Market Briefing For Monday, July 23

Ripple effects from the wide-ranging actions, and threatened moves, by China, the EU, Central Bankers (including our Fed, the ECB, the BoJ and increasingly the PBOC), and of course our President, really are barely surfacing with respect to actual market responses; even though it certainly has pundits and analysts agitated.

This essentially 'benign' response by the S&P has allowed disguising very notable internal corrections that predate current (or forward) action; based on our belief that the S&P topped with its 'unsustainable parabolic thrusts' in late January. That was the core of our belief the forecast 'to the Moon' if Trump won rally (back in 2016) was ending; but would see mostly a series of 'ragged' oscillating moves, not giving up easily, because of the structure of the current market (that includes the ETF and passive-investing mindset that is largely blindly oblivious to what's actually brewing in the backdrop).

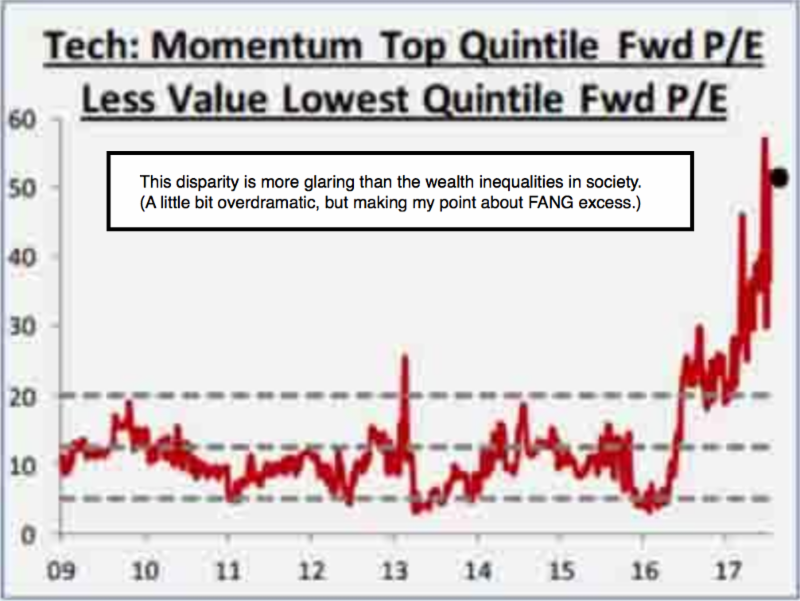

We were (and are) concerned about an extended nature of the momentum stocks in particular (FANG and similar expensive stocks, whether or not a modicum of additional gain occurs; based on our 'let the other guy get the last 10%; if there is another 10%); as we believed contrary to the majority, that these would become 'sources of funds' rather than desired buys.

To a degree, choppy as it has been, almost everything we've outlined last year and this year has proceeded according to Hoyle. During this time the core stocks vacillated; some of the FANG stocks topped as desired (most notably our suggestion after being bearish on AT&T since 40; suggesting a scaling-in approach between 29-31; while concurrent suggesting at least a partial sale of Netflix between 405-420; due to encroaching competition in the future, including from AT&T's own DirecTV Now's growing presence).

Bottom line: the overall Indexes remain 'flattish'; with movement below the surface. S&P resistance came in just as targeted; 2810-20 range. Having preserved these levels is not terribly relevant, as rotational distribution has persisted as outlined; while the market keeps betting on a 'trade resolution' that I of course would like to see; but all the hype makes it tougher to get.

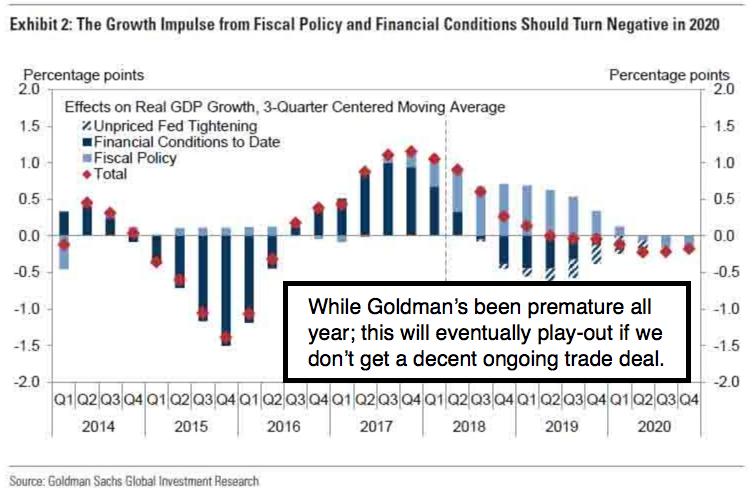

My primary concern remains not just 'trade, tariffs, Putin, or even currency moves'; most of which we've analyzed and targeted as best possible. If I'm to identify a single overriding concern for the next couple months it's a shift that has been ongoing (but likely to accelerate), which is from QE to QT by not just the Fed, but other central banks. There's a correlation that matters beyond the zero-sum worldview (the President's at times) or a superficial emphasis on interest rates.

It's an offloading of balance sheets that matters more; and that continues I believe, regardless of a public spat about 'the President vs. Fed Chairman'half-life, which promises to be shorter-duration tactical discussions (maybe even an intentional whisper by the President); whereas the reversal from a Fed injecting liquidity to one that's withdrawing liquidity, matters more.

Aside that we've talked about whether Trump was 'savvy enough' to apply a 'China card' with respect to Putin; and if so he's deftly (while seemingly so sloppily) deflected virtually all the agenda-preoccupied media from seeing what he's really up to... pulling Russia - presuming they end spying and go to a complete normalization direction - into the Western Orbit to deflect the efforts by China to draw them into a new Asia-Pacific Alliance with a focus that's not in the interest of the Western World or Eastern democracies.

If Michael Cohen indeed recorded discussions of a 'Playmate Payoff'; that is yet another effort that pushes the President to take his 'eye off the ball' in the trade battle; and it encourages other leaders (like the Chinese) not to feel any urgency to come to an accord with the USA. Not justifying any behavior of Trump; just noting how this is a diversion and disruption that a strong stock market may have trouble contending with. Perhaps Chinese problems with their own crumbling markets will compel their cooperation anyway; but media is doing everything it can to oppose moving away from unfair aspects of globalism. So while accusing Trump of harm; they cause harm; whether or not he embarrasses the Nation in other ways.

Conclusion: a lot of shifting of stocks from strong hands to weak hands is behind already; however too much concentration of major funds remains in the high-momentum extremely expensive stocks with dubious valuations. I see this as a process; with risk of an accident occurring; but for now sales on relative strength are still feasible given that some cushion exists above the levels that would regenerate a 'trap door' risk for the S&P.

Markets are not nearly benign going forward; as trepidation increasingly looms. Of course we focus on building prosperity for the American people not salacious controversy as opponents seek to undermine the President. Critics relish that more than they care to emphasize tariff reform efforts, or economic outcomes. Regardless, Putin coming to America, sure is another story (he better cease infrastructure probes; like 'Rocket Man' stopped missile testing). Stay nimble and defensive.

I don't see tariffs helping the American people. I don't see the media to blame for Trump's personal troubles. But author is certainl right that China may just want to wait out a weakened Trump. Europe as well.

thanks Gary... I didn't mean to imply tariffs help; in fact with the G-20 removing a provision regarding 'competitive devaluations' in their communique today (I'm sure media will talk about it tomorrow, or should); you have greater risk of trade and tariff issues being joined by a currency war too. I'll touch on this and a single key market impediment at my Seminar here in Chicago tomorrow as I've already shared with our regular subscribers. Let me point out that I have NOT shorted this market once this year or last year; even as expressing concern after we got our 'to the moon' rally on Trump's election. I urged investors to separate political from investment views back then (Nov. 6 2016) and get in the market fully if he won; even if they hated Trump. Now we had the move; time not to be greedy even if it doesn't fall apart. The only two stocks I picked on the buy side at midyear are doing well by the way. Anyway I'm being chatty; working up to the speech tomorow haha...happy Sunday.