Soaring Global House Prices

“The U.S., despite being the new epicentre of the coronavirus outbreak, is seeing its house price boom markedly strengthening. The S&P/Case-Shiller seasonally adjusted national home price index rose by 5.51% during the year to Q3 2020 (inflation-adjusted), sharply up from the previous year's 1.46% growth. The strongest housing markets in our global house price survey during the year to Q3 2020 included: Turkey (+13.96%), Vietnam (+13.83%), New Zealand (+13.77%), Germany (+12.44%), and Slovak Republic (+10.1%), using inflation-adjusted figures.” (Global Property Guide, Dec. 2020)

Housing markets across the globe are booming even as the pandemic continues to spread.

Real house prices (i.e., prices adjusted for inflation) rose in 43 out of the 55 international housing markets over the year ending the third quarter of 2020.

It is hard to believe that a little over ten years ago the global financial crisis brought the world to the brink of economic collapse. And at that time the cause of the collapse was centered heavily on the housing market, specifically America’s $1.5 trillion subprime mortgage-backed security market.

That began a fire sale of assets that threatened to engulf the world economy.

Since then, house prices have since rebounded close to or beyond their previous highs in many of the world’s largest residential markets.

According to Standard & Poor’s American homes are now 15% pricier than they were at their peak in 2007, before adjusting for inflation.

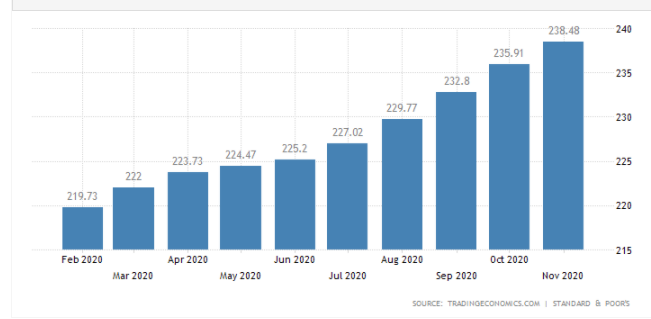

In the US, the Case-Shiller 20-city home price index rose 9.1% from a year earlier as of November of 2020. This represented the largest increase in house prices since May of 2014.

In addition to the attraction from record-low mortgage rates, there was an apparently higher demand created by people moving away from big cities due to the pandemic.

Although housing in Britain has been hit by Brexit uncertainty over the past three years, prices are still up by 21% since 2008. Meanwhile, in Australia, Canada, and New Zealand housing prices barely slowed after the 2009 financial crisis. In these countries, housing prices are up about 40%, on average, compared with 2009.

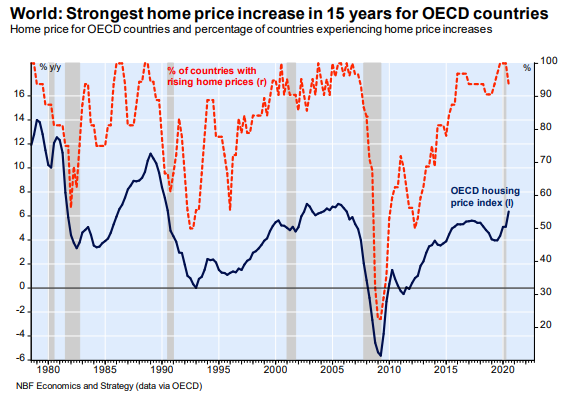

While the pandemic continues to provide a strong headwind for the economic recovery in many parts of the world, several sectors of the economies have been very resilient. Indeed, in the OECD countries, housing prices have been extremely resilient.

As the following chart emphasizes, over the four quarters ending in Q3 of last year, housing prices in the 32 OECD countries rose at an annual rate of 6.4%. The National Bank confirms in a January 27, 2021 article that this represented the largest house price increase in 15 years.

Considering that these same countries are experiencing a deep and long-lasting pandemic recession, it is clear that the combination of the virus and zero interest rates has made a big difference to housing inflation.

According to OECD data, of the 32 countries for which statistics were available, only two experienced price declines (Colombia and Ireland), and those pullbacks were less than 1%.

Clearly, income support programs put in place by governments combined with interest rate cuts have allowed real estate prices to swell during this recession.

Obviously, this is one of the glaring inequities associated with the pandemic recession, and of course, house price increases only add to the global inequity problem across the world.

(Click on image to enlarge)

S&P Case Shiller House Price Index Since Feb. 2020

(Click on image to enlarge)

What happened was that the builders and developers realized that the additional expense to make an expensive house is a very small increment above the cost to build a much lower priced house. and because the FED has interest rates so very low now it is simple for those who choose, to buy that expensive house. Hence we have a huge supply of houses that in normal times nobody could buy.