Feuding Fed-Watchers: Gross Gores Gundlach Over 'Bond King' Title

It's only been two years since former-Bond-King Bill Gross 'feuded' with someone (his neighbor) and spent five days in jail for it.

So perhaps the grumpy old man was due for another fight and who better to battle than the current-Bond-King Jeff Gundlach.

Bloomberg reports that the ex-PIMCO-boss seems unable to hand over his crown...

“First of all, to be a bond king or queen, you need a kingdom,” Gross said at a live recording of the Odd Lots podcast at the Future Proof conference for the wealth management industry in Huntington Beach, California.

“Pimco had $2 trillion, ok? DoubleLine’s got like $55 billion. Come on — that’s no kingdom, that’s like Latvia or Estonia.”

Apparently, the 'beef' between the bond-kings began when Gross visited Gundlach after he left PIMCO, asking if they could work together:

“I went up to his house and said “Maybe I could work with you, we could be two bond kings,” he said during the podcast recording.

“And he trashed me for the next 12 months... And look at his record for the last five, six, seven years,” Gross added. “I got you back, Jeff.”

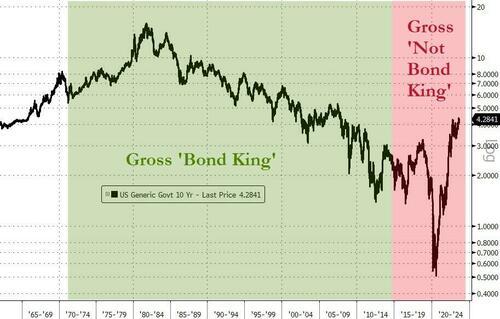

But Gross admits much of his success to a 30-year bond bull market:

“I don’t think there could be another bond king,” Gross said in a slightly less contemptible tone.

“It was the function of a bull market for 30 years that was growing and Pimco was doing well.”

(Click on image to enlarge)

He concludes that asset managers may no longer be wearing the crown...

“The bond kings and queens are at the Fed,” he added.

“So they’re in charge.”

As a reminder, Gross left PIMCO in 2014 after clashing with colleagues.

Video Length: 00:01:47

As the 79-year-old tries a dick-measuring contest, we remind readers that Gundlach is not afraid of mud-slingers.

As yet, Gundlach has not commented...

More By This Author:

New iphones Don't Create As Much Buzz As They Used To

WTI Breaks Out To New Nov Highs After OPEC Data Shows Huge Supply Shortfall

China New Credit Rebounds Sharply On Surge In New Mortgage Loans

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more