Key Events In EMEA - Saturday, June 3

Annual inflation in Turkey will likely decline further in May due to the policy promised by Tayyip Erdogan of making gas free for Turkish households in May. For Hungary's May inflation print, we expect core inflation to remain strong, coming in at around 0.8% on a monthly basis, while headline inflation is around 0.1%.

(Click on image to enlarge)

Shutterstock

Turkey: Inflation trending downwards due to election policy

Annual inflation, which maintained its downtrend to 43.7% in April with large base effects, is likely to decline further in May to 39.3% (-0.1% on a monthly basis). This is because the Turkish Statistical Institute (TurkStat) said it would reflect the impact of the government’s decision to provide natural gas free of charge to households in May in its inflation calculations. TurkStat’s practice is in line with Eurostat guidelines, according to its statement.

However, the outlook is quite uncertain for the rest of 2023, as a lira adjustment post-election and potential adjustments in wages and administered prices are likely to weigh on the inflation momentum.

Hungary: Annual headline and core readings flirting with 22% and 23% levels

Next week is set to be a busy one in Hungary. We are going to see the first set of hard data regarding second-quarter economic activity. We expect both retail sales and industrial production to contract on a yearly basis as high inflation and high interest rates are suffocating domestic demand. The only silver lining in industry is the export-oriented sectors like car and battery manufacturing.

We see some better budgetary figures in May as the heating season has ended and this might reduce the expenditure side pressure arising from energy bills. The relatively small monthly deficit would mean that this year’s budget moves roughly in parallel with last year’s deficit accumulation. The even better news could be if the trade balance posts yet another monthly surplus in April, as we expect.

The highlight of the busy week will be the May inflation print. Seeing the downside surprises across Europe, we wouldn’t be shocked to see something similar in Hungary. We expect the month-on-month headline inflation to come in at around 0.1% mainly on easing price pressures in food, fuel and durables. Services inflation, however, will remain strong, thus core inflation on a monthly basis will stay high around 0.8%. But thanks to base effects, the headline and core readings will flirt with 22% and 23% levels, respectively, a significant detachment from the peak reached in the first quarter.

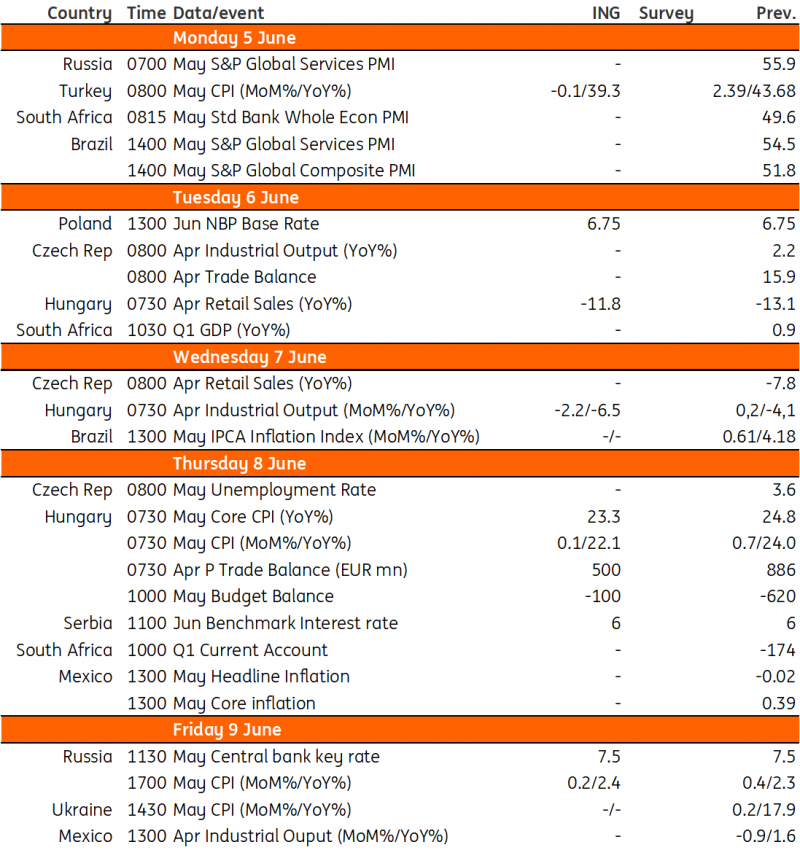

Key events in EMEA next week

(Click on image to enlarge)

Source: Refinitiv, ING

More By This Author:

The Commodities Feed: Debt Ceiling Deal Helps To Improve Sentiment

What To Watch For In Friday’s US Jobs Report

Asia Rebound Could Be Weaker And Later

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more