Debt, Deficits, And False Stories

The ‘common sense’ majority view is that debt is bad, debt is dangerous, and debt will crash the economy / stock market.

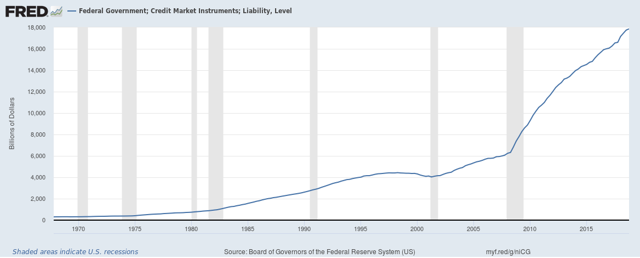

The chart below certainly supports the majority view. In isolation, it looks dangerous.

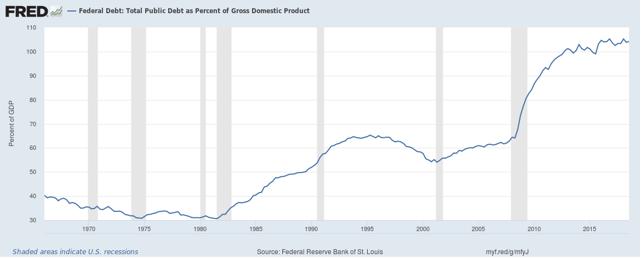

However, in comparison to the size of the economy—percent of GDP—it doesn’t look that bad; the debt has stayed the same over the past six-years (chart below).

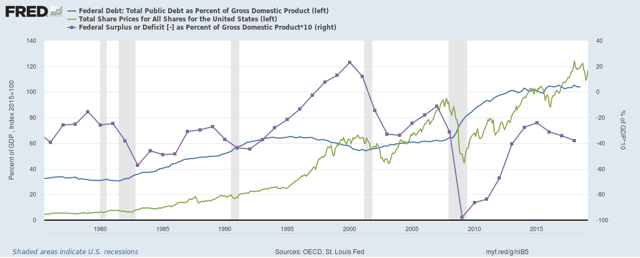

As bad as the reputation of the Federal debt is, the reputation of deficit spending by the government is even worse. Everyone is always whining about balancing the budget, but is deficit spending actually detrimental to the economy/stock market? As we pointed out last week, government spending affects the stock market after a time-lag; every time the deficit is reduced, the economy and the stock market are negatively affected, eventually.

The economic downturns in 1980-83, 1991, 2001, 2008, 2015 where all preceded by reductions in the Federal deficit spending. And in the case of 2001, the budget was in surplus and the debt itself was reduced (thanks to Clinton) in the lead-up to the recession (chart below).

So, which is it: debt and deficit spending are bad for the economy / stock market, or are they good? The evidence supports the latter, but since most humans think in stories, not facts and figures, and since the story that has been promulgated to the masses is the story of ‘debt is bad, debt is dangerous’, that is what the majority believes—despite the evidence. That may partly explain why fear in the market is such a consistent factor during bull markets; belief in a scary, but false story.

This debt is ok view is an echo of Paul Krugman's comparison to the WW2 debt spike which seemed to have beneficial effects. In WW2 the debt built factories on US soil and transitioned to supplying the rebuild of Europe. More recently factories are being built overseas and companies have been getting increasing profits outside USA.

Agree. What the debt is spent on is paramount. Spending that increases productivity--not just asset prices--will keep inflation (which is the only limiting factor for gov spending) at bay.

Followed you, thanks.

Glad that you found some value in our work.

Nicely done.

Thank you.

Right on the money.

Agreed.

Thanks, Alan.

Interesting, thanks.

Glad you found it interesting. Thanks for reading.