How Inflation Is Manipulated By The Federal Reserve

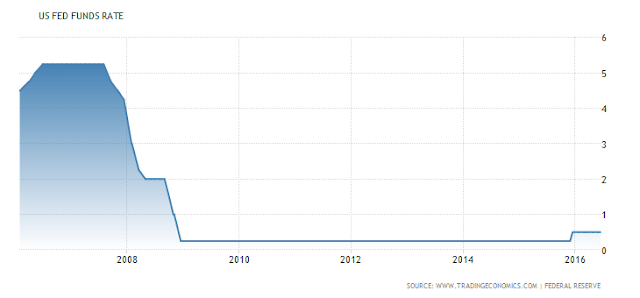

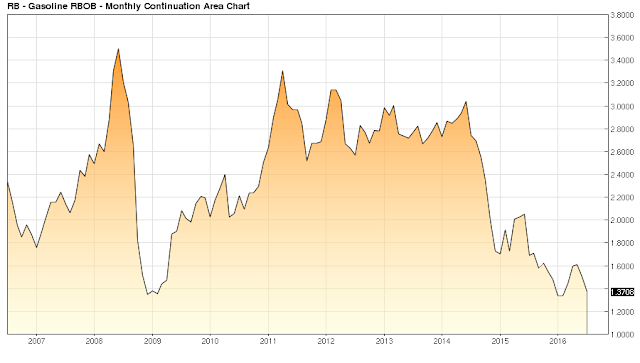

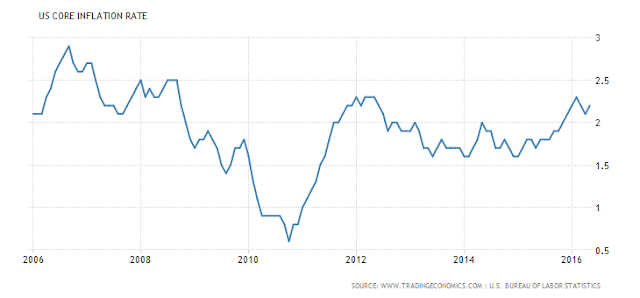

We show the underlying costs of QE by the Federal Reserve in terms of much higher inflation that counters the benefits of lower interest rates on the Home Ownership Rate by lowering disposable income for consumers. The Fed giveth on one hand and taketh away with the other hand.

When the all in costs of QE and ZIRP are fully analyzed these policies are detrimental to long term growth fulfillment, healthy functioning financial markets, and capitalism in general. They should only be used as short term emergency measures by Central Banks. The evidence is quite clear at this point staying at the Zero Bound is detrimental to healthy functioning societies.

Video length: 00:21:14

Disclaimer: All of the content on EconMatters is provided without assurance or warranty of any kind. The opinions expressed here are personal views only, and ...

more

"When the all in costs of QE and ZIRP are fully analyzed these policies are detrimental to long term growth fulfillment, healthy functioning financial markets, and capitalism in general.", hmmm we should think twice next time we choose a a Federal Reserve head that supports planned and managed economies and heralds towards socialism more than capitalism. So far besides making the rich richer and the middle class poorer, she hasn't done much besides somewhat successfully planning the destruction of our economy that now can't grow, has no interest rate safety net, has a angry middle class, and is more indebted than ever and is told that there is no value in having money or saving, that the problem is not spending. I find the ask for negative rates and getting rid of the hundred dollar bill as good evidence that the economy is far from wonderful and that the Federal Reserve has anything good to share with the average citizen going forward besides maybe Yellen's dream of making America a managed economy communist/socialist haven once everyone is hopelessly in debt and TBTF banks own everything after the next set of big crashes.

As for inflation, the real inflation is cost of homes which has been nerfed out of the readings because it would show the opposite of what they want and cause them to have to end the thing eating at capitalism, the maligned and biased give away of free liquidity to the undeserving.

@[Moon Kil Woong](user:5208), while I agree with much of what you said, I wouldn't go so far as to practically call #Yellen a socialist. Don't you think that's a bit much? Excellent post.

A central planned economy is the backbone and the Achilles heel of socialist countries which inhibits free market signalling, confuses market participants, often unfairly biases those with close ties to the central monetary authority and government, and thus leads to corruption. So far I see all of these effects coming from the US Central Bank under Yellen. One may debate whether she is or isn't a true socialist, or whether her ties to socialists and Berkeley are strong or not, however, one needs not look beyond how she has steered the Federal Reserve which by its nature is more planned economy socialist than it ever has been and makes no bones about disrupting the free market.

There are serious economic ramifications that she is implementing in the US that can not be countermanded without severe consequences, and thus locks the US into dependence on central bank manipulation and a planned economy until the US decides that it is worth throwing it away in hopes of actually pursuing a free market with its hopes of growth and prosperity instead of a slow, dying corpse of an economy we are living in under Yellen. Unfortunately, in the near future we will have to face the first of disastrously bad downturns when this cycle ends. Given the solution will be much like Japan, more QE and zirp, I'd seriously think about buying stock in commodity companies before it hits. Undoubtedly the economy won't grow nor will demand, but I assure you, inflation will rear its ugly head as growth slows as Yellen starts throwing "liquidity" around. For some reason she hates it if people call it money. Sadly like all socialist economies the only one who sees the free money is those well connected enough to get it. The rest can starve like North Korea.