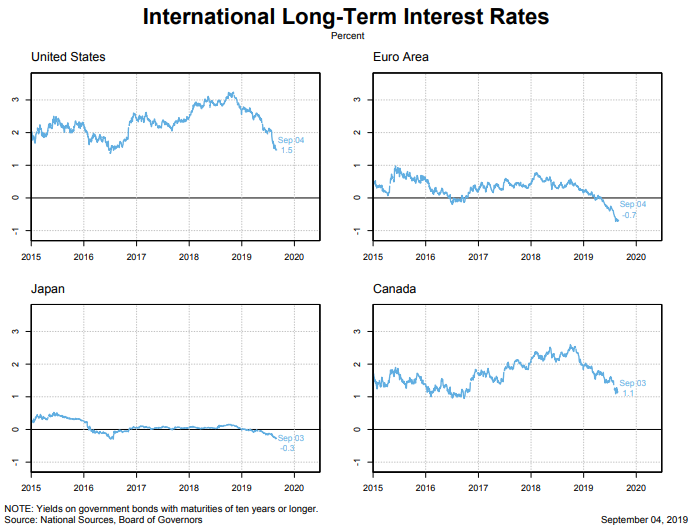

Extremely low government interest rates and inverted yield curves are never positive indicators and they have been around for quite a while.

They signal to the markets both low inflation and low inflation expectations, suggesting at best sluggish economic growth ahead. And though low government interest rates and inverted yield curves are never precise in terms of forecasting the next recession, they certainly are a leading indicators of sluggish growth ahead, if not something worse.

With inflation and inflationary expectations continuing to stay very low, perhaps those who argue that the advanced countries are in a phase of secular stagnation are correct?

Finally, without able economic policy leadership from the US because of Donald Trump’s obstinacy and ignorance, there is a widespread concern that the authorities will not have the monetary and fiscal policy ammunition to be able to offset a new global slowdown.

The following charts briefly highlight some of the best and worst of times aspects briefly touched on in this essay.

The Best Of Times – The Strong US Job Market Is Tight, But Employment Growth Is Slowing

(Click on image to enlarge)

The Best Of Times – An Extremely Tight Japanese Labour Market

(Click on image to enlarge)

The Best Of Times - The Euro Job Market Is Strong (e.g. Germany), But Employment Growth Is Slowing

(Click on image to enlarge)

The Worst Of Times - The IMF Projects Sluggish Global Growth, But Also Emphasizes The Many Risks Which Could Make Matters Worse

(Click on image to enlarge)

The Worst Of Times -- Low Or Negative Long-Term Interest Rates Underscore The Weakness Of Monetary Policy And Are Consistent With Secular Stagnation

(Click on image to enlarge)

This is a must read.

It certainly is.