Czech GDP Paints A Cheerful Consumption Picture As Investment Disappoints

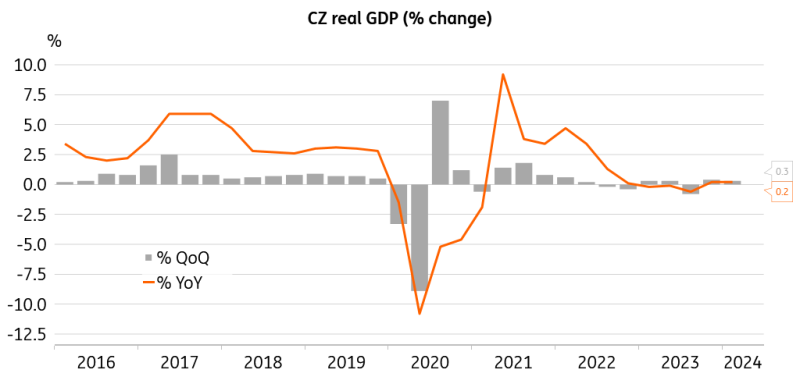

According to the revised estimate, the Czech economy expanded by 0.3% quarter-on-quarter and by 0.2% year-on-year in the first quarter, well below the previous estimate and the market consensus.

GDP growth driven by household spending and exports

The main contributors to the mild 0.2% yearly expansion of the Czech economy were robust household consumption and external demand. Consumer expenditure contributed 1.2 percentage points to the overall growth figure, while net exports added robust 2.1 percentage points. In contrast, gross fixed capital formation was a drag, shedding -0.4 percentage points.

Investment in dwellings, other buildings and structures – as well as other machinery and equipment – declined, pointing to the fragility of the current cyclical upswing. The lead among the negative contributors, however, took the rather volatile item of changes in inventories, which cut 3.4 percentage points from the annual expansion. Overall, the Czech economy continues its mediocre performance, fundamentally below its growth potential.

Czech economy continues in mediocre performance

(Click on image to enlarge)

CZSO, ING

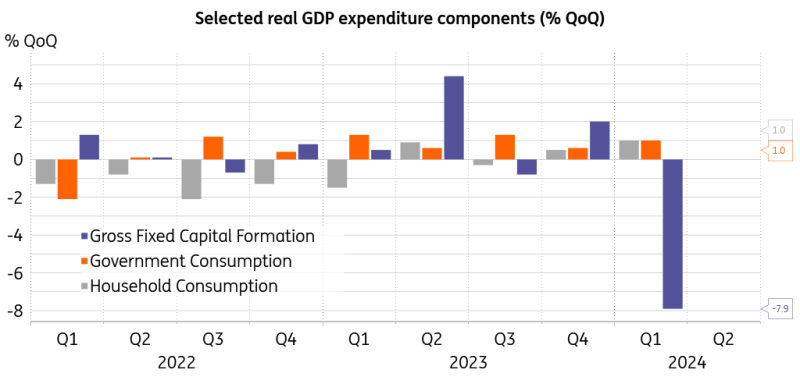

Fixed investment collapsed on a quarterly basis

Turning to the quarterly expansion of 0.3%, both household and government expenditure have accelerated, rising by 1% each in the first quarter. The quickening in household consumption likely reflected the positive effect of renewed real wage growth. In contrast, the gross fixed capital formation dived a staggering 7.9% from the previous quarter – a record drop since 1995. Such a big hit brings investment back to numbers observed in 2018, well below pre-pandemic levels.

Fall in fixed capital formation is pronounced

(Click on image to enlarge)

CZSO, ING

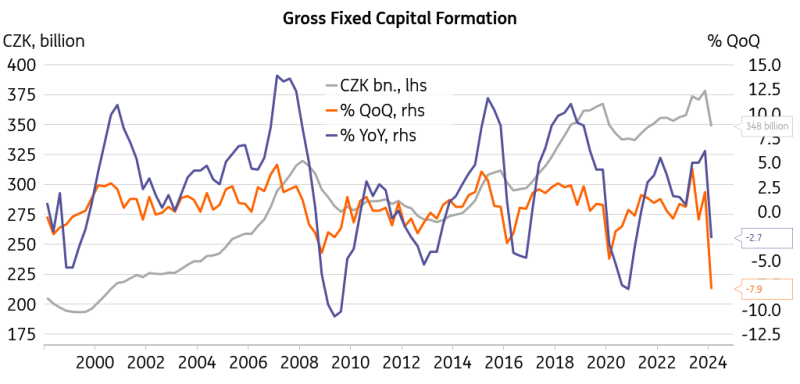

We see the fall in fixed capital formation as a particularly pressing issue, as it puts a lid on medium-term economic performance. One could argue that investment is a volatile item, that this drop represents a correction following the strong 2023 fixed capital formation, and that the decline in annual terms is not so bad after all. Still, this does not feel like a fully-fledged robust economic recovery. We see the weakness in investment as a symptom of structural issues that prevent the country's full economic potential being reached.

Investment is well below pre-pandemic levels

(Click on image to enlarge)

CZSO, ING

Our current forecast of 1.2% real GDP growth for this year is slightly below the Czech National Bank's expectations of 1.4%. The mediocre dynamics in the first quarter will likely imply a downward revision of the annual figure, as it has a profound impact on the yearly average. The Statistical Office has announced that it will publish an extensive revision of the national accounts from 1990 onward on 28 June, so major changes in the vintage data are possibly considered for this occasion.

The wage bill for the first quarter posted annual growth of 6%, indicating some easing in the labour market compared to previous quarters. The CNB expects a 6.4% year-on-year wage growth for the first quarter, so next week’s wage data will likely not be a hawkish surprise. We see average wage growth at 5.8%.

Overall, the latest GDP reading points to further monetary policy easing at the CNB's June meeting, and a 25bp rate cut remains our base case scenario.

More By This Author:

Let’s Get Real On U.S. Rates

US Inflation Relief Keeps The Door Open To A September Rate Cut

Italian GDP Growth Confirmed As Demand Breakdown Adds Upside Risks For 2024

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more