Currency Misalignment Measured Assuming A Balanced Financial Account

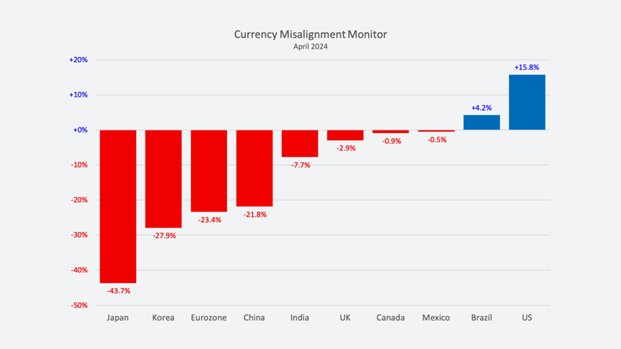

The Coalition for a Prosperous America and the Blue Collar Dollar Institute have developed a measure of currency misalignment, reported in their latest Currency Misalignment Monitor (April issue).

Source: CPA.

Note that the US estimate is for a multilateral balance, while the individual estimates are the implied dollar/local currency change for a given move to an individual country’s “equilibrium” exchange rate.

There’s a reason why I put the word “equilibrium” in quotes. The CPA/BCDI estimate is based on the approach adopted in William Cline’s (2008) SMIM. Using trade elasticities, the overvaluation is defined as the percent depreciationrequired to bring the current account to balance over time, requiring consistency across all other current account balances. However, Cline’s approach did not assume zero balances were the targets. Hence while the overall mathematical framework is the same (matrices, matrices!), the targets are quite different. In order to see how crazy this zero balance criterion is, this means that “fair” exchange rates are those that mean zero current account balances, which in turn means zero financial account balances. In other words, countries would be neither borrowers nor savers in the medium run. Here’s what this means in terms of an intertemporal model.

Note that no intertemporal trade results (in this case) in a lower indifference curve.

See discussion of earlier CPA analyses of the dollar’s value, here. Discussion of measuring misalignment, here. Contrast with the IMF’s EBA here.

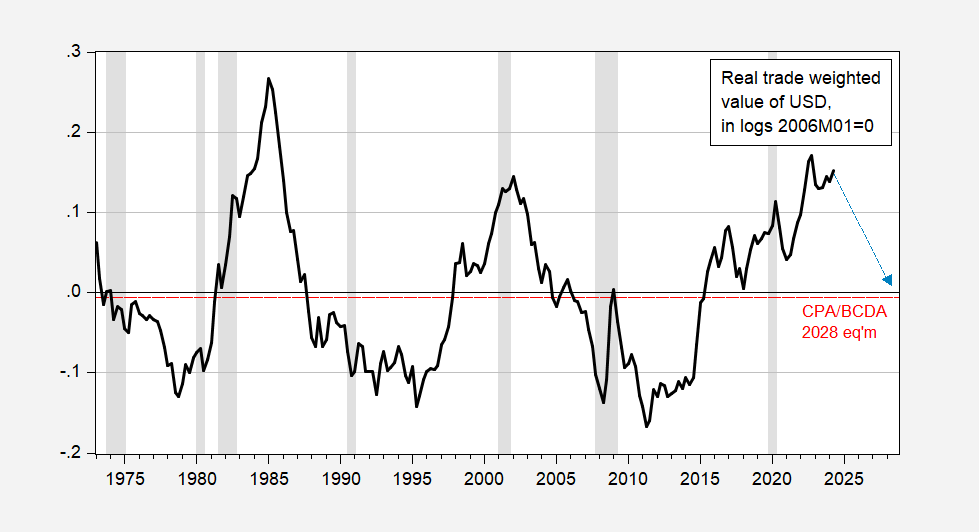

Here’s the implied path for the dollar to hit CPA/BCDI “equilibrium” by 2028.

(Click on image to enlarge)

Figure 2: Broad real dollar value (black), CPA/BCDI “equilibrium” for 2028 (red dashed line), and implied path (blue dashed arrow). 2024Q2 observation is for April. NBER defined peak-to-trough recession dates shaded gray. Source: Federal Reserve via FRED, CPA/BCDI (April 2024), NBER and author’s calculations.

More By This Author:

“Is the Boom-And-Bust Business Cycle Dead?”Hi Ho, Hi Ho, It’s Off To FX War We Go!

“You Have To Look Pretty Hard To Find The 'Trade War' Effect In The Data”