Fed Easing Cycles

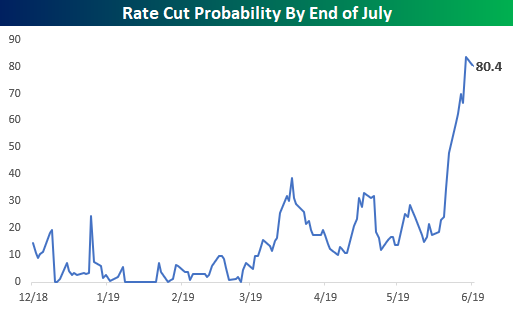

After the last ten to twenty years of market ups and downs, it takes a lot to surprise experienced investors. One recent trend that qualifies, though, is the rapid and aggressive pricing of Fed rate cuts in the coming months. The futures market is pricing in over an 80% chance that the FOMC will cut rates between now and the end of July. This comes even as there has been an absence of any overwhelmingly supportive or consistent commentary from Fed officials suggesting that rate cuts are imminent.

With rate cuts likely on the horizon, it’s time to look back at prior rate-cutting cycles from the FOMC to see how equities performed leading up to and after the first cut in an easing cycle. To do this, we looked at all prior periods in the last thirty years where the FOMC cut rates at least three times after a series of hikes. While we could have gone back further in our analysis, the last thirty years essentially covers the period since Greenspan became the Fed chair, and it also wasn’t even until 1994 that the FOMC actually announced what the interest rate policy was on the day of their meetings. Therefore, the further you go back in time the less relevance there is to circumstances today. Interestingly enough, at 1,272 calendar days and counting, the current rate hike cycle has been the longest of the last 30 years.

Our latest B.I.G. Tips report provides an insightful look at the stock market’s performance during prior rate cut cycles. To see the report, more