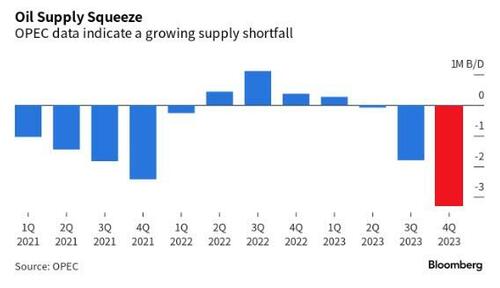

WTI Breaks Out To New Nov Highs After OPEC Data Shows Huge Supply Shortfall

Oil prices had been coiling for a few days ahead of this data and are breaking out now after OPEC reports that global oil markets face a supply shortfall of more than 3 million barrels a day next quarter - potentially the biggest deficit in more than a decade.

If realized, it could be the biggest inventory drawdown since at least 2007, according to a Bloomberg analysis of figures published by OPEC’s Vienna-based secretariat.

(Click on image to enlarge)

OPEC’s 13 members have pumped an average of 27.4 million barrels a day so far this quarter, or roughly 1.8 million less than it believes consumers needed, according to the report.

WTI pushed above $88 on the news, its highest since Nov 2022...

(Click on image to enlarge)

As Bloomberg reports, The kingdom’s hawkish strategy, aided by export reductions from fellow OPEC+ member Russia, threatens to bring renewed inflationary pressures to a fragile global economy.

Diesel prices have surged in Europe, while American airlines are warning passengers to brace for increased costs.

It could even become a political issue for President Biden as he prepares for next year’s reelection campaign, with national gasoline prices nearing the sensitive threshold of $4 a gallon.

More By This Author:

China New Credit Rebounds Sharply On Surge In New Mortgage LoansBig-Tech Best, Bitcoin Battered As Event-Risk-Ridden Week Looms

Key Events This Extremely Busy Week: CPI, PPI, Retail Sales, ECB, China Data Dump, new Iphone, ARM IPO, UAW Strike And More

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more