Fed Adds Nearly $300 Billion To Balance Sheet In One Week With Bank Bailouts

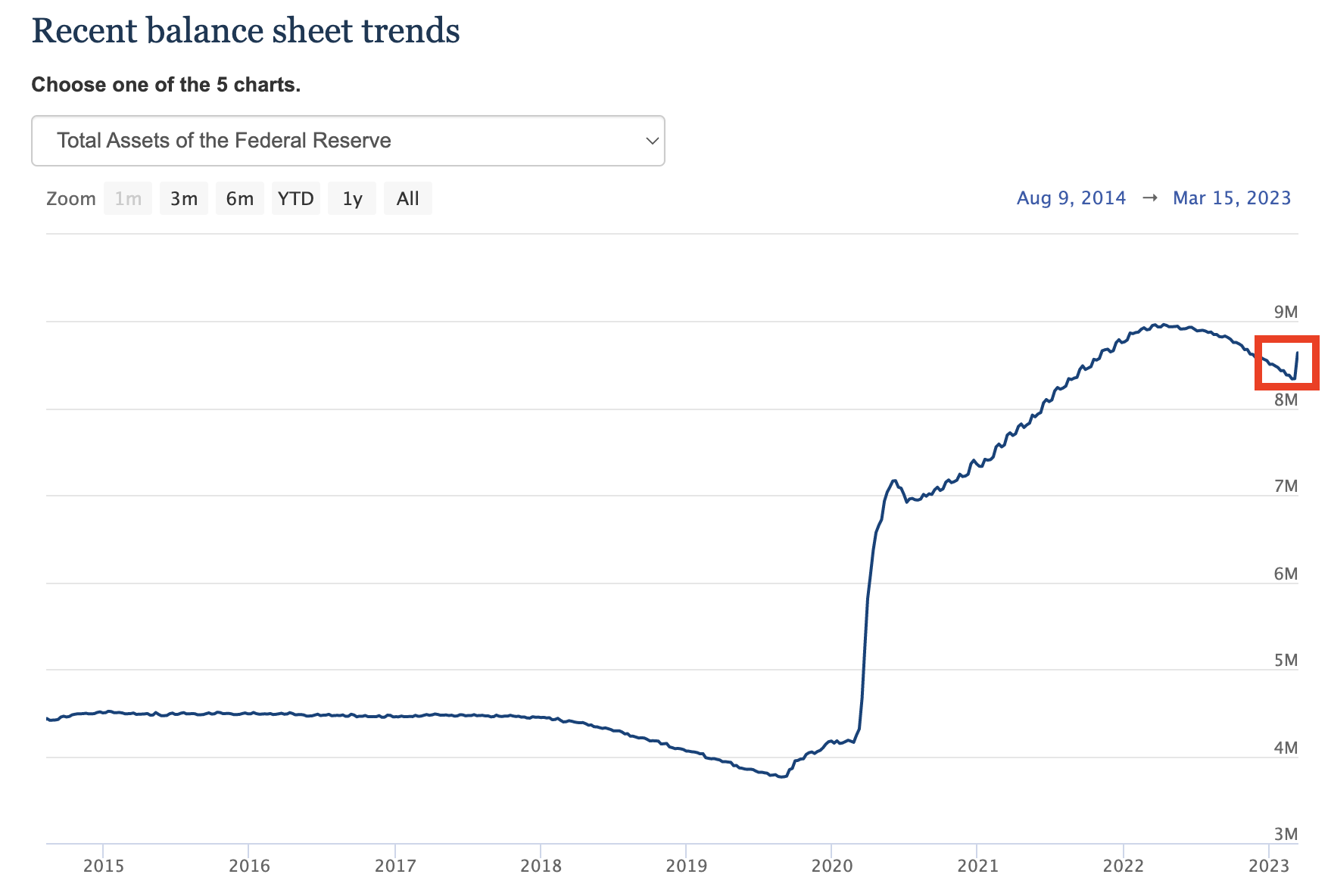

The Federal Reserve added nearly $300 billion to its balance sheet in a single week as it kicked off its loan bailout program for banks.

In effect, the Fed loaned troubled banks $300 billion of new money that was created out of thin air.

In other words, we got $300 billion in inflation in a single week.

After the failure of Silicon Valley Bank, the Federal Reserve announced a loan program that will allow other banks to easily access capital “to help assure banks have the ability to meet the needs of all their depositors.”

The Bank Term Funding Program (BTFP) will offer loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging US Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. Banks will be able to borrow against their assets “at par” (face value).

According to a Federal Reserve statement, “the BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.”

The fact that banks borrowed $300 billion in just one week reveals just how unsound the US banking system is.

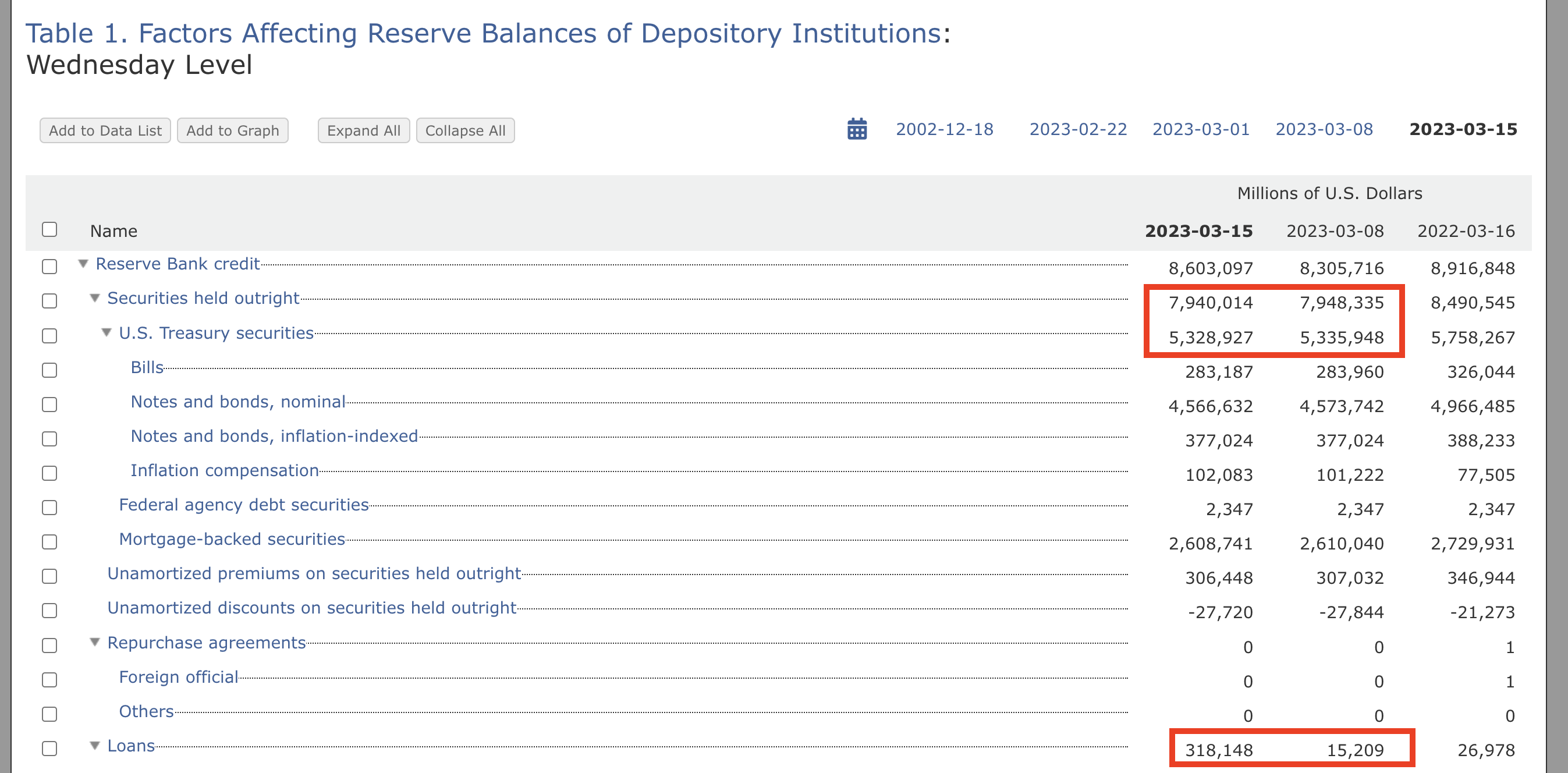

As you can see from the breakdown below, the entirety of the balance sheet expansion came from new loans added to the Fed’s balance sheet. Interestingly, the amount of Treasuries and mortgage-backed securities fell. That’s because the bonds pledged in collateral don’t show up on the Fed’s books unless the bank defaults. So, while the Fed can plausibly argue that they aren’t engaged in quantitative easing, the effect of this loan program is exactly the same. The central bank is creating new money out of thin air and injecting it into the financial system.

(Click on image to enlarge)

As Peter Schiff said in an interview on NTD News, this is how Americans are going to pay for these bank bailouts – the inflation tax, and when President Joe Biden claims Americans won’t pay for these bailouts, he’s lying.

They’re going to pay the cost through higher prices. And when he says that everybody’s bank account is now safe, it’s not. It’s in more danger than ever before because your bank account is going to be eroded in value because of inflation. So, even if your bank doesn’t fail, and you don’t lose your money, your money is going to lose its value.”

Trying to Have Its Cake and Eat It Too

In effect, the inflation fight is over. You don’t fight inflation by creating $300 billion out of thin air. But the Fed has concocted a scheme that will allow it to plausibly claim it is still in the inflation fight a little longer while simultaneously trying to minimize the negative impact of higher interest rates on the banks.

With this loan program in place, banks can access capital based on their devalued bond holdings without selling their Treasuries and mortgage-backed securities into the market at a big loss (as SVB was forced to do). This provides some stability for both the banks and the bond markets.

Keep in mind, the banks are struggling precisely because the Fed raised interest rates so fast after holding them at zero for so long. As Schiff noted, “It was the Federal Reserve that created all these distortions by its artificial suppression of interest rates, and it caused financial institutions to take incredible risks in order to get a return.”

Now Fed has tried to create a way to mitigate the impact of interest rate hikes on bank balance sheets without having to lower interest rates more broadly. It can theoretically raise interest rates at the March meeting and keep on shrinking its balance sheet bond holdings. Meanwhile, the banks can avoid the pain by accessing this crazy loan program. I say crazy because no sane person would make a loan based on the par value of the collateral. The value of the collateral is generally based on market value, plus a haircut to further protect the lender. By accepting collateral at face value, the Fed is effectively making unsecured loans.

And this raises a question: what incentive do these banks have to ever pay this money back? If they default, they just lose some devalued bonds they don’t want anyway. It is highly likely these bad bonds will ultimately end up on the Fed’s balance sheet.

This looks a lot like a “kick the can down the road” scheme. I think Powell and Company are hoping this loan boondoggle will buy them time to keep tightening for a while longer in the hope that CPI will drop enough in the next couple of months to claim victory over inflation and then pivot without losing face.

I have been saying for months that something was going to break. This bubble economy is built on artificially low-interest rates and money creation. In its attempt to bring down price inflation, the Federal Reserve took that away. It was inevitable this dam would eventually break when they started digging out the easy-money foundation. The Fed may have managed to get a finger in this hole, but it won’t be long before another hole appears. And then another. And then another.

The question, in my mind, is where will the next hole manifest? And how will they plug that hole?

More By This Author:

The Comex Is In Far Worse Shape Than SVB

A Crack In The Dam

Chinese Gold Demand Continued To Surge In February