It Is The Economics, O America

Helped by James Carville, President Clinton had it almost right, “It’s the economy, stupid.”

However, it is not the economy, but the economics—in both its expressions: Economic theory and economic policy that we have to pay attention to.

Let us see. These are Keynes’ famous parting words in the General Theory:

“At the present moment people are unusually expectant of a more fundamental diagnosis; more particularly ready to receive it; eager to try it out, if it should be even plausible. But apart from this contemporary mood, the ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back. I am sure that the power of vested interests is vastly exaggerated compared with the gradual encroachment of ideas. Not, indeed, immediately, but after a certain interval; for in the field of economic and political philosophy there are not many who are influenced by new theories after they are twenty-five or thirty years of age, so that the ideas which civil servants and politicians and even agitators apply to current events are not likely to be the newest. But, soon or late, it is ideas, not vested interests, which are dangerous for good or evil.”

Less well known, Hayek said:

"When I look back to the early 1930s, they appear to me much the most exciting period in the development of economic theory during this century…. [T]he years about 1931,…. and say 1936 or 1937, seem to me to mark a high point and the end of one period in the history of economic theory and the beginning of a new and very different one. And I will add at once that I am not at all sure that the change in approach which took place at the end of that period was all a gain and that we may not some day have to take up where we left off then."

Both Keynes and Hayek are dead. And the tragedy is, not that one was right—as partisans like to believe—and the other was wrong. The tragedy is they were both right.

Can we conceive of the economy without the government? Even more absurdly, can we conceive of the economy without the market?

The tragedy is that they did not realize, nor do their followers today yet realize, that both positions are essential to the comprehension of reality and the operation of the economy. The two positions are complementary. One does not function well without the other.

The work then is to determine what are the functions of government and what are the functions of the market. Each entity has to perform its functions—and stop there.

Instead, today the government attempts to enter the field of the market; and the market attempts to perform the role of the government. The market attempts to regulate itself—and fails miserably.

The tragedy is that neither Keynes nor Hayek had the right framework of economic analysis. Their minds were so imbued with their own theories that they could not see the reality.

Most economists today are still wonderfully knowledgeable of economic theories, but they know not the economic process.

The economic process is a complex operation. Each economic school studies one portion of the economic process, but none studies the economic process as a whole.

Besides, many schools of economics, in their attempt to remain within the realm of pure science refuse to acknowledge the need to call upon expertise from other disciplines such as morality and the law in order to understand the process as it is.

The economic process at its core is simple indeed. Even when you buy a chocolate bar, you are in the midst of the economic process as a whole, a process that is determined by a long chain of operations and operators. You have these three basic elements: 1. Real wealth: 2. Money; 3. The sales slip, as legal proof that a proper exchange of ownership between the money of the consumer and the real wealth of the producer has taken place. Possession of the money in the cash register is prima facie evidence of legal transfer of money from consumer to producer.

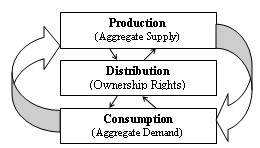

The following figure/picture is worth a thousand words:

The long chain of events that results into the production of anything, Leonard E. Read so beautifully explained, is rather well known and can be easily reconstructed through a variety of textbooks.

The technology of production and distribution of money is still shrouded in mystery. Most textbooks follow either one of two major errors: One type of textbook assumes that money is created by banks on the basis of savings deposited in banks; the other type assumes that money is created by the central bank out of “thin air.” Both misconceptions lead to incalculable damage to the poor, to the middle class, and to the rich.

Everyone likes to address the plight of the poor; a few try to address the plight of the middle classes; no one seems to address the plight of the rich.

I am not rich, but if I were rich, I would not tolerate the misbehavior of the economy today.

The rich suffer most from the ups and downs of the Stock Market. That they suffer most in absolute terms is clearly observable, but hardly acknowledged. What is absolutely neglected are the effects of flux and reflux of adrenalin and blood in the body of the rich. Verily, I tell you, I would not like to be rich today.

What to do, then?

The most important single fact to learn is that new money is created on the basis of credit: Personal credit by private banks; national credit by central banks. Old money is also exchanged on the basis of credit, the creditworthiness of the borrower in his or her ability to return the money borrowed.

It is still like a dream to me, but it seems that so far I have been able to convince the Federal Reserve System (the Fed) of the validity of these statements. The Fed, quite naturally, likes to hear these propositions from the Congress. And it is unlikely that, alone, I will be able to convince Congress of the validly of these propositions. But We the People can.

We the People can become convinced of the validity of these three rules that ensue from the realization that the Fed creates new money on the basis of our national credit, our common credit, our common wealth: 1. Loans have to be issued only for the creation of real wealth; 2. Loans have to be issued at cost; 3. Loans have to be issued to individual entrepreneurs, cooperatives, corporations with ESOPs and CSOPs, and to public entities with taxing power so that loans can be repaid.

Quite apart from operating on the basis of balanced rights and responsibilities, the repayment of loans is essential to avoid inflation. Once the money has performed its function of helping to create wealth, the money has to be destroyed (digits have to be canceled). If it remains in circulation, it will serve only to bid the price of existing wealth up, but it will not add one iota of real wealth.

As I pointed out in an earlier contribution titled “Rebuild The Downtown Through Racial Harmony,” if we implement this program starting with the redevelopment of our cities and our infrastructure, we can keep the earlier promise of President Obama and the current promise of President Trump to create “jobs, jobs, jobs.”

And we will do much more. We will start unifying the country. Did the Democrats, as well as Republicans, not raise their hands in applause in response to these promises by President Trump in his Address to Congress last night?

Yes, they did.

The country is ready to be unified. It is a faulty economic theory that is keeping us apart. It is a faulty economic policy that is tearing the country asunder.

It is overwhelmingly about economics, O America. But not economics by itself. There is good and bad economics. The right economics is ready to serve us all.

Disclosure: Visit http://www.somist.org/