Fed Sends Mixed Message: Repeats Willingness To Cut Rates Despite "Transitory" Soft Inflation

Ahead of Powell's semi-annual Humphrey Hawkins testimony before Congress on Wednesday and Thursday of next week, the Fed has published its Monetary Policy Report, which while very similar to the June Fed meeting, had some seemingly contradictory aspects.

First and foremost in the report - which was published before today's blistering payrolls report - was the section discussing inflation, where to the surprise of many, it was said to reflect "transitory influences", an apparent change from the recently "no longer patient" Fed, which is focusing on downside risks and extending the recovery, to wit:

“Consumer price inflation, as measured by the 12-month change in the price index for personal consumption expenditures, moved down from a little above the FOMC’s objective of 2 percent in the middle of last year to a rate of 1.5 percent in May. The 12-month measure of inflation that excludes food and energy items (so-called core inflation), which historically has been a better indicator than the overall figure of where inflation will be in the future, was 1.6 percent in May—down from a rate of 2 percent from a year ago. However these year-over-year declines mainly reflect soft readings in the monthly price data earlier this year, which appear to reflect transitory influences. Survey-based measures of longerrun inflation expectations are little changed, while market-based measures of inflation compensation have declined recently to levels close to or below the low levels seen late last year.”

Of course, this hawkish read got a kick today following a blockbuster payroll report which has relieved some pressure to cut and certainly collapsed the market's expectations of 2 rate cuts in July (even if the job report also showed no acceleration in annual wage gains, signaling that broader price pressures remain contained).

Despite again noting that lack of inflation may be "transitory", the Fed reiterated its openness to cutting interest rates to extend the longest U.S. economic expansion on record while noting that the pace of growth had slowed in the second quarter of 2019.

“Data for the second quarter suggest a moderation in GDP growth -- despite a pickup in consumption -- as the contributions from net exports and inventories reverse and the impetus from business investment wanes further."

The report repeated wording from the June FOMC statement saying officials would closely monitor incoming data and “act as appropriate to sustain the expansion.”

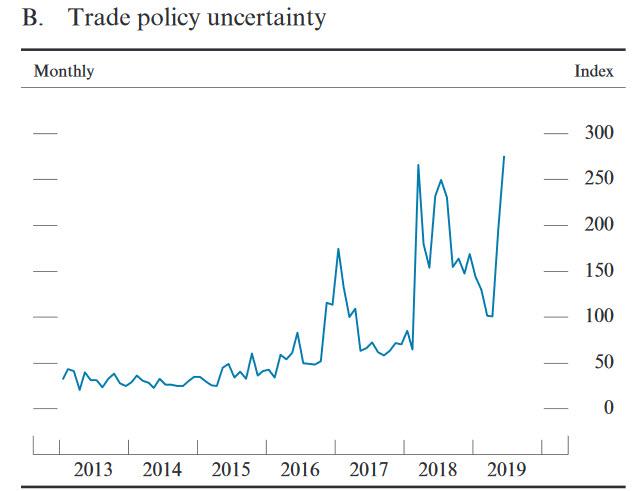

The report also highlighted a significant weakening in global trade growth and manufacturing since 2017 "even as growth in services has held up" although even that is now cracking with the ISM Services survey sliding: "Trade policy developments appear to have lowered trade flows to some extent, while uncertainty surrounding trade policy may be weighing on investment," the Fed said.

According to the Fed, foreign economies were hit even harder, to wit:

"after slowing in 2018, foreign economic growth appears to have stabilized in the first halfofthe year, but at a restrained pace. While aggregate activity in the advanced foreign economies (AFEs) increased slowly from the soft patch oflate last year, activity in emerging Asia generally struggled to gain a solid footing, and several Latin American economies continued to underperform. Growth abroad has been held down in part by a slowdown in the manufacturing sector against the backdrop of softening global trade flows. "

The report said new tariffs were likely to have lowered U.S. imports by about $70 billion. At the same time, the report said tariffs to date probably had a “material but modest” direct impact on global trade flows. The punchline, as shown in the chart below, is that global uncertainty about trade policy has never been greater:

(Click on image to enlarge)

Repeating what it has said on numerous prior occasions, the Fed said that when it comes to financial stability, asset valuations remained “somewhat elevated” in a number of markets, "with investors continuing to exhibit high appetite for risk. Borrowing by businesses continues to outpace GDP, with the most rapid increases in debt concentrated among the riskiest firms. In contrast, household borrowing remains modest relative to income, and the debt growth is concentrated among borrowers with high credit scores."

Finally, the report noted that while valuations for leveraged loans had eased, there were signs that credit standards for new leveraged loans were weak and had deteriorated further over the past six months.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more