Market Briefing For Monday, Nov. 23

Great Reset Fears dominate speculation about debt-triggered systemic risk promulgated by global central bank monetary policies; or by market correction risks in the US based on the calmed-down collision between Treasury and the Federal Reserve (which is why Secy. Mnuchin was on TV before NY's 'open', to dissuade concerns, and we thought they would essentially do that). Plus a controversy about conflicting interpretations of the forthcoming vaccine rollout as some sort of conflict between pro-and-anti vaccine crowds; and so on.

In actuality there is not much shifting going on. Even globalism has polarized views out there (a bit ironic since they are from both sides of the spectrum), at the same time our 'centrist' view hasn't change on that either: some globalism is favorable (especially for trade and commerce, and the irony is that Trump at no time was against; trade, just trying to bring more work back to the USA).

At the same time I grasp populist leanings, versus increased internationalism; although again we see that as broadly misunderstood by extremists on both sides who either want to drive us to isolationism or back to prior decline of US manufacturing and trade; which the 'centrists' recognize led to the populism in terms of business views; and the decline of America's middle / working class.

Of course the 'Great Reset' can be 'normal' (it's confusing because both fairly normal business and political people have called it 'that', here, Canada, and in Europe); versus alarmist calls that are periodically heard from the 'far right' or the 'far left' that wants much more than seems pending.

Hence many believe a lot here depends on a presumption of 'common sense' prevailing in Congress; itself a tough bet, as that would be uncommon. But as a 'centrist', President-elect (pending) Biden, needs to make it clearer that he'll stick with 'compromise and balanced policies' rather than embracing radicals, which some worry might be tipped-off depending on the Labor Secretary pick.

Thus for now, the market's 'indecision' pattern in what I call an S&P overshoot zone is keenly contemplating whether a Democrat win of both Senate seats in a way revives a variation of the 'blue wave' that the market feared earlier.

Meanwhile . . you know I doubt vaccines are the panacea some believe; but that's 'was' the market view. Covid resolution (or failure) far overshadows any technical or basic look at markets; while political theater will increasingly be a side-show. Today's Presidential absence at part of the G20 on the pandemic, made it look like G20 was the sideshow; but that's how Trump intended it.

It harms America though, if we don't see return to understanding compromise as a replacement to the 'self-righteous' overly assertive divisive backdrop that some politicians and most media have displayed. More recently some of that toned-down slight; whether it is because it appears Joe Biden won; or Rupert Murdoch admonishing at least some Fox News staff for the slanted reporting (most networks do it but having the media mogul Australian initiate lessons that helps normalize things it seems is just a sign of the times). Likely he, as I, saw directly contradictory commentary on his network; responded to President Trump's call for his 'base' to change channels; and largely they did; which is absurd.

Later I'll note the best weekend news of the weekend: Saturday's approval of Regeneron's 'antibody therapeutic'; accredited for likely saving President Trump's life. It's important for the 'class' of treatment of course; since that's what Sorrento Therapeutics is primarily focused-on.

Antibody therapeutics matter a lot; including for 'confidence' since Dr. Fauci is out there making people nervous talking about getting infected with no visible symptoms, even after being vaccinated.

I think this is rather important because 'if' the 'nose drops / nasal spray' and/or 'pill' work; that's really what opens-up society beyond even the best vaccines.

I reiterate this because to me that's how you eliminate a fear of the economy not rebounding back. If the traffic I saw during an essential errand today is an indication; many people are not waiting at all for 'clear sailing'; so that has for sure good and risky aspects with the exponential Covid case levels seen.

Bottom-line: for now, the market's 'indecision' pattern in what I call the S&P overshoot zone is very keenly contemplating whether a Democrat win of both Senate seats in a way revives a variation of the 'blue wave' that the pundits as well as markets contemplated earlier. The general idea is that gridlock will be an easier way to keep things 'balanced' and that Biden would actually like that to be how this sorts out. There is increasingly nervousness resulting.

REGN SRNE

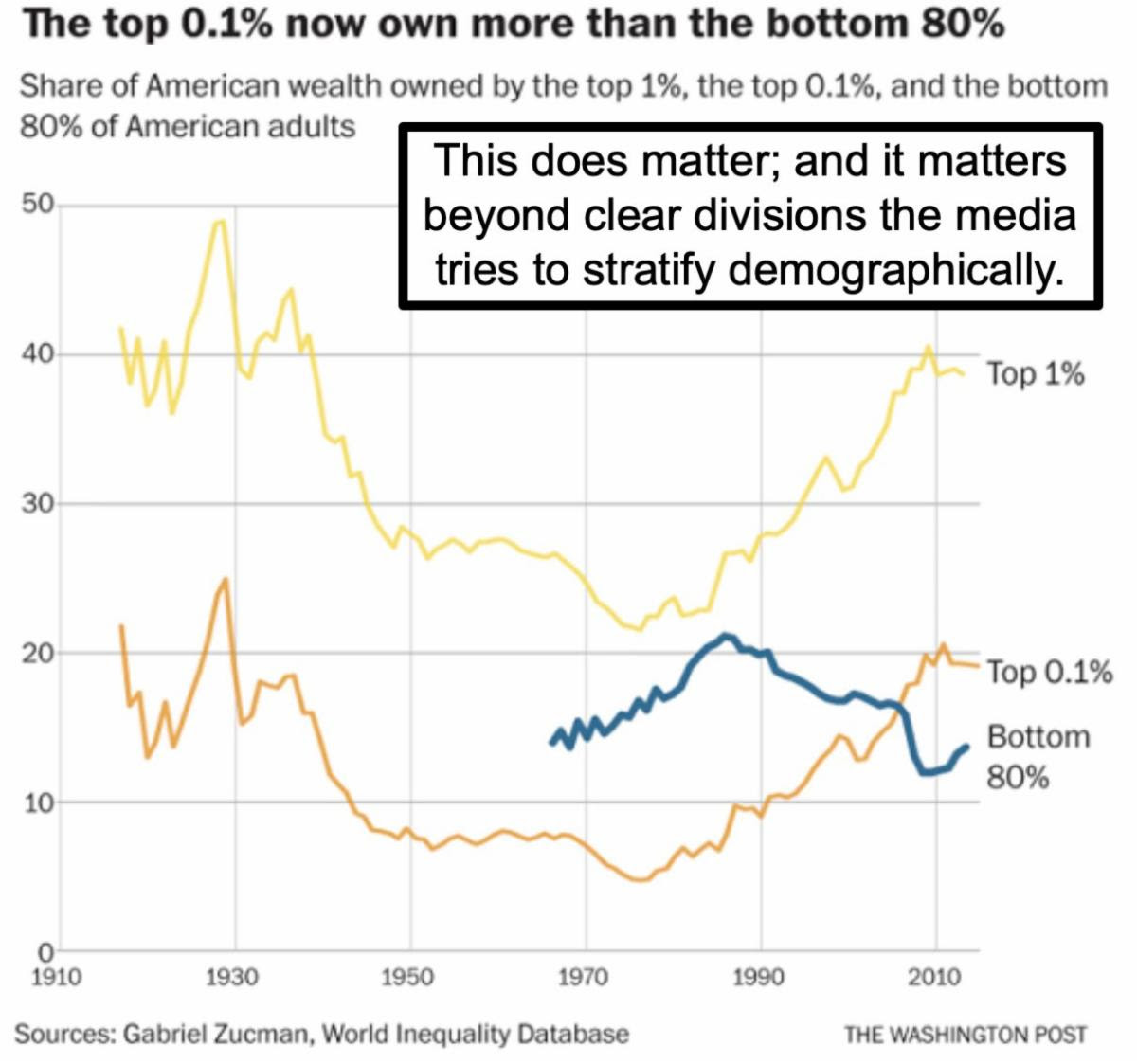

By far the most disturbing part of this article is the assertion about who owns how much of the wealth! Even if the numbers are off quite a bit, the reality is discomforting, because wealth is power. And we know that the power of the wealthy will not be used to the benefit of that bottom 80%, (or 60%) because that is not how "normal" works.

In a war-fighting zone killing and destruction are NORMAL, that does not make them OK.

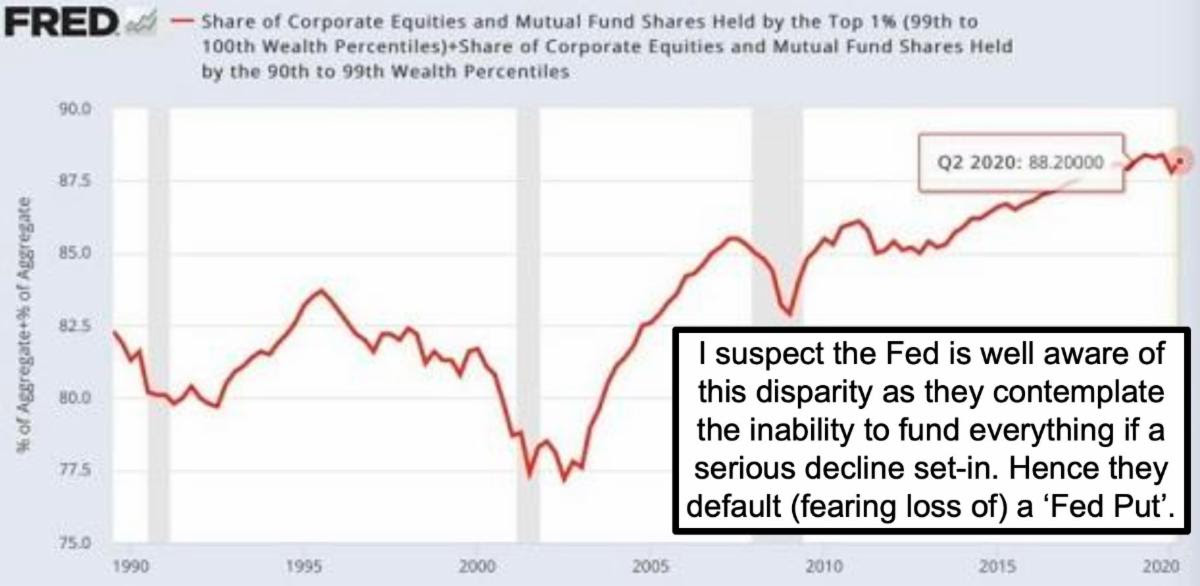

Whatever becomes the stable state of humankind will be the normal condition and it may be a lot closer to hell, as described by many religions. Certainly not a desirable place. So perhaps the federal banking folks need to consider taking care of some folks who are not the friends in that top 15 OR 0.1%.

i FAVOR PEACE AND REFORM THROUGH LEGISLATIVE ACTION, NOT BY VIOLENCE.

I want to be clear about that! But certainly there has been a wrong path taken and followed for some time now. So certainly a few things do need to change. I hope that President Biden is able to steer without crashing. The previous driver was not, it seems.