Peter Schiff On Recession

Peter Schiff on X (formerly Twitter) today:

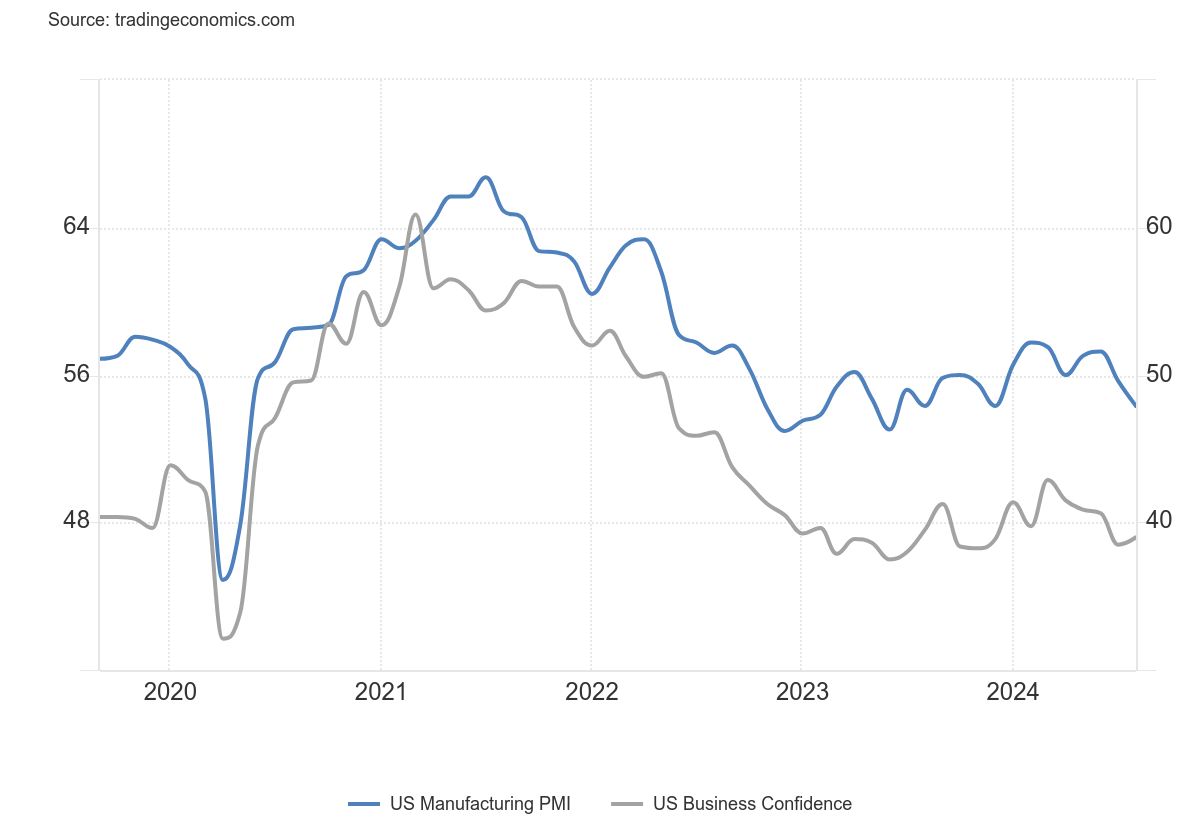

This morning has seen a trifecta of weak economic data. Aug. PMI & ISM manufacturing both came out even weaker than expected, while July construction spending unexpectedly fell. It's becoming clear the #economy is entering a #recession just as #inflation is poised to turn higher.

— Peter Schiff (@PeterSchiff) September 3, 2024

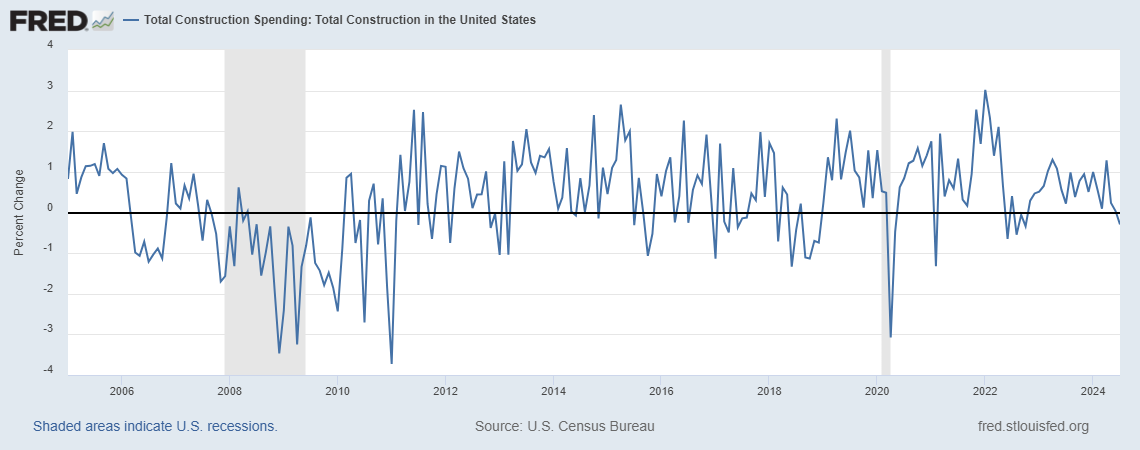

Bloomberg indicates manufacturing PMI was 47.9 vs consensus 48, ISM manufacturing was 47.2 vs. 47.5 consensus. Over the last year, the standard deviation of forecast errors is 0.5, so the -0.3 surprise is not statistically significantly different from average surprise of 0.17. Construction spending was down 0.3% m/m vs +0.1% consensus. The standard deviation of errors is 0.4 ppts, so once again the drop is within one standard deviation and not statistically significantly different from zero.

As for construction spending:

Goldman Sachs comments:

. Nominal construction spending decreased by 0.3% (mom sa) in July, against expectations for a 0.1% increase. Spending growth was revised up in June (+0.3pp to flat) and May (+0.6pp to +0.2%). Private construction spending declined by 0.4% in July, as private residential spending (-0.4%) and private nonresidential spending (-0.4%) both decreased. Public construction spending edged up in July (+0.1%), reflecting an increase in public nonresidential spending (+0.2%) but a decrease in public residential spending (-2.6%). Construction costs increased by 0.6% in July (mom sa, Census measure), indicating that construction spending decreased 0.9% in real terms.

Maybe recession is coming. Not sure these releases a persuasive. Note: Mr. Schiff has been predicting recession since November 2023.

More By This Author:

The Ito-McCauley Database On Individual Central Bank Reserve HoldingsEmployment Slowdown In Context

A Puzzle: Private NFP And The Preliminary Benchmark Vs. Current Official [Updated]