It’s The Most Wonderful Time Of The Year

Yes, it’s that time of year again—Christmas trees, yule logs, caroling and all-around holiday cheer. However, for the money and bond markets, the end of December brings another thought to mind: “the turn.” The turn represents the period around the final business day of the calendar year, which for 2019 is December 31, when banks need to address their cash needs to get through this crucial funding period.

Let’s revisit Federal Reserve (Fed) 101. There’s a certain level of reserves in the banking system that can fluctuate on a daily basis. The New York Fed, acting on behalf of the FOMC’s monetary policy directive, is charged with keeping the Federal Funds target within its prescribed trading range by either adding or deleting reserves via temporary repurchase (repo) agreements with the primary dealer community, depending on what is needed to achieve the aforementioned goal.

Typically, these operations from the Fed go essentially unnoticed and don’t garner any headlines. In the case of the turn, there can be heightened potential for volatility or stress as banks look to fund themselves. This is not something new at year-end, but given what occurred in mid-September, when funding rates (repo rates) temporarily spiked, there is an elevated level of anxiety for what may transpire at the upcoming year-end.

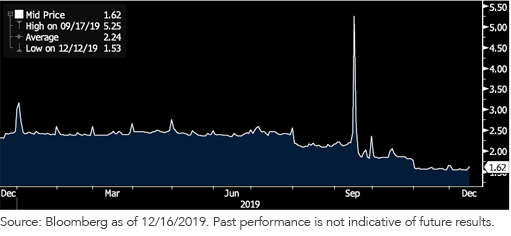

U.S. Secured Overnight Financing Rate (SOFR)

It is interesting to note that the funding market had a dry run of sorts just the other day on December 16. Indeed, two of the key culprits behind the stresses three months ago, a corporate tax date and large Treasury securities settlements from prior auctions, were also evident this time around. However, unlike the mid-September experience, this time there was no spike in the repo market. As the enclosed graph reveals, one of these key repo-related rates, the SOFR, came in at 1.62% towards the lower end of the current Fed Funds target range.

Conclusion

So, what can we expect for 2019 year-end? Fed Chairman Powell was quoted at the FOMC presser last week as saying, “Year-end funding pressures appear manageable,” and as we mentioned earlier, these temporary pressures are "not unusual at year-end." The Fed has many tools at its disposal to help combat any potential issues. In addition to the aforementioned repo operations, the Fed has been adding to its balance sheet, buying $60 billion in T-bills per month, providing permanent reserves to the banking system, accordingly. There has been some conjecture that the Fed would need to add Treasury coupons to this plan, but Powell stated they are “not at the place yet,” and “if it does become appropriate,” they will. In addition, the Fed has already announced repo operations that have been reported to be as large as over $400 billion to potentially ward off any significant funding pressures.

While the turn is hard to predict, I can’t help but remember all the hubbub surrounding Y2K. We’ll find out soon enough. Happy New Year!

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more

Good read. And it really is a wonderful time of year!