Market Briefing For Monday, March 25

Upheaval conditions are neither magic, nor tragic for investors, at the same time the persistence of cheer-leading or resistance to realities by so many, was almost mystical. Most have acknowledged declines (how can they not?), but few saw the handwriting on the wall, even though that was not well-concealed, during preceding (desperate) 'Hail Mary' rallies. And fewer yet (in all humility) called for the market to 'go to the moon' if Trump 'won', but from January warned it's not going to interstellar space.

And even now they fail to see the sensitivities of this market to news of a negative or 'hopeful' tone. What they shouldn't miss is the long-ongoing monetary shift, which has triggered (as we've mentioned a few times) the rise in Libor and shifted credit market conditions beyond whether the US Fed (or other central banks), remain mild-mannered in their official hikes, as so far all major nations (and EU) have continued their gentle touch. I am going to touch on our new Fed Chairman's philosophy, versus those of his predecessors, in tonight's quite long main video.

What bothers me most here, is not the erratic behavior related to tariffs, or even the prospect of a rally, 'should' successful trade negotiations be concluded with South Korea, Japan, the EU or even China itself. Actually I've long felt (and now other countries grasp that too, which makes it just a bit tougher to banter with) a '"Let's make a deal' approach dominated the intentions of this administration. And it should but I don't believe we will (or should) back off as other Presidents did, from pursuing the neglected real needs to revitalize and spur growth in America's. Chinese retaliation is a concern, but don't forget we are their indispensable trading partner.

I even think that this weekend's threats against Taiwan are superfluous, as imagine what happens if they actually tried to attack and the U.S. Fleet resumed cruising between Quimoy and Matsu (island); like the old days. Not only does China not want conflict with us, their financial structure is 'at risk' of collapse without us. Yes that's why they want to consolidate in the region with less U.S. dependence, but they're nowhere near that yet.

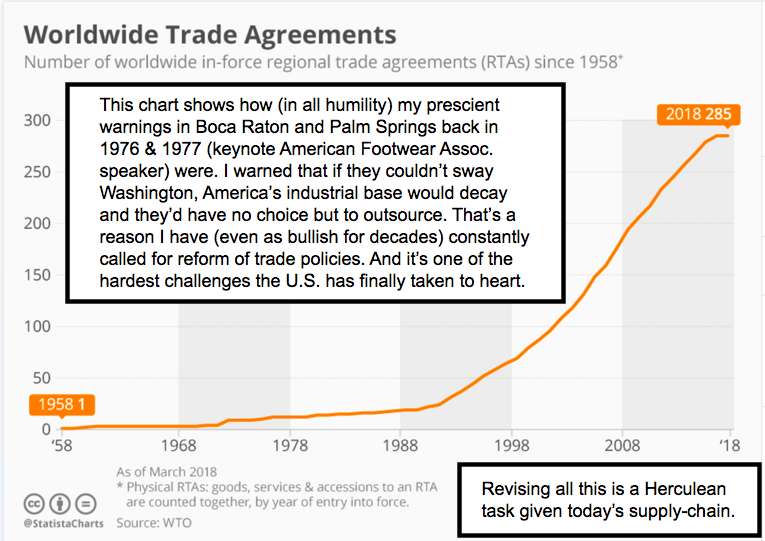

Supply-Chain is the 'choke point'

It's really essential, even if the shorter-term will be negatively impacted by shifting manufacturing and formerly-outsourced services, back here. I realize most complain about that, but it's near-term earnings dislocation concerns largely without the vision to look beyond the horizon. So sure, one of the main issues (and that can impact almost everyone, even firms that won't be targeted by China no matter what) is forward 'supply-chain' challenges.

Boeing is a great example; because (for instance the Dreamliner 787's) 'world-class' airplane, reflect how these days components are sourced from many places. It's something you can't really interrupt. Even Airbus, despite their huge mistake of misjudging the market and focusing on the albatross of an older-era aircraft (the A380 which creates incredible costs to operate, and challenges airports with arrival and departure traffic and other issues), rather than shifting to more moderate aircraft like (now) the popular A321 / Neo and A330; competing with Boeing's 787 and 777. In this scenario I doubt China or anyone else is going to cripple themselves by aligning only with Airbus; although the market is concerned about it.

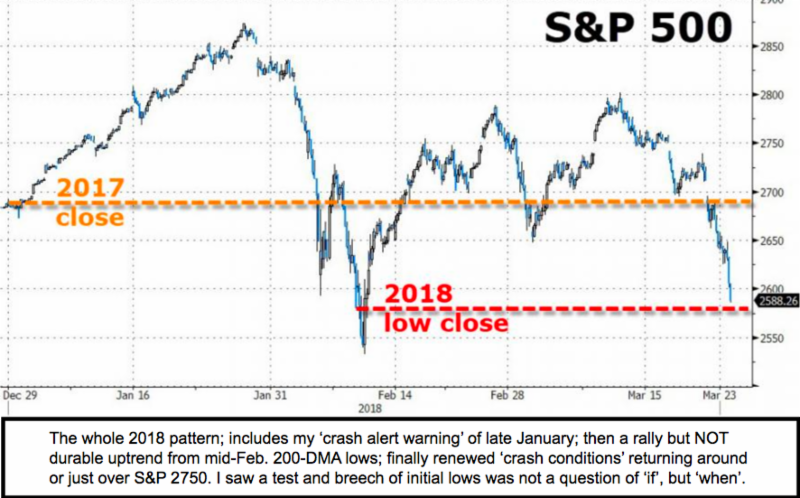

Technicals have telegraphed the evolution of this pattern as outlined, really in a progressive (and painstaking) way over the last two months. I was glad to take extra time often to make my points as to why I believed rallies had limited potential, while lots of risk loomed below the ranging levels around S&P 2750 'inflection', that we did our best to navigate.

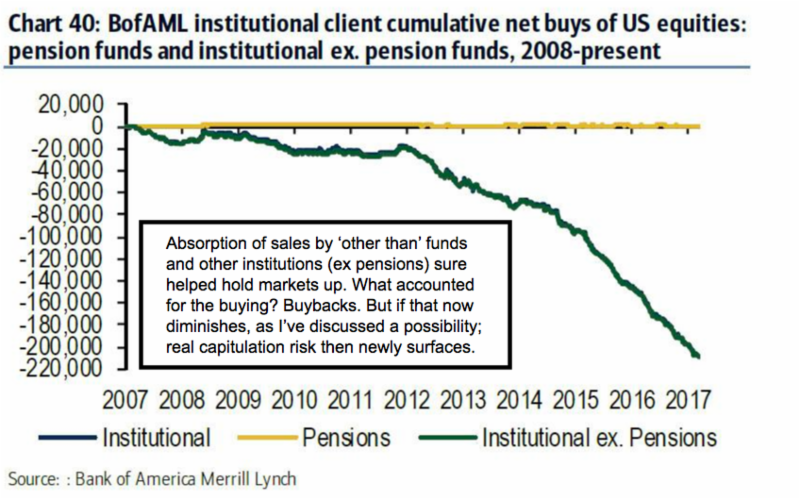

Now that the market has fulfilled the pattern projections (that doesn't by any stretch mean declines are over) around that tricky distribution zone, we can speculate about 'free-fall' risks if the algorithmic after-the-fact sort of players effect an exodus. I believed the smart money was selling rallies for many weeks now while statistics strangely tried to argue that. Really it was an effort of hedgers and fund managers (as I suspected) to throw money/leverage at markets in a 'Hail Mary' attempt to stave off selling.

It's a reason (back in January) that I described the parabolic advance as a bearish move because they knew the prospect if they 'let go'. And as I projected the February breakdown, I talked about now the extension they engineered, would actually enhance the downside by forestalling normal corrective actions. Most institutions I presume, because they were overly leveraged or just flat-out fully invested (which I've pointed out is folly this year) were over-impressed with themselves and thought they could defy not just the Fed, but gravity.

In sum, the prediction of the February break included a trading rebound, but not investment-grade buying conditions and boy was that spot-on. At this point everyone sees how the secondary rebounds were ploys to get buyers interested, and as I suspected it wouldn't last long or get very far.

That takes us to 'Trap Door' risk. Trade protectionism matters. Any sign of pressure on 'earnings' resulting from this, matters to markets. All this is 'on top' of general concerns and anticipated (already achieved before this past week) breakdowns and culmination of the 'structured' rebound 'they' needed from the double-bottom (trading only) low back in February which I indicated would work for traders; but for investors (newly joined here) just for lightening-up selling ahead of the decline's next phase.

Conclusion

Our indicated 'Bear Market' commenced with the projected 'crash of 2018' (first phase, as a process) back in late January (February breaks shuffled just for a few days before caving). It may be intermediate in quality and duration or it may be swift with an 'event', particularly if we get institutional capitulation from those who 'using leverage' held this up with nonsensical pie-in-the-sky valuation estimates.

As a matter-of-fact, while thinking about it I wouldn't be surprised if we're going to get pretty good 'earnings' reported for the first quarter; but they'll not help stocks much; because guidance will be increasingly uncertain in this kind of erratic environment. Upheaval and uncertainly are not exactly inducements to buy stocks, until and unless the market finds a base. We are likely nowhere near that, as I'll explore in the main video.

|

Weekend (final) MarketCast |

Enjoying the 'crash'... we first warned of 'crash conditions' underlying the market back on Jan. 25 and 26; and again when I spoke at TraderExpo in New Your a month ago. Just so you know, we are offering a 'rebate' coincidentally because it's Easter / Passover week. It's $30 for a Daily Briefing and $100. for MarketCast subscriptions and won't be repeated anytime soon. We only do this 3 times a year for new members at www.ingerletter.com and in-addition you'll get the comments immediately not on a multi-day delayed basis (they are intended to be only excerpts here). Also I will be speaking at TraderExpo in Chicago in July; which will be well after the Crash has mostly run it's course...or as we'll outline along the way. Join us for the journey if you feel we've (in all humility) nailed this market; as we're not going to often permit full quotation of my thoughts in the future...Happy Holidays and please visit www.ingerletter.com to join. Gene