Powell Promises Fed Remains "Committed To Using Every Tool" To Save The World From Virus' "Considerable Risks"

"This is about as dire as the language the Fed uses can get."

Those are the words of George Pearkes, macro strategist at Bespoke Investment Group, as he reflects on what The Fed promises and worries about going forward.

***

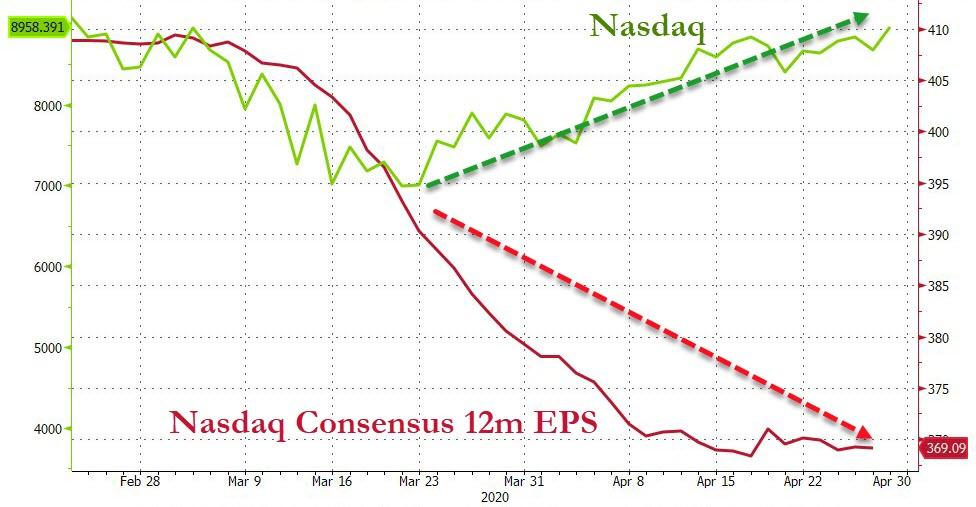

Since the weekend when The Fed went "all-in", the dollar is marginally lower, Treasury bond prices are marginally higher, Gold is strong... but stocks are f**king insanely bid...

(Click on image to enlarge)

And during that same exuberant rampage in stocks after The Powell Put was "reportedly" unleashed, earnings expectations have collapsed...

(Click on image to enlarge)

Source: Bloomberg

Is this really all that matters now?

(Click on image to enlarge)

Source: Bloomberg

It would appear so and therefore any hint of a doubt about The Fed's full-throated "all-in", "print-or-die" approach to monetary policy forever will hit markets (stock markets most of all) like a ton of bricks.

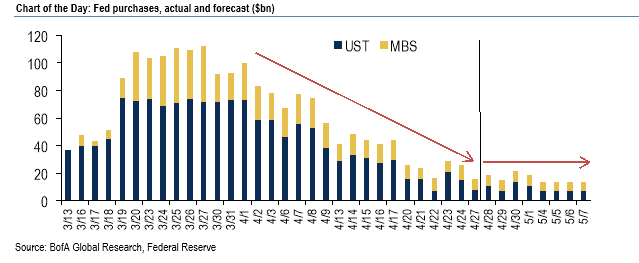

But, don't forget The Fed has been tapering its QE-Infinity recently...

(Click on image to enlarge)

As we detailed earlier, WSJ's Fed watchers Jon Hilsenrath and Nick Timiraos started off their expose on how the "Fed Is Changing What It Means to Be a Central Bank" in which the only thing that really mattered was the first paragraph:

The Federal Reserve is redefining central banking. By lending widely to businesses, states and cities in its effort to insulate the U.S. economy from the coronavirus pandemic, it is breaking century-old taboos about who gets money from the central bank in a crisis, on what terms, and what risks it will take about getting that money back.

This is a good description of what the Fed has done in the past month: the breach of virtually every central bank taboo imaginable, crossing lines not even Ben Bernanke dared to cross by openly buying corporate bonds and backstopping virtually all credit instruments, all in the pursuit of stabilizing markets the US economy and avoiding a full-blown depression, even if it meant institutionalizing moral hazard as the only imperative and ending free and capital markets as we know them, resulting in "markets by decree."

Broadly speaking, markets don't expect big policy decisions at today’s FOMC - After all, with rates at zero and QE already "unlimited" what can the Fed do absent announcing negative rates and starting to buy stocks (it will likely pursue both, but it first needs another market crash.)

***

So what did they say...

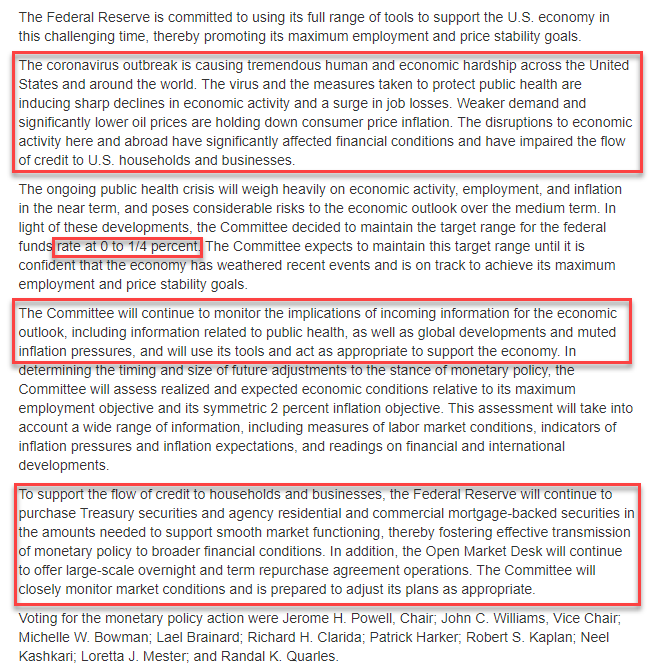

Pretty obvious and expected: Fed says it will do all it can to help the economy still facing considerable risk

The Federal Reserve on Wednesday committed itself to use its full range of tools to help the economy facing considerable risk from the coronavirus pandemic.

"The ongoing public health crisis will weigh heavily on economic activity, employment and inflation in the near term, and poses considerable risks to the economic outlook over the medium term," the Fed said in a statement after two-day meeting.

The Fed kept its benchmark rate close to zero and repeated it would hold policy steady until the economy has weathered recent events and "is on track" to achieve full employment and price stability.

"In determining the timing and size of future adjustments to the stance of monetary policy, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. "

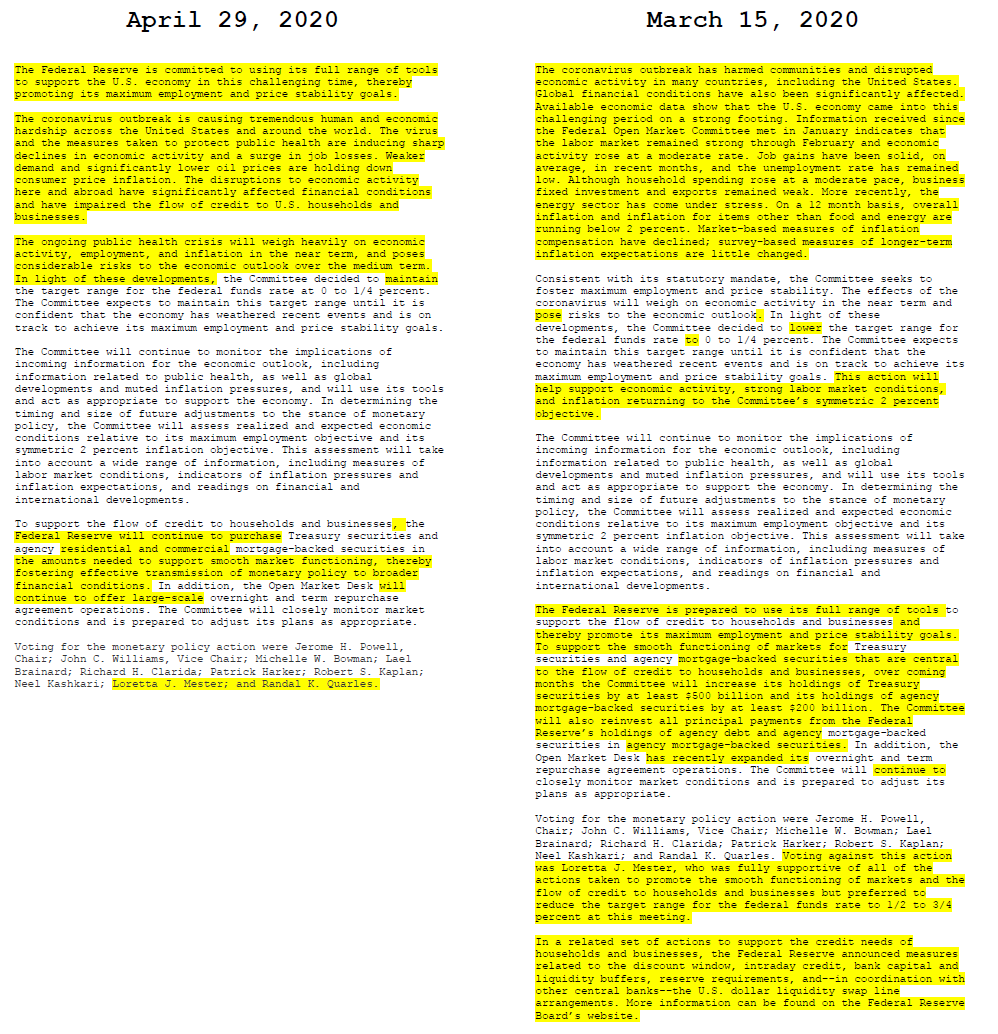

That is unchanged from the March's broad-based forward guidance.

In addition to inflation the Fed will now be monitoring incoming health data:

"The Committee will continue to monitor the implications of incoming information for the economic outlook, including information related to public health, as well as global developments and muted inflation pressures, and will use its tools and act as appropriate to support the economy"

Finally, we note that The Fed offers no guidance on future QE (which we noted above is tapering rapidly), and surprised many Fed-watchers with a lack of actual quantitative forward guidance on asset purchases, timing, rates, inflation, or bubble size.

Regarding asset purchases, the FOMC used wording similar to last month, saying the buying of Treasuries and mortgage-backed securities will continue “in the amounts needed to support smooth market functioning, thereby fostering effective transmission of monetary policy to broader financial conditions.”

Full Statement below:

(Click on image to enlarge)

Quite a cutdown from its 'war and peace' statement in March...

(Click on image to enlarge)

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

The more I see what the Fed is doing, the more confident I am in buying precious metals.

Agreed.

Couldn't have said it better myself.