Hypertakeflation And The Sportification Of The Fed

In order to be the most insufferable newsletter, I am going to quote Nietzsche -

The men of corruption are witty and slanderous; they know of types of murder that require neither daggers nor assault; they know that whatever is said well is believed.

Whatever is ‘said well’ is to believe.

That’s sort of the impetus of this whole piece - whoever says it neat and tidy, even if it is blatantly false or sensationalized or both - will be believed.

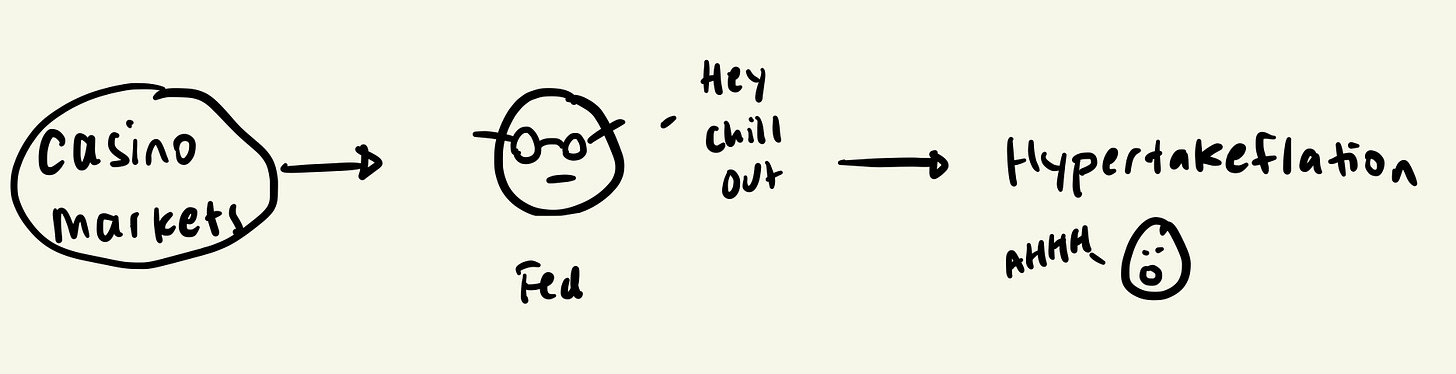

Casino Markets

The meme printer is running again. Why? Who knows. Things are happening! You might as well bet $25m on Bed Bath and Beyond at that point.

-

The impact of this is funny: But what’s really interesting about meme stonks is the removal of the Very Serious Nature of markets.

-

My model! Large parts of the industry are dedicated to putting numbers into Excel and saying “this stock will maybe do that” and it usually never does and meme stonks have pointed out this inherent unseriousness of this. (this is a gross generalization but for illustrative purposes)

-

* As a caveat to that overly simplistic generalization on the finance industry - Patrick McKenzie has a good thread on the purpose of the industry as something that is ‘better capitalized and has risk tolerance to maximize wealth creation’*

Meme stonks say, “we will pump the most ridiculous stocks on this market and make money”. There is some institutional play being done in the meme stonk arena, certainly, but it is pretty wild to watch things like AMC, GME, etc catch huge bids - for no reason other than ‘number go up’1.

$BBBY is up 57% today because people assesed new information and decided the NPV of future cash flows of the business were worth 57% more based on new information the market recieved this morning. Stocks always are a reflection of the sum of their future cash flows discounted.

— Thunderdome Capital (@MadThunderdome) August 16, 2022

So the meme stonk phenomenon accomplishes two things -

-

The market is not real - The existence of meme stonks can make the stock market seem like a very fake thing.

-

And of course - companies make money, that’s reflected in market cap, there is real money involved etc - but when stocks completely break from any fundamental value, it definitely requires some sort of gut check that usually ends with a question mark.

-

-

Financial conditions are disconnected from economic reality - The Fed also uses financial conditions (like the stock market, meme stonks) as a transmission mechanism for the impact of monetary policy.

-

So if AMC is mooning, the Fed is probably not going to feel super great about how their tightening path is going. As Jonathan Levin points out -

To meaningfully cool consumer demand, the Fed might need to engineer a sentiment shift, and that’s where stocks come in… Stocks are the most visible feature of US financial markets, and they have a significant impact on the way Americans feel about the outlook.

-

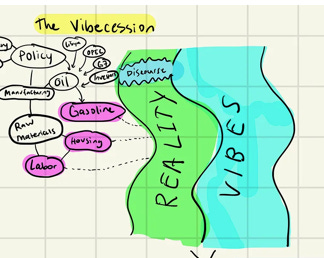

But of course, markets are real! Retail sales came in flattish this week, and we see that the consumer is still spending money - driven more by price versus volume as they try to budget against inflation. But that’s a big disconnect from some of the market moves we’ve seen. Going back to the Vibecession - there is a gap between reality and vibes!

All of this contributes to the idea of markets as entertainment. People go to the casino to gamble, but they also go to have fun. It’s really similar with markets - people ‘invest’ to make money, but also! Somehow, it has become a community-oriented experience! Which people use as a form of entertainment!

Markets as Entertainment

When people are able to watch something from afar, and make bets (monetary or not) on what happens, that’s entertainment. Sports are entertainment. The Federal Reserve has become entertainment. Data releases have become entertainment.

-

There is the gamification part of finance that Robinhood and other social investing apps have contributed to.

-

But arguably, there is a party-ification of it too - financial data releases have become big events (this sounds ridiculous, but that is the sentiment!).

-

Fed meeting days are almost like the Superbowl, especially now that there is uncertainty around 50 bps, 75 bps, pausing etc - people watch the movements of speakers like they would their favorite players

-

It’s great that people are interested in the markets!! But there are two core points here -

1. Fed credibility reduction - People treating the Fed as a game or something that is ‘consumable content’ might work to reduce Fed credibility.

-

Action! There are real world consequences to what the Fed does - raising rates and shrinking a balance sheet does show up in our real lives - the housing market is the clearest example of that right now.

-

Fed influencers? But if the Fed themselves become content - which I think they have become with the increased amount of Fedspeak that happens between meetings - that reduces their overall credibility because it’s saturation and distraction.

FED'S KASHKARI: I DON'T KNOW IF WE CAN AVOID RECESSION

— *Walter Bloomberg (@DeItaone) August 18, 2022

2. The Need for Big Takes - When the Fed saturates the take market with their own (sometimes contradictory takes!) that creates a lot of confusion.

-

Incentives: So when things as obscure as economic data releases (like the CPI) become things to rally around and have a Very Big Take on, that creates skewed incentives for said takes - people want to understand, so they often just pay attention to whoever is screaming the loudest.

-

This applies to more than just the Fed - The government passed the Inflation Reduction Act this week (which Hank Green has a good thread on). And most of the responses I got in my TikTok about it were - “spending leads to INFLATION”2

-

There is no concept of future, no concept of investment, because we have turned everything into a + b = z, when in reality, it’s much more a + b - y^2 + 3 = z. There is a desire for simplification, and Very Big Takes provide that

-

That gets into ‘take inflation’.

Hypertakeflation and the Power of Doomerism

Take inflation is part of the Fed's monetary policy toolkit, which is why this tweet from InternetHippo3 is modern philosophy.

The reason you're seeing increasingly batshit opinions on here is due to a phenomenon called Take Inflation. All the regular takes have already been posted so each subsequent generation of takes has to outdo the previous one

— Primary Takes Provider (@InternetHippo) June 22, 2020

The Fed released their minutes this week, and it was essentially - “yeah, we are going to keep hiking rates and checking out the data, lower gas prices aren’t enough” and then the day after the minutes were released, there was an onslaught of speakers with a lot of Very Big Takes!

full-court press

— Katie Greifeld (@kgreifeld) August 18, 2022

*KASHKARI: FED IS COMMITTED TO GETTING INFLATION UNDER CONTROL

*FED'S BULLARD LEANS TOWARD 0.75 POINT SEPT. RATE INCREASE: DJ

*FED'S GEORGE: JULY CPI ENCOURAGING BUT TOO SOON FOR VICTORY LAP

And I get it! The Fed wants to direct the market to where they think it needs to go, because right now, it’s a game of chicken. The Federal Reserve is squaring up against the market. And someone is going to have to swerve first.

This is sort of complicated.

- The thing is - if the Fed does swerve first and start cutting rates, the market *did not* win. As Modest Proposal points out, if the Fed switches from raising rates to cutting, that likely means that something broke entirely. This is not good.

- There’s also a disconnect between what the Fed is doing and what the market *thinks* the Fed is doing as Dario Perkins points out. For the Fed, slowing down is *slowing down* rate hikes - but the market expects rate cuts.

There is a gap between expectations and reality, which creates the perfect storm for Very Big Takes. Supply side information issues compounded by ‘printing’ too many takes has created a hypertakeflationary environment.

-

Hypertakeflation: You have to scream louder in the void to be heard. If you aren’t hearing your own echo rattle around - well, better turn it up a notch.

-

As Talmon highlights, this could be driven by “something more cynical, driven by trades/wanting to be right on bearish macro calls”

-

The problem is when bad news + bad takes begin to drive the overall narrative - that’s when things devolve into harmful rhetoric and misleading information, which impacts expectations and outcomes and isn’t reflective of reality.

-

It’s much easier to say “Things are Bad and You Should Be Mad” versus saying “Things are Okay-ish and That is Okay”.

-

NBER studied this in a recent paper - “stories which attribute outcomes to causes have stronger effects than statistical information… we show that factual, statistical information does not eliminate the power of causal narratives.”

Rhetoric exists! Benn Eifert has had a series of good tweets on how the extrapolation of narrative (specifically around theory) applies to the finance industry and wrote an entire piece for Noahpinion about it -

If there's one point from the bullshit-in-investing complex I'd emphasize above all others, it is that the classical Chicago economics view that creating markets in absolutely everything leads to an efficient allocation of investment capital is sheer lunacy… Markets can be useful tools but this utopianism is hopelessly naive and not even remotely what the field of economics says

But take inflation rewards these Very Big Takes because they are sort of inflammatory narratives! It’s something to be Loud about. Hypertakeflation takes hold.

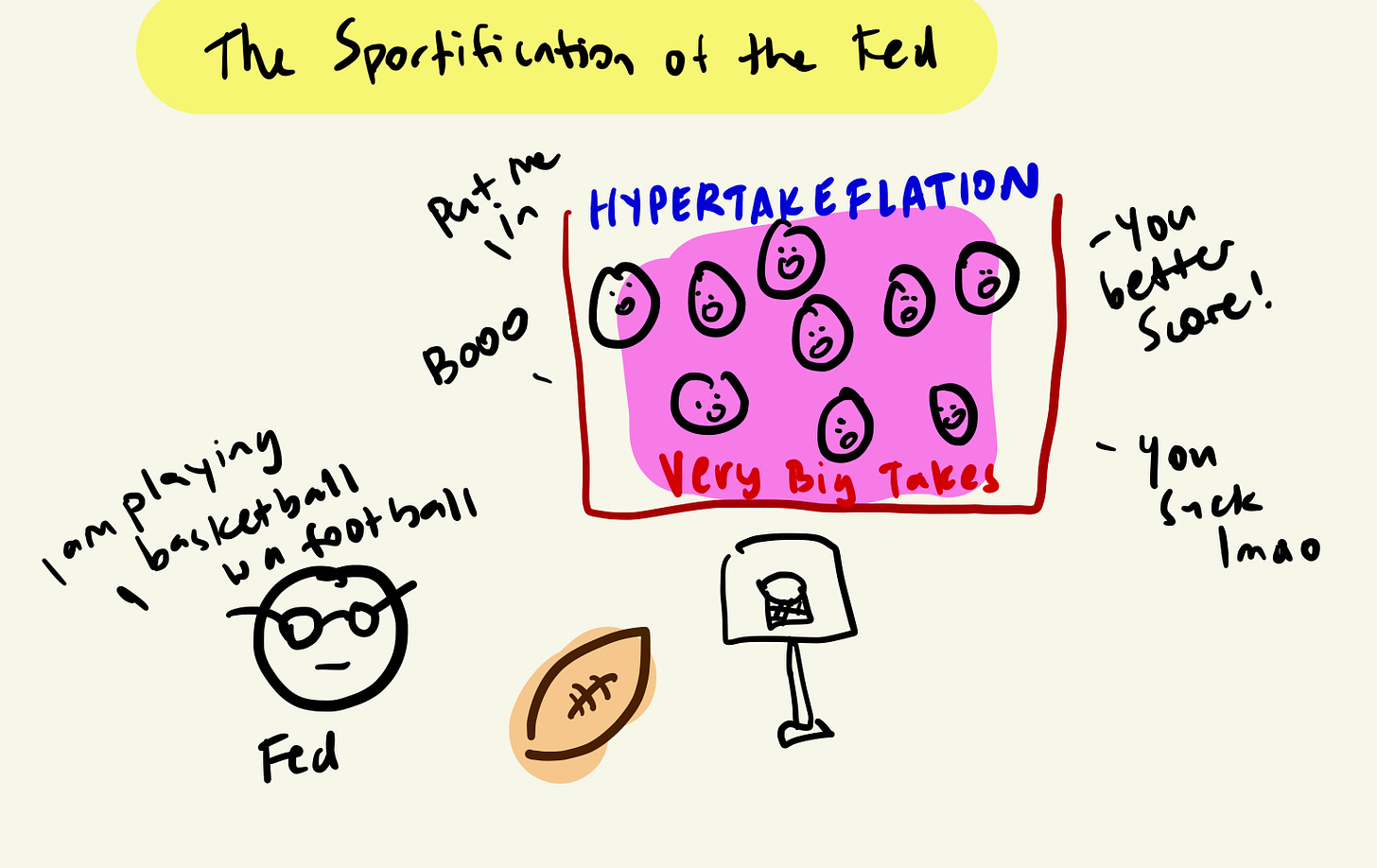

The Sportification of the Federal Reserve

And that gets into the Meta Game. People love watching sports. It’s a big hobby for many - tailgates, parties, apparel - you pick a team (usually based off where you live) and you (sometimes) become a very Passionate and Devoted Fan to this team.

There are a few key parts to the Passionate and Devoted Fan -

-

“Put me in coach” - The Passionate and Devoted Fan often thinks of themselves as Very Good at whatever sport that they are watching - or at least, better than those currently playing.

-

“Run the Ball” - The Passionate and Devoted Fan also tend to think that they would know exactly what to do in every situation - and that they, would do a very, very good job at all of it.

-

“Oh yeah, they are hurt!” - The Passionate and Devoted Fan tends to forget that these are people and roots for the physical demise of players on the other team

-

“That’s MY team” - The Passionate and Devoted Fan ties “up a lot of who they are in their identity as fan of X-team”

This is sort of showing up in what is happening in markets. I think it’s wonderful that people want to understand what this huge entity that controls a large percentage of our lives is doing.

-

Sports don’t exist without fans. Someone has to buy the tickets. It’s similar with the Fed! The Federal Reserve wouldn’t exist without the economy, which is people peopling.

But this Passionate and Devoted Fan behavior is showing up in markets in hypertakeflation about whatever the Fed does -

-

“They need to cut rates NOW”

-

“It’s all money supply”

-

“I want a recession”

-

“I have my entire identity tied up in my portfolio”

None of these armchair takes are inherently bad or good, but it’s the vibes they drive that matters most. The noisiness of Very Big Takes could erode the Fed’s credibility.

Most of all, it’s just interesting - circling back to Jonathan Levin’s point that “the Fed might need to engineer a sentiment shift” - the Fed might need to engineer a sentiment shift about themselves too.

Final Thoughts

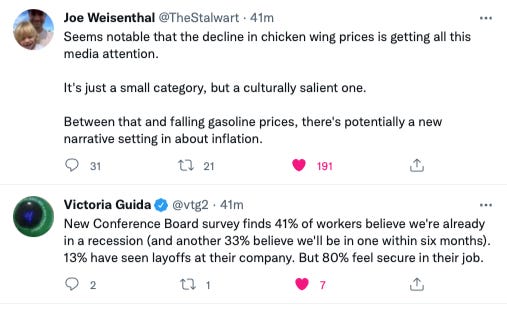

I don’t know! Things are improving, but Hypertakeflation don’t really reward that. We are seeing recovery in things like chicken wing prices, people feel secure in their jobs - but an alarming number of people think that we are *already* in a recession.

Bill and Skanda have been tweeting out a lot of positive news about markets -

- The fall in used car prices (and how that will provide some relief to CPI) and strength in subprime auto loans and gas prices continue to hit new lows

- Stronger employment income indicators (as well as initial and continuing claims coming in below expectations) and healthy credit card balances

- Domestic production of paint, coatings, and adhesives are ramping, agricultural machinery production gaining, multifamily completions are ticking up

But I think although the data is improving (this is a big aside), the inputs themselves might be worsening?4

- There is a great video that Nicole Ruiz shared on how the Delaware Aqueduct got built and it’s really a wild and great water system!

- But as Anthony Lee Zhang highlighted “as resources get cheaper, we find progressively dumber uses of them.”5

Like would we be able to build the Delaware Aqueduct today? And zooming out even more - what *are* we able to build today? Shannon Vallor discussed how tech companies don’t pay attention to user need anymore-

The saddest thing for me about modern tech’s long spiral into user manipulation and surveillance is how it has just slowly killed off the joy that people like me used to feel about new tech. Every product Meta or Amazon announces makes the future seem bleaker and grayer… There’s no longer anything being promised to us by tech companies that we actually need or asked for.

I think a derivative of this shows up in the whole Adam Neumann/Flow/a16z thing too. For however you feel about Neumann - he did build WeWork, he is a Character, he does have 3,000 rental properties - it’s kinda like… oh.

Oh.

The private markets are inherently more gamified than public markets because it’s sort of the wild west of capital allocation, but it almost feels dismissive of the Very Real Problem of the housing crisis to say “hey we are going to allocate capital HERE, to this guy! and that will fix it”.

Mac Conwell has a great take on it

In times of economic downturn allocators turn back to what they deem is safer. That's right you'd get fired faster for investing in underrepresented founders than investing in Adam Neumann from WeWork fame. (And with a giant check too)

Zooming out again, I think Home Depot has the right approach to all of this -

We're in such a unique environment that to try to build models off it of macroeconomic factors is probably less valuable than spending our time managing in an agile way

You just have to respond to the data as it comes, which is what the Fed is doing. However - whatever is ‘said well’ is to believ. That’s why its so important to sprinkle in a bit of optimism here and there. As the Shirley Wang wrote in Sports Complex: The Science Behind Fanatic Behavior -

“Sports fans are so resilient because they can hope.”

1 Squeezes etc are a big part of all of it, but the drive behind number going up in the first place is people saying “ah ya, let’s make number go up”

2 Yes, it is also political

3 The dichotomy of quoting a hippo and Nietzsche!

4 My own hypertakeflation!

5 We also do things stupidly now - for example, we are using 1,600 polluting, diesel-powered truck refrigeration units to keep produce fresh rather than cold storage in NYC’s main food distribution point!

More By This Author:

The Inflation NarrativeThe Semantics Of A Recession

Inflation, Oil, And The Federal Reserve

Disclaimer: These views are not investment advice, and should not be interpreted as such. These views are my own, and do not represent my employer. Trading has risk. Big risk. Make sure that you can ...

more