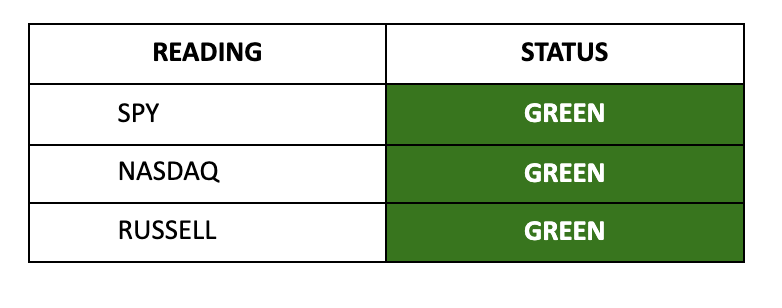

Hurry Up And Wait

Action to Take: Powell's "no hurry" stance on rate cuts reshapes our near-term outlook. As December cut odds drop to 62%, markets transition from momentum to fundamentals. Consider 20% trailing stops on speculative positions that surged post-election while giving quality names more room to breathe. Watch domestic small-caps and sectors most insulated from higher-for-longer rates while reducing exposure to growth names that rallied hard on aggressive easing hopes. Bond vigilantes are winning round one in forcing a Fed pivot on easing pace, suggesting a focus on capital preservation.

-----------------------------

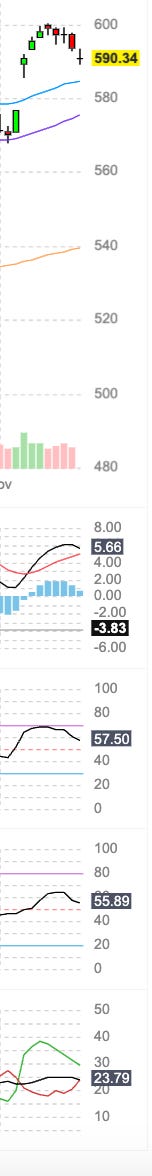

Momentum: Despite this week's pullback from post-election highs, momentum signals are still pointing up. The S&P 500 has given back about a third of its recent gains as markets react to Powell's hawkish tone, with December rate cut odds dropping from 82% to 62%. Gold's worst weekly drop in three years shows how traders are repositioning. If the downturn continues today, keep an eye on the MACD for a potential bearish crossover—it could be our first warning sign to start rethinking our outlook after another day of weak momentum.

Here is the S&P 500 ETF (SPY) price, followed by the MACD, RSI, MFI, and ADX, respectively. I’m on HIGH ALERT RIGHT NOW.

Insider Buying: Buyers Start to Step In

-

The ratio of Buys to Sells: 1:21 ($88m to $1.86b)

-

Top Buy: $43m of EchoStar Corp (SATS) by Chairman Charles Ergen

-

Top Sell: $686m of Amazon (AMZN) by Jeff Bezos

Liquidity: Treasury yields are steady at 4.43% as markets adjust to shifting rate expectations. The NY Fed says money markets are in good shape, but the rising dollar is making funding more expensive worldwide. With more Treasury debt coming and unified GOP control, we’re likely to see the yield curve steepen further, raising questions about how markets will absorb the flood of new debt.

Market outlook:

-

Futures Fall: S&P -48bps, Nasdaq -74bps, Russell +6bps

-

10-year yield holds 4.43% after Powell’s hawkish remarks

-

Fed Watch: December cut odds plunge to 62%

-

Druckenmiller loads up on regional banks before post-election rally

-

Buffett Takes New Position in Domino's Pizza (DPZ), stock up 6% premarket

-

WTI Crude once again tests $68 as IEA Warns of 2025 Supply Glut

Greetings from a tower somewhere in Towson, Maryland. From this perch, I can see the mall… the Sheraton Hotel… the bars where I used to frequent in my 20s… every place has a memory. Close enough in my mind that I can touch it. How strange to see all it from this angle. It seems like so long ago - but so soon.

It’s been about 18 years since I was last in this space. So, it distracts me a bit. Most of the restaurants I loved are gone - replaced by more corporate names. There wasn’t a Starbucks (SBUX) here. There wasn’t an LA Fitness. What are half these publicly traded salad shops?

The human mind has a long memory.

The stock market does not.

My Eyes are On China\

It’s easy to keep your eyes focused on what’s directly in front of you.

This morning, the market’s doing so with comments from Jerome Powell on the timing of rate cuts. This is a significant development from Powell - a possible turning point as we press toward the end of the year and post-election euphoria subsides.

Powell said he’s not in a rush to cut rates. Why?

I have to stretch my eyes over the horizon… to the other side of the world.

There lies China. At the moment, the U.S. dollar’s strength has become a problem again for the country. China is enjoying a record trade surplus, which is one of the highly positive elements of its economy.

However, if tariffs are introduced, China will face a real problem.

How will it sustain its economy? The answer is obvious, yes?

Stimulus. Russell Clark at Capital Flow & Imbalance said this week that the most bullish thing for the market is that China IS NOT STIMULATING.

And when they finally do get around to it, it will fuel inflation.

This is one of the forgotten elements of global capital flows and trade.

China’s stimulus could very well create volatility, as it could impact U.S. inflation and, ultimately, rates here. Not all stimulus is the same, and I hadn’t considered this over the last few weeks.

So, I’ll be reevaluating the impact of China’s pending stimulus. As I’ve said - it’s largely built on the back of the Hedge of Tomorrow investments.

And it could push us toward increased speculation in the global markets.

Stay positive.

More By This Author:

What You Missed, And What's Coming In The Week Ahead

An Overtime Thriller And The Week Ahead

Here's How to Play the Election

Disclosure: None.