The Bank Of Canada Calls The Trade War The Greatest Threat To Financial Stability

Image Source: Unsplash

In the fog of trade war, it is important to examine just how reliable is a nation’s financial system to withstand major disruptions in trade and investment. In living memory, there has not been such a disruption to the international trading world to match that which we are experiencing under the Trump Administration. We know that employment and business activities in a host of key sectors are now facing considerable stress as the Canada-US bilateral relations have been thrown into such upheaval from tariffs and other trade restrictions. That there is no obvious, clear resolution emerging to replace the current trade pacts is a major concern to the Bank of Canada. All the while banks and other credit institutions are scrambling to prepare for the worse should their clients and the entire banking world suffer heavily. The Bank of Canada released its Financial Stability Report which is a detailed analysis of the key risks threatening the Canadian financial system and provides considerable insight into the country’s financial sector ability to hold up during this period of turmoil.

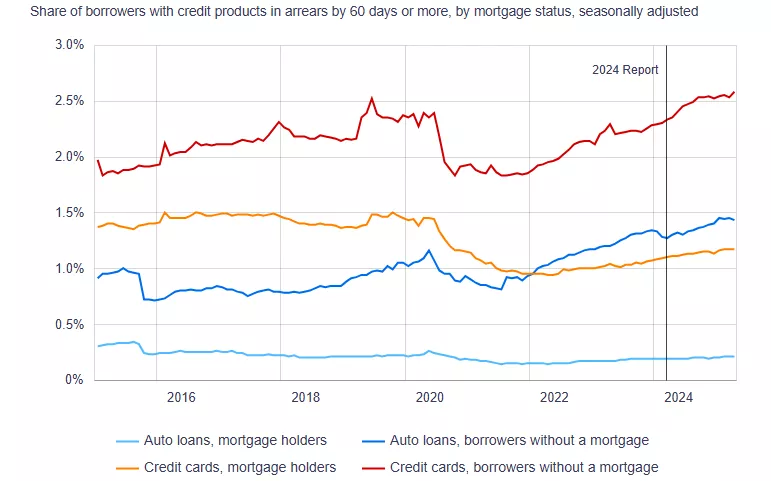

Taking a snapshot today, the Canadian financial system is not under any duress. The share of households in arrears on auto loans and overall credit card debt exhibit no unusual stress when compared to the last 5 years (Fig 1).Since Canadian households have remained resilient overall, the banking system, similarly, has not show any weakness. The Bank of Canada was quick to point out that the Canadian bank’s capital positions are more than adequate and that provisions for credit losses are within acceptable range.

Figure 1 Household Borrowing in Arrears

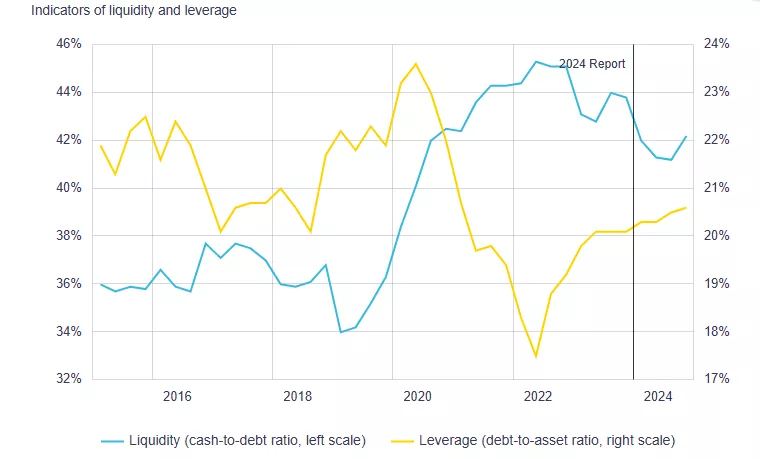

On a positive note, the non-financial business sector is relatively in good shape to withstand a trade war of limited duration.Non-financial businesses have relatively good measures of liquidity and at the same time, are not burdened with excessive leverage (Fig.2). Given this solid financial health, non-financial industries are reasonably well positioned. Nonetheless, the Bank is cautious that we don’t know the extent or duration of these tariffs affecting bilateral trade. Financial stability is relatively more difficult to measure when a trade war is long and severe.

Figure 2 Non-financial Liquidity and Leverage

The future remains unclear. The financial market for stocks, bonds and interest rates have experienced considerable volatility. The year-to-date, the USD has dropped more than 7% and long-term interest rates have soared by nearly 50pb. Market participants are constantly being tested by the volatility in these markets. Moreover, the non-financial sector is in a state of great uncertainty and corporate leaders are unable to provide any forward guidance to the stock market. From this vantage point, it is understandable why the Bank posts a clear warning, to wit:

The trade war currently threatens the Canadian economy and poses risks to financial stability. Near-term unpredictability of US trade and economic policy could cause further market volatility and a sharp repricing in assets, leading to strains on liquidity. In extreme circumstances, market volatility could turn into market dysfunction.

So, while currently the financial system is stable and functionally normally, the Bank warns that a prolong global trade war will impact Canada in many ways. We can expect economic growth to slow, if not outrightly sink into a recession. The ability of households to support and maintain current debt payments will be severely tested. Commercial banks will then need to set aside more loan loss provisions and tighten up credit conditions to existing borrowers.

More By This Author:

Early Waring Signs Of The Impending RecessionA Perfect Storm Is In The Making For The U.S. Economy

The Slide In The U.S. Dollar Threatens Its World Dominance