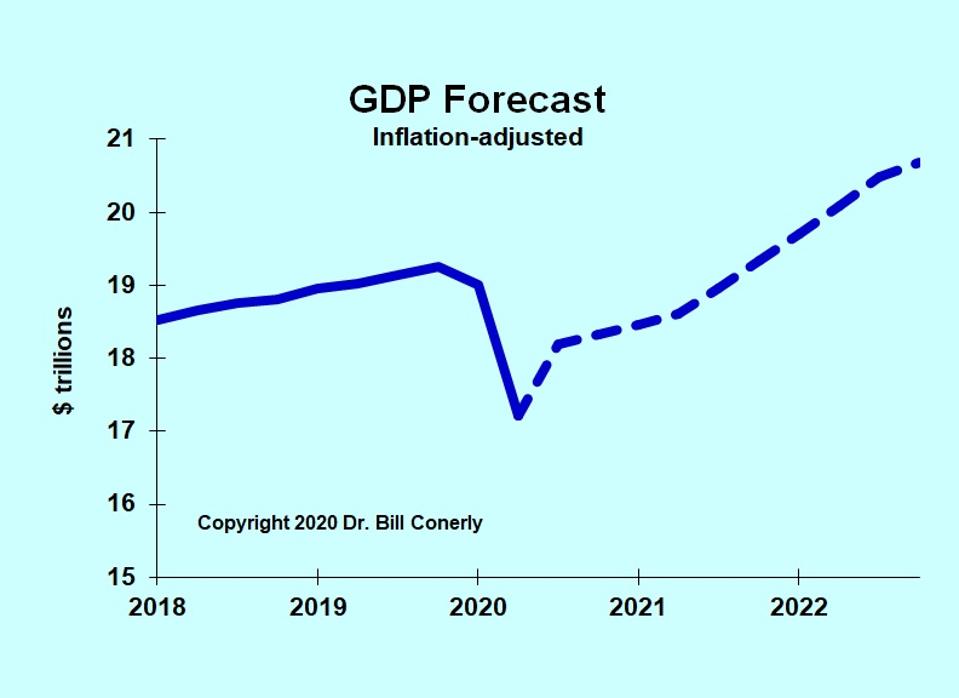

Economic Forecast 2022-23: Recovery From The Pandemic Recession

Many businesses use the autumn to set budgets for the next year and to reevaluate corporate strategy. Planning meetings often begin with an economic forecast, but how do you do that in the midst such a weird year?

GDP forecast

DR. BILL CONERLY

We are imperfect people living in an imperfect world, doing the best we can. That’s the theme of this economic forecast. It won’t be perfect, but it will illustrate a likely path and also discuss plausible ranges of variation.

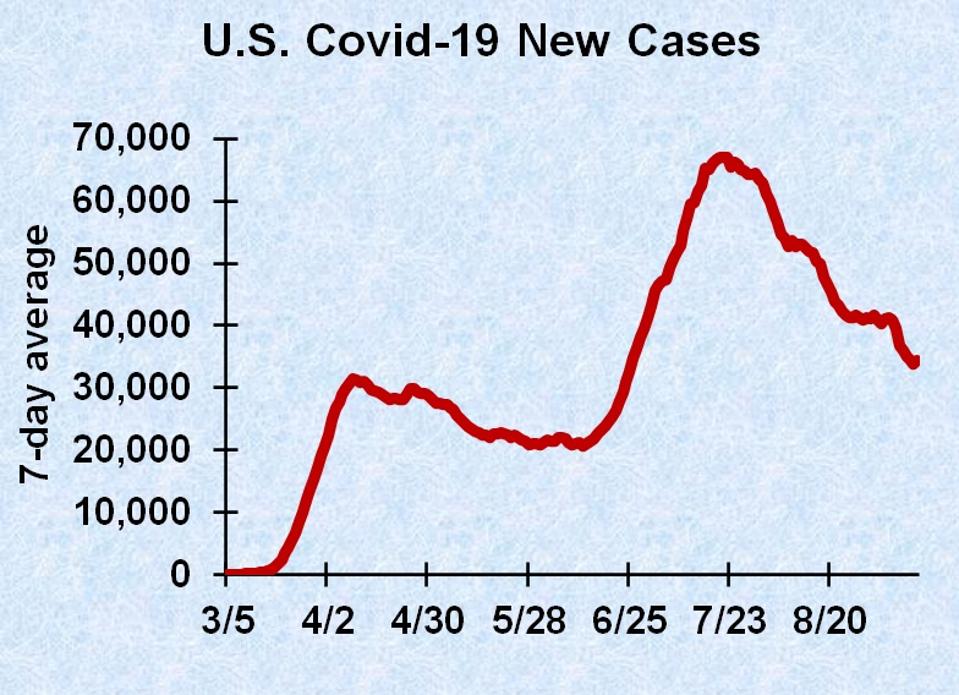

The economic forecast depends on the COVID-19 pandemic forecast. Around the world, the number of new cases identified has leveled off. That does not mean that illness is leveling off, but the growth rate is now steady. That’s a big improvement, but not the great news we’d all like to hear. Different regions of the world vary greatly, with Europe doing poorly but East Asia doing very well.

New COVID-19 cases in the U.S.

DR. BILL CONERLY BASED ON DATA FROM USAFACTS.ORG

In the United States, the second wave of new cases has leveled off. The good news is that the number of deaths has dropped dramatically. That’s important not just for the lives saved, but economically as well. The risk of more lockdowns or shelter-in-place orders comes not from people getting sick for a few days, but from people dying. With fewer deaths, we face lower risk of business-throttling orders from the government.

The lower death rate comes from three factors. First, doctors and nurses are better at treating very sick COVID-19 patients. They have learned from experience, thankfully. Second, we are testing a lot more than we used to, so some cases that would have been undetected in April are not being diagnosed. Third, young people are getting infected more, and they are at much lower risk of death from COVID.

Currently the economy lies in a middle ground, not locked down but not back to normal. We are waiting for a vaccine or effective treatment. The best estimate of availability comes from the Good Judgment Project, which asks a panel of superforecasters various questions, including when we’re likely to have an FDA-approved vaccine. (I described the vaccine prediction earlier, but the data are now more encouraging.) A majority of superforecasters, 61 percent, expect we’ll have a vaccine sometime between October 2020 and March 2021. Rolling out the vaccination program to most of our population will probably take six months, so look for a return to close social contact in the second half of 2021.

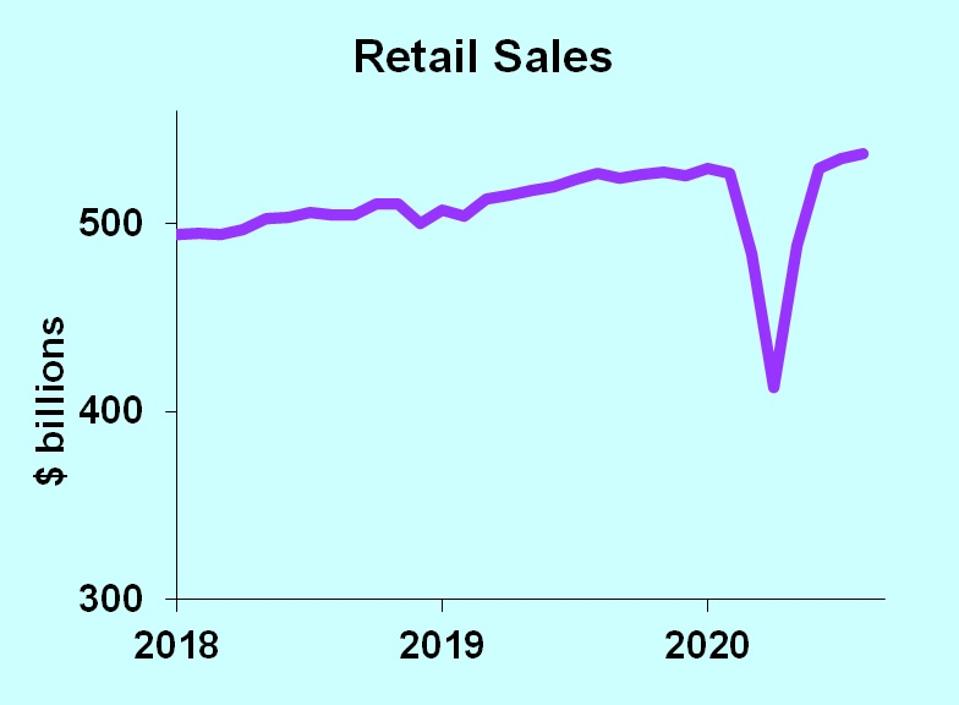

Retail sales showed a "V" with a sharp downward spike followed by sharp rebound.

DR. BILL CONERLY BASED ON DATA FROM U.S. CENSUS BUREAU

Right now the economy has rebounded partially. Employment fell by 22 million jobs from February to April, and has regained nine million of those jobs as of the August jobs report. Despite the continued high unemployment rate, though, retail sales have fully recovered. That’s because take-home pay, which we economists call jumped well above trend with the $1200 stimulus payments in April, and then continued at elevated levels through July thanks to bonus unemployment insurance payments. In the near term, incomes are likely to fall because the $600 extra unemployment payments are over. Consumer spending will drop a little, but not nearly as badly as in the spring.

The V-shaped pattern is also reflected in home sales. Real estate professionals have done a great job of adapting to social distancing, enabling the buying and selling of homes, appraisals, title insurance policies and closings at the same pace as before the pandemic. With the shift to suburban living that is beginning, house prices will rise and more new homes will be built.

Busines spending on capital goods also recovered from a spring slump, though the outlook is a little soft moving forward. With so much change possible in a post-COVID world, many companies will hesitate to make big commitments. This effect won’t be disastrous, but will pull the trend down a bit.

Nonresidential construction began declining before the pandemic. Although office and retail construction will be soft in the near future, they account for less than one-fourth of private nonresidential construction. The big categories include power production, manufacturing, health care and warehouses, which should do fine in the transition to post-COVID business.

Government spending has risen substantially, thanks to all of those stimulus payments. (And the lack of another stimulus package won’t hurt the economy.) Automatic stabilizers and the increased saving from past stimulus payments will support the economy in the near term.

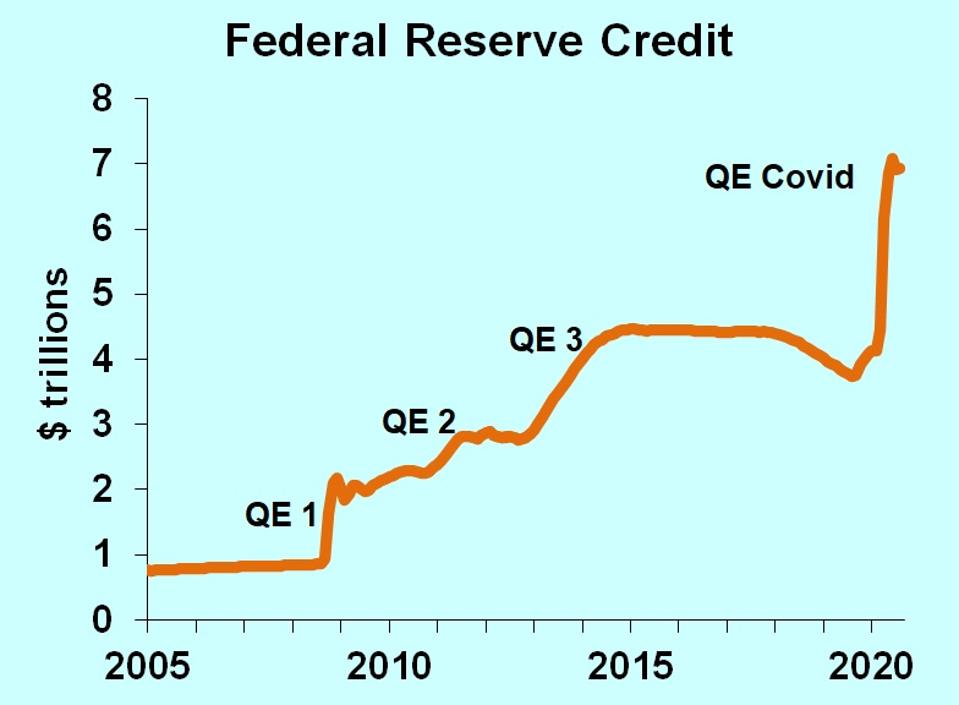

The fourth round of quantitative easing is the largest.

DR. BILL CONERLY BASED ON DATA FROM FEDERAL RESERVE

Those government expenditures were enabled by aggressive monetary expansion by the Federal Reserve. As a result of their earlier traditional easing plus the recent quantitative easing, interest rates fell to near zero.

The economy will likely expand from the current depressed level at a moderate pace through summer 2021. About six months after a vaccine is approved, the economy should grow rapidly to regain all lost ground. During this recovery era, interest rates will remain low.

Thereafter, however, the economy is likely to destabilize, with the Fed over-tightening in response to inflation, then over-easing in response to the resulting recession, as described in my article about the Fed’s new strategy. This more-cyclical era won’t begin until 2022 or 2023, but it’s coming.

This forecast should be taken as a general direction, not a finely-tuned prediction. We are imperfect people, in an imperfect world, doing the best that we can.

Disclosure: None.

Pretty optimistic for the real economy. As long as a third, winter wave of Covid-19 does not hit with force, then this scenario looks good. Otherwise, we will have big problems.