Dollar Devaluation And The Antisystem Youth

Image Source: Pexels

Per usual, I’ve been trying to summarize the flood of news we’ve all been hit with over the past week. Four interesting points seem to thread together the same story:

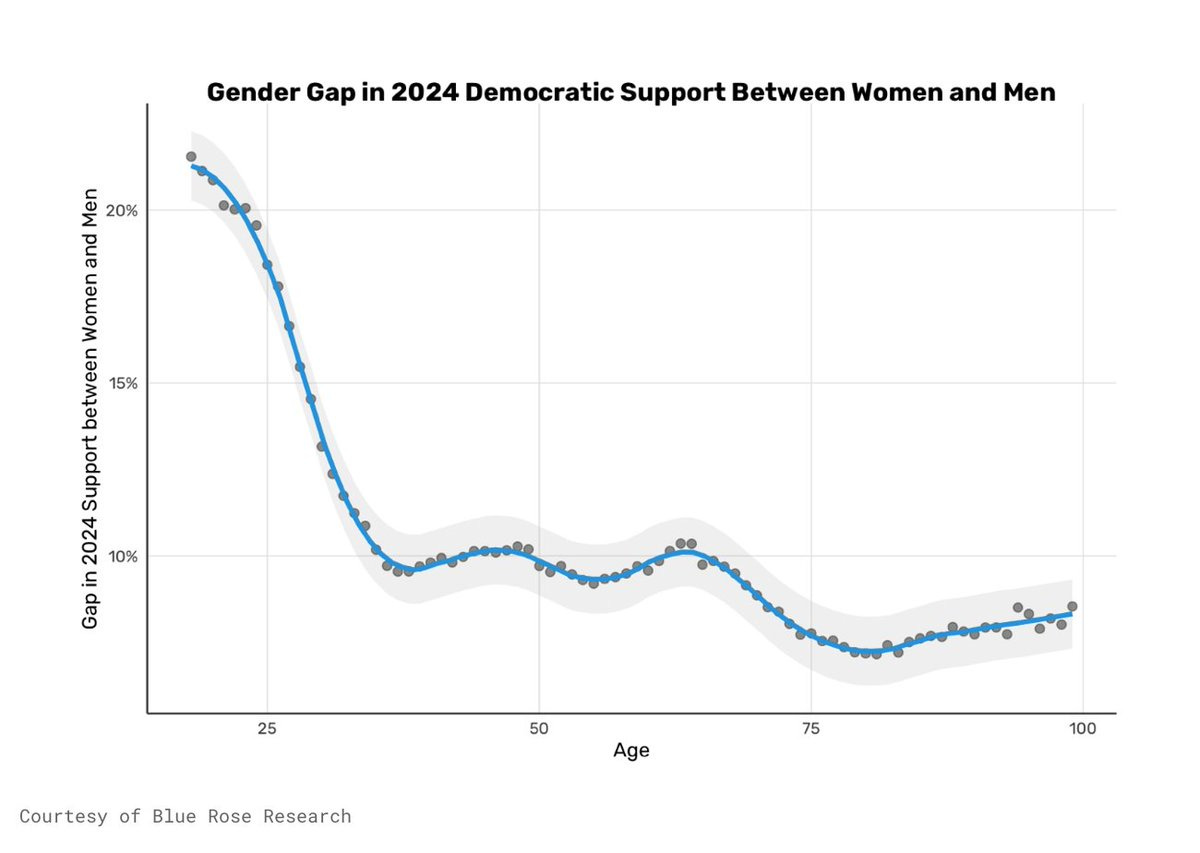

- The growing evidence of an antisystem mindset among young people - especially young men -rooted in a sense of futurelessness.

- The collision of AI and the “actual world,” torching what remains of trust (extraordinarily so, as documented by the FT) and clarity in public discourse.

- The Trump administration’s moves around the so-called Mar-a-Lago accord (brilliantly covered by Gillian Tett).

- The endgame to reshore manufacturing, spotlighted in recent JD Vance speech.

All these developments - the antisystem youth sentiment, the AI disruptions, Trump’s Mar-a-Lago accord moves, and attempts at reshoring - tie back to one urgent problem: no policy will really work if no one trusts in it.

The Crisis of Futurelessness

First, let’s talk young people. The beginning of this essay will hit on the points that many others have made, but hopefully it will provide a lens for the policy analysis part later on. For young people (honestly, many people) there is a sense of futurelessness stemming from rising costs, a stagnant labor market, and the nonstop barrage of social-media outrage. This is hardly new - many have pointed it out, including me but recent pieces have hammered it home, like Conor Sen's piece1:

-

The Gen Z job recession: Conor highlights a “low firing, low hiring” job market (which Jerome Powell also noted during the FOMC meeting). This dynamic might be fine for older workers, but it feels like a recession to new grads.

-

Economic pain, now: The unemployment rate for 20- to 24-year-olds has jumped to 8.3% (7x the deterioration seen by prime-age workers). 80% of white-collar Gen Zers say it’s difficult to find a better position, and AI threatens to replace entry-level roles they once relied on to launch their careers (and no one is really talking about what we are going to do about that).

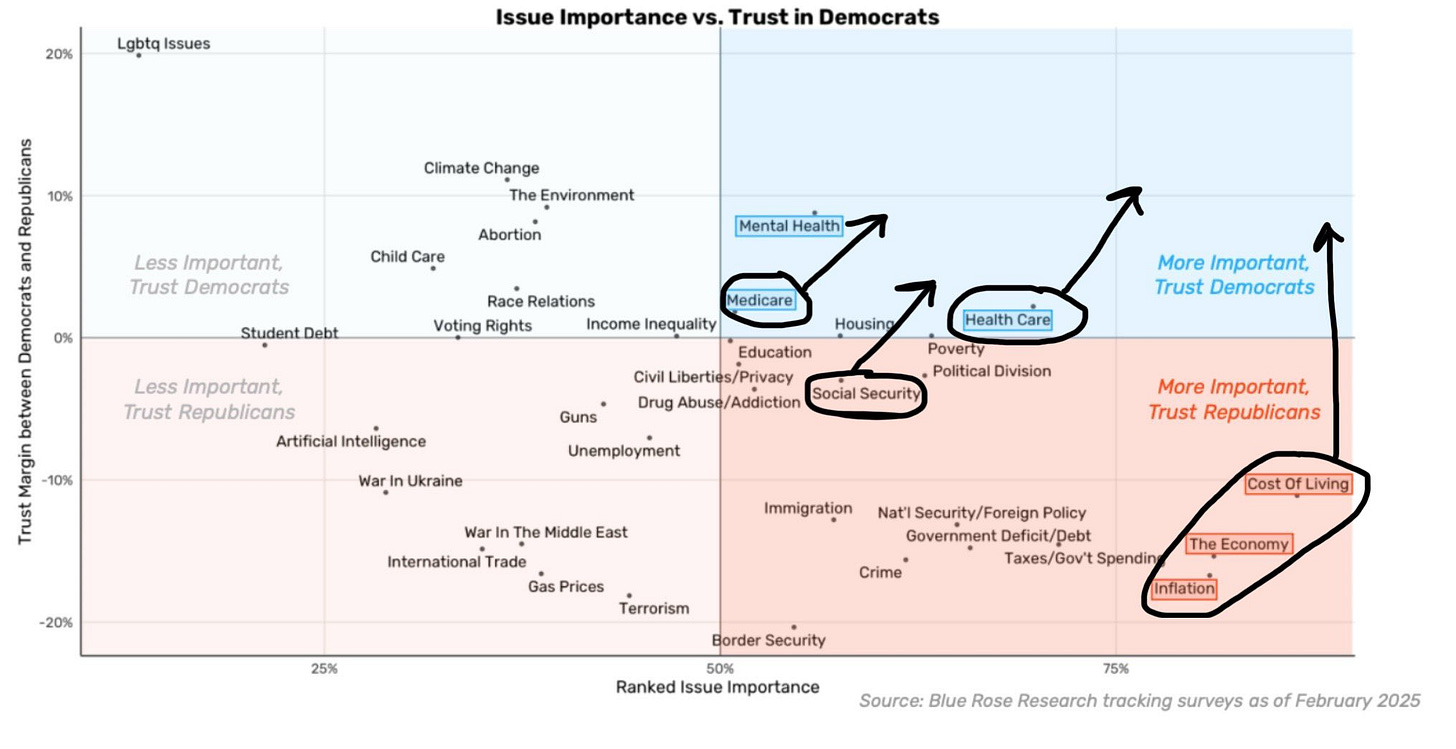

Young people feel a broken social contract: effort and patience no longer guarantee security or opportunity. The result is a kind of presentism (sports betting, meme trading) instead of planning for a future that feels out of reach. For a young workforce facing these barriers, it’s logical to tune out or embrace an “antisystem” candidate who at least acknowledges their desperation, reinforcing the cycle of futurelessness. In the 2024 election, this economic pain was front and center. David Shor’s post-election autopsy shows how desperately voters wanted cost-of-living relief and how strongly they believed Republicans could deliver it.

(Click on image to enlarge)

Marked up by Adam Carlson

The issues of housing, job prospects, inflation all feed into “antisystem” sentiments among young men, who also find themselves drawn into online echo chambers.

The thing about pain is that it has to go somewhere.

Economic insecurity creates both apathy and extremism. Barack Obama captured Millennials’ imagination in 2008 because they wanted a break from financial-crisis-era politics. Now Trump serves that function for segments of Gen Z: if you can’t see a future, drastic action feels more appealing.

Cognitive Capacity & Phoneworld

Layered on top of the economic stress is what John Burn-Murdoch calls a cognitive crisis: we aren’t getting dumber, but we can’t think as well. Our ability to maintain sustained attention, do deeper critical analysis, and solve complex problems is fried by fragmentation, especially because of social media.

Kate Wagner calls it ‘phoneworld’ - a place where we’re inundated with the same news and hundreds of knee-jerk reactions, locking us in an eternal present. Meanwhile, material reality – crumbling infrastructure, economic insecurity, and declining global influence - demands serious solutions. But the constant storm of hot takes saps our capacity for nuance (you can see this in any Twitter interaction), making it easier for political actors to weaponize half-truths and reinforce distrust in any meaningful governance.

Role Models

Adding to the chaos is a leadership vacuum. Compare older generations of the ultra-wealthy, like Andrew Carnegie, who gave away 90% of his fortune building libraries, to the new wave of Twitter feuds and boring culture-war stunts, like the recent Solana ad. Warren Buffett is really the only outlier now, writing in his recent shareholder letter (as he discussed how much he pays in taxes):

Someday your nieces and nephews at Berkshire hope to send you even larger payments than we did in 2024. Spend it wisely. Take care of the many who, for no fault of their own, get the short straws in life. They deserve better.

And never forget that we need you to maintain a stable currency and that result requires both wisdom and vigilance on your part.

He’s effectively telling policymakers to support those who can’t support themselves—and to avoid messing with the dollar (we’ll get to the Mar-a-Lago accord soon). It’s refreshing because we don’t see it a lot? We kind of have a lot of jerks leading the charge out there. As Trump reminded us, all of this is “great television” - personal vendettas and ideological grandstanding sell better than integrity or decency!

But like… DOGE is slashing cancer research funding rather than addressing genuine waste. That reinforces the perception that our systems are irredeemably broken. People begin to feel no one genuinely has their back (or their future) in mind. That vacuum of trustworthy leadership sets the stage for a world where political theater becomes the main act.

Sometimes when I am traveling and ask students what they're saving for, they literally laugh - it’s a very grim resignation. They don’t trust that their effort will be rewarded. Again, the pain of economic insecurity has to go somewhere and if it can’t be channeled into meaningful work or stable institutions, it festers into alienation or extremes.

Trump Exposes Our Institutional Cracks

And we are in the extremes, no matter how you feel about the policies. Trump recently said:

We're doing very well right now. We're doing well because I won the election. If I didn't win the election, we would have had a very bad period. Stock market going down was because of the bad four years we had.

This sums up the Reality TV approach to governance: endless spectacle! From threats like “Canada should be our 51st state (he keeps on saying it as well as threatening Greenland2 and now Canada understandably doesn’t want to negotiate) to defying judges, to dismantling Voice of America (so important in places like Ukraine, Russia, and Afghanistan), the Trump administration has tested every constitutional norm.

But.

Trump's real genius is turning governance into entertainment while simultaneously exposing the rot in our systems. This administration has shown us the weaknesses in our democracy, again, for however you feel about what they are doing. They’ve shown the cracks that partisanship has created, something George Washington would be ashamed of. They have ignored all of what makes America good, and have unfortunately focused on what makes her weak, at the cost of how young people feel about their future.

If it turns out that the Trump administration can defy direct Supreme Court precedent (84% of Americans believe he should follow court orders) and overturn the will of Congress, then we are experiencing a true test of power - trying on the One Ring just to see what it feels like. If the Federal Reserve’s independence3 goes too, as the FTC’s went (likely surprising the head of the FTC, at least based on his recent Odd Lots interview) inflation will shoot up and interest rates could spike, really pulling the rug from under the economy.

Quick Fed Note

The Federal Reserve decided to pause rate cuts yesterday, reiterating many times that the economic environment is extremely uncertain and they don’t really know what’s happening. They revised inflation and unemployment projections upward and economic growth downwards, partially due to the tariffs (which could lead to stagflation over time, especially if inflation goes up and economic growth flatlines). But, Jerome Powell said that any inflation caused by these tariffs would be transitory, basically saying that the Fed would look through them.

Powell’s in a tight spot, navigating an orchestrated slowdown from the administration - firing government staff (they have already had to rehire some of them), deregulating finance, trying to delever the public sector, all while wanting the 10-year Treasury yield down. The Fed signaled that the next time they cut will be when the economy is in dire straits. President Trump didn’t quite like that, tweeting that the Fed should have cut in preparation for tariffs.

We will see what happens. But there is definitely a push for change.

JD Vance’s Speech & the Reshoring Push

Against this backdrop of institutional strain, JD Vance spoke at the a16z American Dynamism summit about making manufacturing great again in the US. It was a relief to hear something that wasn’t pure demolition - he focused on building. His core arguments:

- We can’t separate innovation from manufacturing.

- Immigration has hurt innovation (controversial, especially given how immigration historically boosts U.S. productivity and contrasts to Japan, who has very restrictive immigration policies, and hasn’t seen the same growth as the US)

- The U.S. is falling behind in productivity, though data generally shows we are phenomenally productive.

And to be clear, there is power in bringing manufacturing back to the United States. We desperately need another Bell Labs and another DARPA. But it’s important how we do it. He states that their entire economic package is:

- Tariffs to protect domestic industries (they plan to do ‘trillions’ by April 2)

- Tax cuts4 & deregulation to spur investment

- Lower energy costs

- Strong border enforcement to curb the influx of cheap labor

- Full expensing of investments.

Some of this… is not new!

- Biden was doing similar things through federal spending, tax incentives, and public–private partnerships (e.g., the CHIPS Act, the Inflation Reduction Act) as well as subsidies and direct federal outlays.

- Trumponomics is more on tariffs, reducing immigration flows (especially lower-wage labor), lowering regulations, and cutting taxes. A lack of low cost labor will force innovation.

The real question is which approach better serves long-term innovation. Most research suggests:

-

Targeted public investment

-

Competitive market pressures

-

A skilled workforce (including specialized immigrant labor)

… drive innovation more effectively than protectionism. But Trump is consistent: his mercantilist stance (steady since his 1987 full-page New York Times ad arguing against defending Japan militarily) views the economy as zero-sum. Funnily enough, this contradicts Ronald Reagan's warning that same year:

When someone says, 'Let's impose tariffs on foreign imports' it looks like they're doing the patriotic thing... But what eventually occurs is: First, homegrown industries start relying on government protection. They stop competing and stop making innovative changes... Then, high tariffs inevitably lead to retaliation by foreign countries and fierce trade wars... Markets shrink and collapse; businesses and industries shut down; and millions of people lose their jobs.

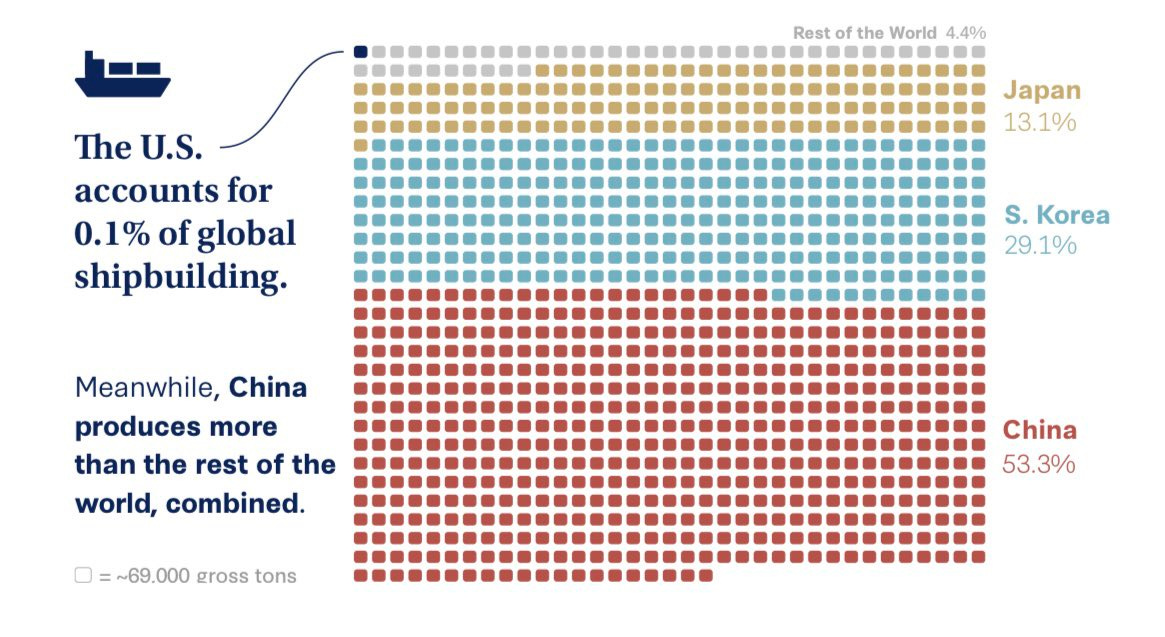

The American shipbuilding industry is a protectionist cautionary tale - it fell behind while China surged ahead. A single Chinese state-owned shipbuilder now produces more commercial vessels by tonnage than the entire American industry has since World War II (great read from CSIS on that here).

And trade wars are EXPENSIVE. We're already distributing $10b in economic loss recovery payments to farmers facing trade retaliation, and Liberation Day (April 2, where we put trillions of tariffs on other countries) hasn’t even arrived yet.

And would reshoring even fix everything? Alison Schrager has a great piece about how we aren’t in the 1960s and “the blame doesn’t lie with trade.” Manufacturing jobs have declined primarily because of technology, not offshoring. The real issues are workforce training gaps and regulatory barriers, again making deregulation more effective than protectionism.

And the economic uncertainty is already visible:

- Companies aren’t investing with 6-month capital expenditure expectations falling in March to their lowest since November 2020

- Businesses’ outlooks for the next 6 months continued to deteriorate in March

- Industrial production skyrocketed but that’s because motor vehicle production surged as companies try to get in front of the tariffs

It’s a bipartisan issue, though: we do need to build here, but it’s not about which party does it “better.” I am so extraordinarily sick of political parties. I appreciate Derek Thompson's point on the Honestly with Bari Weiss podcast that liberal "obsession with process is getting in the way of outcomes":

Something broke with American innovation because we over-regulated the physical and got obsessed with the digital… We have artificial intelligence that is massively brilliant... while at the same time, we can't build a train at the same speed that we did 50 or even 100 years ago.

As Ezra Klein and Thompson argue in their book "Abundance," building is always better than dismantling. The challenge, as Zach Weinberg wrote, is recognizing that some production simply doesn't need to happen domestically - other countries do it cheaper, alleviating price pressures. Forcing everything onshore risks creating inflationary problems, export difficulties (especially after alienating trading partners), and higher costs throughout supply chains. We can build here, but we should also believe in the free market and free trade.

For younger Americans especially, these mixed signals about manufacturing and tariffs only deepen their uncertainty about the future. If companies are hesitant to invest in long-term projects (and trade fights further erode global markets) then Gen Z is left wondering whether the system can ever offer them stable opportunities or upward mobility.

The Mar-a-Lago Accord

Perhaps the most consequential yet least understood aspect of Trump's economic strategy (because it isn’t quite happening as far as we know) is what Gillian Tett brilliantly unpacks as the the Mar-a-Lago accord - a plan to fundamentally reshape America's economic relationship with the world.

Named after Trump's Florida estate and modeled on the 1985 Plaza Accord (when major economies coordinated to devalue the dollar), this strategy aims to devalue the US dollar to boost American manufacturing competitiveness. The underlying belief is that the global trade system unfairly burdens American workers while benefiting financial elites. From what I gather, these are the key components:

-

Dollar Devaluation – Lowering the dollar’s value to make U.S. exports cheaper and help domestic manufacturers compete internationally (despite alienating allies)

-

Tariff Implementation – Imposing (many) taxes on imported goods to protect domestic industries and gain leverage over trade partners.

-

Debt Restructuring – Swapping Treasuries for perpetual dollar bonds, reducing immediate obligations and freeing up fiscal space for tax cuts and other spending.

-

Sovereign Wealth Fund – Creating a state-run investment vehicle to direct capital into strategic industries

-

Capital Flow Taxes – Taxing cross-border capital movements to control speculation and maintain leverage in international financial markets.

The Trump administration doesn’t want to be the “defender of the free world.” They see the dollar as too strong and global trade as rigged against Main Street, as Trinh Nguyen highlighted. Tariffs become a tool to force allies into compliance, while a weaker dollar boosts exports. They also hope to make China focus inward (though China is moving at the literal speed of light). But there are a few headwinds:

-

Lack of international cooperation: Unlike the original Plaza Accord, which required coordination with allies, the Mar-a-Lago approach is unilateral and confrontational, perhaps forcing people to join. But Germany has already established a massive €500 billion infrastructure fund - equivalent to a $3T American investment when adjusted for GDP. The European Union is excluding the United States from their €150bn rearmament fund. Canada plans to join.

-

Investors are grimacing - fund managers are rotating out of US stocks at a record pace into Chinese and European alternatives.

-

-

Currency Contradictions: Tariffs generally strengthen a currency, so trying to devalue the dollar at the same time is tricky. Debt restructuring, such as swapping Treasuries for perpetual bonds, risks undermining the dollar’s global reserve status.

-

Alienating trade partners: The plan assumes partners will endure tariffs to retain U.S. market access. But the Walmart–China standoff shows Beijing is prepared to protect its interests. European allies are also forming alternative economic frameworks. Lockheed Martin is already showing signs of strain because of the damage inflicted by the movement of money and erratic US leadership.

The US isn’t the “big dog” anymore and might not be able to force other countries to play our game. As Steve Hou said:

The the essential contradiction is what they are trying to do takes time, broad buy-in, continuity to succeed and have anything genuine to show for, which is not how they are approaching it. Trump doesn’t do patient. He’s a good promoter though that he’ll point to something that’s not really a big victory and say it is and keep repeating it until it’s believed

China, for its part, is offering an opposite blueprint: they’re investing heavily in domestic consumption and social safety nets, not slashing spending. Their "Consumption Boosting Action Plan" spans wage increases, expanded welfare, and strategic market interventions across multiple sectors - even offering consumer loans with 60-second approvals. We will see who wins.

The reason the Chinese stock market is booming is because the government plans to support industry, rather than abandon it. China is methodically building a different economic vision that could reshape global power dynamics.

The US doesn’t have the cards right now to tell them what to do.

Trump's assertion that Russia "would like to have some of our economic power" while claiming they agreed to a ceasefire (which they hadn’t, at least according to Putin) reveals this too - we have torched pretty solid trade relationships to ally with economic and administrative weaknesses. Turkey is already going off the rails partly because there is no international guard dog - the US has stepped away.

Again, none of this is lost on the young population. If the rules of international trade can change on a dime - and if currency devaluation, tariffs, or sovereign wealth schemes gamble with economic stability - then for a 23-year-old just entering the workforce, it’s yet another reason to doubt that “playing by the rules” will pay off.

Rebuilding Cognitive Capacity and Trust

Welp. How do we get young people to buy into a future again? It’s bigger than just policy tweaks. We need to rebuild trust in institutions, strengthen our cognitive capacity like John Burn-Murdoch wrote to parse complex information, and give people real opportunities to do meaningful work. AI, social media, and the “eternal present” of phoneworld intensify cynicism, but we can counteract it:

-

Education Reform with Measurable Results: Louisiana's education transformation offers a helpful blueprint. By implementing the Science of Reading, establishing clear accountability metrics, and investing in teacher training, they boosted literacy rankings from 50th to 16th nationally.

-

Digital Literacy as Infrastructure: Finland has successfully countered misinformation through their "Faktabaari" (Fact Bar) program, teaching students to evaluate information sources critically. Estonia has integrated digital citizenship into their core curriculum since 2012, producing demonstrably higher media literacy rates. The U.S. could adopt similar methods without huge new spending (perhaps challenging in Reality TV governance land)

The path forward requires both technological innovation and social renewal.

No dollar strategy or manufacturing initiative can succeed without this foundation of shared purpose and cognitive resilience. Our challenge now isn't just to reshape trade policies or educational systems, but to rebuild the belief that working toward a common future is worth the effort (the Klein and Thompson Abundance agenda does a good job of this, in my opinion). Until we meet that challenge, gold prices will keep rising on uncertainty, antisystem sentiment will keep growing, and the sense of futurelessness will continue to define a generation.

More By This Author:

The Parallel Economy And The New Rules Of American Power

Recession Risk

An Orchestrated Recession? Trump’s Tariffs, AI, And The Future Of U.S. Power

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, ...

more