Steel And Aluminium Tariffs Are Bound To Fail A Second Time Around

Image Source: Unsplash

On Feb 10th Mr. Trump signed executive orders imposing 25% tariffs on all steel and aluminum imports. He cited these measures were strategic in nature in an effort to revitalize US basic industries. The tariffs were launched in the name of protecting “national security”. The name of the game has changed from using tariffs, in the case of Canada and Mexico, to meet his demands on immigration and drug controls.

Readers will recall that in the first Trump term in March, 2018, he slapped on a 25% tariff on steel and a 10% tariff on aluminum from Canada, Mexico and the European Union. Other nations were subject to controls on volume sales into the U.S. At that, the concern was over national security. In hindsight, the industry successfully lobbied for tariffs to support efforts to increase its market share and overall profits. Hiding behind a tariff wall was the easiest way to justify increases in domestic prices. The burden of tariffs fell largely in the lap of US secondary metal producers and end-users in a host of manufactured products.

Canada retaliated in 2018 by imposing tariffs on U.S. imports, including 25% on steel and 10% on aluminum. Trump was forced to walk back his tariff measures because of the great uncertainty for US manufacturers, which led to a downturn in bilateral trade.The metal fabricating sector has been on a bit of a roller coaster since 2018, but has not yet recovered to prior output and employment levels achieved a decade ago.

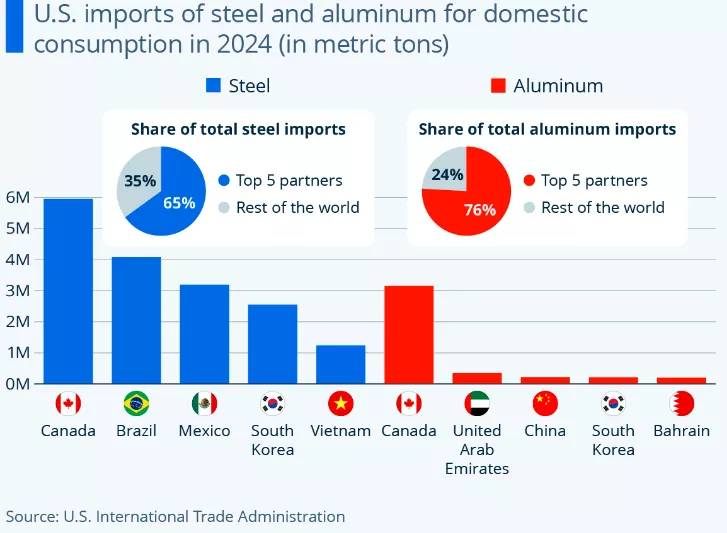

In arguing that tariffs on basic metals in the interest ofnational security, Mr. Trump has no leg to stand on especially with regard to Canada. Canada is the major external source of both steel and aluminum into the U.S. , taking advantage of its low-cost electricity and market proximity. No other reliable source of these base metals is available to the US at such competitive prices.

(Click on image to enlarge)

Wall Street Journal editors take issue with these most recent tariffs, citing that the steel and aluminum industries are blaming imports for the decline in domestic production. Steel production has steadily fallen in recent years and efforts to re-vitalize the domestic industry are failing. The Nippon Steel offer to purchase US Steel was blocked for political reasons, and the company continues to look for ways to fund its badly needed modernization program.

However, steel and aluminum prices are much higher than pre-pandemic levels.For the time being, these producers will support tariffs without exemptions. The WSJ editors do not mince words when saying that,

This is political rent-seeking at its most brazen, and it benefits the few at the expense of the many. None of these matters to Mr. Trump, whose dogmatic views on tariffs can’t be turned by evidence. But we thought our readers would like to know the rest of the story.

Canada faces the prospects of losing out on some of the US market it previously served. The burden of a large tariff will have to be shared within industry on both sides of the border.So far, Canada has not announced any retaliation measures to the 2025 tariffs, but Ottawa fully intents to respond to these tariffs.

More By This Author:

Trump Clearly Blinked, Backing Off On Tariffs Against Canada And MexicoThe US-Canada Trade War Starts In Earnest: The Risks To The US Are Substantial

Canadian Exchange Rate, Interest Rates And U.S. Tariffs All Wrapped In One