Kinky Economics - When Must Fiscal Policy Tighten To Combat Inflation?

Image Source: Pexels

The prevailing mood in global macro discussions seems to be as follows; inflation is past its peak, but it is set to remain a lot higher for a lot longer than initially anticipated, forcing central banks to continue hiking, keep rates higher for longer, or a combination of the two. The interest rate shock in the UK, as markets have adjusted their expectations for the BOE bank rate higher, and hawkish comments from the ECB are the two most obvious cases in point in developed markets. But a surprise hike by the Bank of Canada, and a larger-than-expected hike in Norway have added to the sentiment. We only really need the Fed to be forced into a hawkish turn to complete the narrative. This shift is important for investors. We are not just trying to calibrate when central banks will pause their hiking cycles—probably soon—but we’re also increasingly discussing, and pricing, how long rates will stay elevated, and whether central banks will have to resume hiking before they cut. Higher-for-longer, or #H4L, is already a trending hashtag on FinTwitter.

On June 26, the IMF added further official gravitas to this theme when first deputy managing director Gita Gopinath identified three uncomfortable truths for monetary policy, supporting the somber message from policymakers that rates might have to go higher than anticipated and stay elevated for longer than hoped.

The first uncomfortable truth is that inflation is taking too long to get back to target. This means that central banks, including the ECB, must remain committed to fighting inflation despite risks of weaker economic growth.

The second uncomfortable truth is that financial stresses could generate tensions between central banks’ price and financial stability objectives. Achieving “separation” through additional tools is possible, but not a fait accompli.

The third uncomfortable truth is that going forward, central banks are likely to experience more upside inflation risks than before the pandemic. Monetary policy strategies and the use of tools like forward guidance and quantitative easing must accordingly be refined.

In this framework, the burden of bringing down inflation falls on the shoulders of independent and inflation-targeting central banks, which are price-takers of government policies, geopolitical shifts, and corporate pricing behavior. In the real world, however, inflation invariably has a political and fiscal dimension too. The pre-Covid flurry over MMT set the stage for a shift in the macroeconomic discussion on the trade-off between inflation and growth/unemployment, and whose responsibility it is to determine the appropriate balance between the two. Covid and the war in Ukraine followed. This was/is a twin-shock that foisted upon the global economy the combination of a negative supply shock and a positive demand shock. Fiscal policy was largely responsible for the latter, aided and abetted by central banks, during the pandemic.

We might then reasonably ask whether the fiscal policy has a responsibility for bringing down inflation since it arguably has been one of the key instigators of our current inflation shock in the first place. The BIS, not surprisingly, believes that it does, as reported by the FT last month.

“[Fiscal] consolidation would provide critical support in the inflation fight,” the BIS said in its annual report, published on Sunday. “It would also reduce the need for monetary policy to keep interest rates higher for longer, thereby reducing the risk of financial instability.”

The BIS makes two points; first, it argues that relying too heavily on monetary policy to combat high inflation risks stoking financial instability. This is the argument that raising rates too far too fast risks breaking something in financial markets, which is unlikely to break if tighter fiscal policy is used instead to stamp out inflation. Secondly, the BIS notes that by running excessively loose fiscal policy today—which obviously is a matter of judgment—governments risk squandering the firepower they need to combat the next downturn. I have no problem with these points, but the BIS raises a more profound question; can the political process deliver a credible inflation-fighting fiscal response, and if so, how?

This takes me back to one of the major unanswered questions during the height of the MMT debate. It is easy to show how fiscal policy can effectively combat inflation in the simplest macroeconomic models, with a downward-sloping aggregate demand curve and an upward-sloping short-term supply curve, or even a vertical supply curve at potential output. This is to say, fiscal policy can drive a leftward shift in the demand curve just as well as monetary policy can. The BIS calls for spending cuts and tax increases, both of which can be effectively inflation-fighting tools if applied with sufficient force and scope. Both, however, are also politically unpopular, especially in an environment where governments remain under pressure, and are politically inclined, to run expansive fiscal policies. After all, cost-of-living crises, sky-high energy prices, the need to speed up the energy transition, combat climate change, fix crumbling infrastructure, support near-shoring of productive capacity in key goods and services, and boost defense spending are all themes that demand government intervention. Taxing the rich sounds like a panacea, but it is not, mainly because taxing the rich and wealthy is unlikely to curb aggregate demand anywhere near as effectively as taxing the middle and lower income and wealth brackets, with a relatively high marginal propensity to consume. The problem with that of course is that it is wildly unpopular.

What about price controls? Some economists make the point that because so-called seller’s inflation—greedflation, margin expansion etc—has been a key driver of rising inflation after Covid and the war in Ukraine, governments should take more active steps to curb firms’ profits. Some governments already are. The idea of windfall taxes on energy companies, to pay for subsidies designed to curb consumer prices in electricity, gas, and petrol is a special case of price controls, in this case in an already regulated market. Similarly, interest rate caps on some mortgage loans in France and Spain, and the more general discussion about a windfall tax on banks as rates rise, is also a case of price controls, even if it does not impact consumer prices. As it turns out, price controls to combat runaway inflation are an integral part of the theoretical framework in MMT, though I wouldn’t go as far as to say that all economists who advocate price controls adhere to MMT. In the context of margin expansion by greedy and opportunistic firms, price controls are provided with a righteous hue, but it does not change the fundamental reality. Price controls in the context of inflation driven in part, or entirely, by margin expansion are the same as government control over firms’ profit-maximizing decisions. This is true in particular if it is strong aggregate demand allowing firms to expand their margins in the first place. Once you go down that road, you might as well go all the way and tell firms how much they should pay their workers, for a given profit margin deemed appropriate by policymakers. The issue here is that it is difficult to verify empirically the split between margin expansion, wages, and other input costs in driving industry-level inflation, never mind inflation in the economy as a whole. So, the more fundamental question in my view is whether it is plausible to expect fiscal policy to lean against inflation in an environment where expansive fiscal policy is a prime driver of rising inflation in the first place. I am not so sure, but I am also convinced that it will be a big discussion for policymakers, economists, and market participants going forward.

A Framework To Understand When Fiscal Policy Is Called Into Action

Looking beyond the question of whether fiscal policy is institutionally able and willing to prove its inflation-fighting credentials, it is interesting to consider the conditions under which the pressure on fiscal policy to tighten would increase. This question can be treated in the context of the kinked Philips Curve, which I recently discussed when I asked whether central banks were on track to achieve a soft landing.

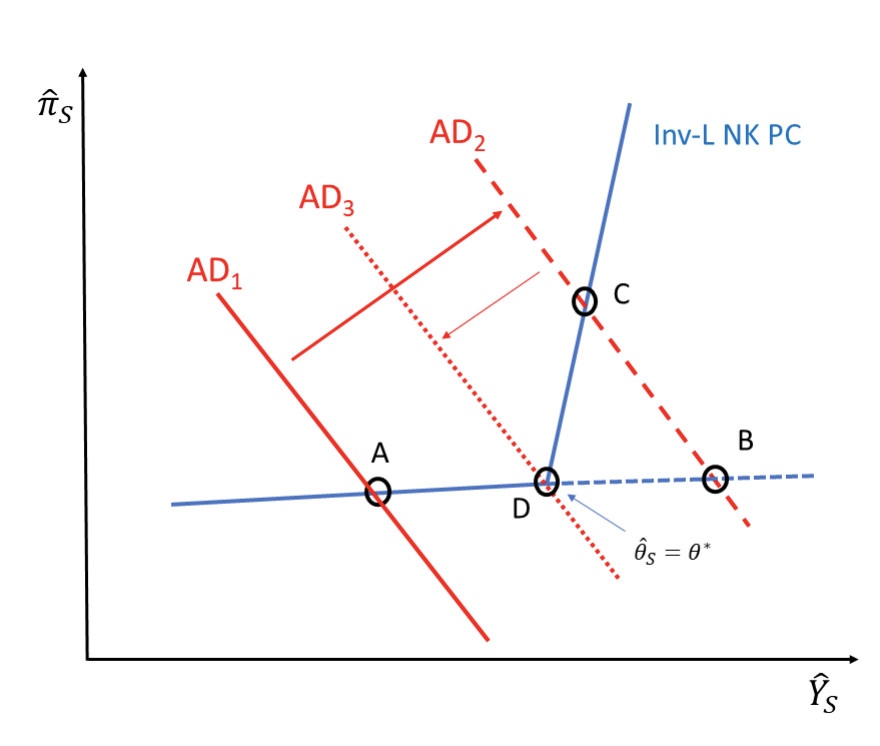

Pierpaolo Benigno and Gauti B. Eggertsson (2023), fig 10

In my discussion on this model, I speculated that the key distinction between a hard and a soft landing—the size of the decline in output and unemployment needed to bring down inflation—is whether the rate of inflation at point D is consistent with the central bank’s target. Or more specifically, the key question is whether inflation at point D is within an acceptable range of slippage so that it can be considered consistent with price stability. Using the U.S. as an example, I’d say that 2-to-3% would be ok, while anything above 3% would present a problem, but it is impossible to tell because it is impossible to say for sure how inflation and wage expectations would behave at any given threshold.

If inflation is deemed sufficiently low at point D, policymakers have avoided having to force a big decline in output to get inflation down, but if it is not, the economy has to travel on the painful road from point D to A. Using the framework just noted, I would suggest that if inflation is still unacceptably high at point D, the call on fiscal policy to contribute to falling inflation will strengthen. This could then be the point at which, according to the framework set out by the IMF and BIS, the financial stability of costs of relying solely on monetary policy to bring down inflation, taking the economy to point A, is deemed too high. Of course, in this model, there is no distinction between fiscal and monetary policy, and we are not allowed to change the shape of the AD curve as a function of the mix between monetary and fiscal policy. In other words, the economy would still have to move to point A, through tighter economic policy. The question is whether fiscal policy would share in the burden of doing. Time will tell.

More By This Author:

The Burn From The ChurnThe Looming Downturn In Capex And The Rise Of EVs

Can We Pull Off A Soft Landing?

Disclosure: None