Cryptocurrency Policy Choices And Consequences

Almost all countries of the producing and developed world have made a policy decision as to how to define cryptocurrencies, and they do not define them as securities. The United States has not finalized its singular definition as its designation is not uniform among agencies: the United States Commodity Futures Trading Commission defines virtual cryptocurrencies as commodities, while the Internal Revenue Service defines them as property on which to collect capital gains taxes. The U.S. Treasury Department Financial Crimes Enforcement Network sees them as “counterfeit money” to be treated accordingly, and the Securities Exchange Commission wants to treat them as securities, which they would regulate. It is clear, that there is a “turf war” taking place as to which agency is to exert control regulation over this new virtual asset. There is much at stake: much more than which agency will regulate cryptocurrencies or be able to “extract favors” from the implementers of this new asset class. However, if policy decisions are not constructive to supporting this fast-growing industry, or if this decision takes too long to reach, the dynamic entrepreneurs will move to countries which are more supportive.

Let’s be clear, decisions have consequences, and how we define and regulate cryptocurrencies will have long-term nation-impacting consequences. Political leaders base most of their decisions and cast their votes in Congress for near-term political benefits – as most will be out of the government when the long-term consequences become operative. For example, politician’s support for increased government spending is nearly universal, despite the fact that over the longer-term government debt accumulates to consequential levels.

Our politicians and other leaders have also made important decisions regarding fiscal, monetary, and military policies which have impacted this nation. For example, short-term expansion of currency in an economy with low debt levels may temporarily stimulate an economy, but persistent money printing ultimately destroys the value of savings, investments, and pension assets making people dependent on the state – a sort of backdoor socialism destroying our free market foundations. Let us not forget also government decisions to enter expensive wars which were unnecessary, and never in defending against a foreign aggressor on our borders. Wars which the public has not supported – like those over the last twenty-plus years in the middle-east which have squandered our nation’s fortune and suffered embarrassment such that we can no longer claim to be the exceptional nation. Thus we can see that decisions have important long-term consequences.

At this truly historic intersection of coming global fiat monetary demise for all debt-based fiat currencies around the globe and the emergence of new blockchain virtual currencies, congressional decisions with respect to defining and regulating cryptocurrencies will be singularly important. Given the apparent knowledge level of politicians regarding distributed ledger technologies, or even their understanding of our current debt-based fiat money system and its consequences, or proposals for ravenous increases in taxation to cover huge politician-created budget deficits, expectations for near term constructive regulation remains mediocre.

Dealing with deficits

From the dawn of history, commodities such as gold and silver coins have been used as money. Governments which had spent too much relative to their store of this commodity money started to dilute gold and silver with other metals as a means to disguise and extend budget deficit expenditures. This universal practice by rulers had led to an equally universal demise of such kingdoms.

There were then, and are today difficulties in transporting or exchanging a large asset value in gold. It is heavy and bulky, and with its high value, it is unwise to personally carry around a large amount of gold without substantial security or safety precautions. While China had paper money over a thousand years ago, it was with the invention of the printing press that an explosion of gold-based paper currencies became ubiquitous and persistent. In the most recent centuries, government deficit spending has manifested and been “solved” in this new way - with the government simply printing more currency than that originally backed by gold. However, the detection of excess printed paper currency was almost impossible to confirm, until massive printing had taken place. Today, with the periodic reporting of statistics by government agencies, such excessive printing, and monetary dilution is detected immediately.

So it is that over centuries, governments have proven that they cannot be trusted to issue commodity or paper currencies! The currencies of previous global leaders such as Portugal, Spain, Netherlands, France, England, have all receded from global dominance as their currency value withered, as the United States, the latest global hegemon, and its currency now also appears to be in irreversible decline.

Our fiat monetary system

It was in 1971 when President Nixon “temporarily closed the gold window” – meaning that the U.S. government was breaking its promise to foreign countries to redeem their dollars gained in trade for $35 an ounce. This was the direct consequence of persistent prior U.S. war and other deficit spending programs that caused excessive currency printing. Foreign countries recognized this as future dilution in the value of their paper dollars and they then sought to covert the fiat dollars to gold at the promised rate. The breaking of that promise brought great losses to every country which had trusted the United States.

The Federal Reserve has been the enabler for our government to ignore a balanced budget through artificially depressing interest rates and buying Treasury debt – creating a new currency. This Fed action is defined as financial suppression. By depressing interest earnings on people’s savings, and causing pension funds from achieving actuarially sufficient rates of return, these policies are rapidly destroying the modest wealth of the middle class, and ultimately relegating them to poverty. Coming price inflation in conjunction with this financial repression will make everyone but the very rich dependent on a bankrupt government. See: “What to Expect in Our Next Recession/Depression”. So it is with great irony that the formerly greatest capitalist country in the world now appears as the greatest promoter of socialism. It seems that we will get to experience that which Winston Churchill ascribed to socialism and communism – “the equal sharing of misery”.

Blockchain-based currency

It is in this environment, after the financial trauma of 2008, that a new form of currency called Bitcoin came into existence. It has been called by many different names: cryptocurrency, virtual money, digital currency, and others. Its characteristics require that any transaction in these coins is recorded forever on a widely distributed computer ledger called the blockchain. This public record serves to confirm its existence, validity, and transfer of value from one computer address to another. Encryption is necessary to prevent interlopers from being able to divert this digital value to unintended beneficiaries. And the owners of this currency are not dependent on a third party such as a bank for its custody, nor are they dependent on any third party for its usage. It is a currency that no one can dilute in value by extemporaneously issuing more coins, nor can anyone take control of your very personal asset.

The popular name of “cryptocurrency” is unfortunate because it conveys some specter of stealth or secrecy about the electronic or virtual currency that really is misleading. Data regarding these currencies is publicly distributed over thousands of computer nodes and can be tracked by anyone. Cryptography is necessary to protect the private wallet key of a currency owner, and the value that this coin represents. By contrast, consider that dollar printing has been uncontrollably growing, is untraceable, and can be conveyed to others in complete secrecy. Yet the conveyance of fiat paper currency for centuries has been totally acceptable. Over time we should expect that the suffix for cryptocurrency will be dropped, and it may become known as e-currency or simply currency.

E-currencies are supranational in that their platform and coins can be used globally.

It is because cryptocurrency is not issued by the state and consequently is difficult to control that it receives scorn from traditional government institutions. But government currencies are debt-based, while e-currencies are not based on the issue of debt. In addition, they are deflationary as the creation of new coins is strictly programmed and enforced by computer code. As such, e-currency has greater potential to hold value than fiat. The destiny of fiat currencies over the long term, as corroborated by centuries of world history, is to reach their intrinsic value of zero. By comparison, Bitcoin’s limited supply implies that with growing global adoption, its value will rise. In addition, to its strictly limited supply, similar to gold, e-currencies have no counter-party risk. Every coin value is the property of its owner, and because blockchain technology keeps transaction history forever distributed on thousands of computer nodes, coin owners have indelible validation of ownership.

Taxation

It is important to first point out that prior to the founding of the Federal Reserve in 1913 there was no income tax in the United States. Taxes required for the government to function were fully collected from tariffs on imported goods. It was only with the founding of a Federal Reserve System central bank that its ability to create money out of nothing required an income tax on the populace to ensure the servicing and repayment of the government-issued debt, and profit to its owners.

After the 2008 financial crisis, there was some brief consideration of eliminating income taxes, to be substituted by a higher national sales tax. This was a truly liberating idea, saving billions of dollars spent for tax preparation services, or billions of hours citizens must otherwise spend on quarterly or annual tax preparation themselves. This benefit to the country was denied to the nation’s citizens. While politicians may point to the “other” political party for failing to support and enact such legislation, the truth of the matter is easily understood. With complicated tax law, politicians can provide “services” to corporations and wealthy individuals for which they are amply compensated. Establishing a sales tax would eliminate this gravy train to politicians, so it was squashed.

Last year apparently 61% of people paid no income taxes. In this light, it seems that it is high time for sales taxes to substitute for income taxes. The political impediments for getting this done remain high, but perhaps with the continued demise of our middle-class income earners, and likely future collapse of banks and eventually the monetary system itself, an opportunity for doing the right thing may surface. This future crisis should be used to do the right thing, and should not be wasted.

Corporations should likewise be freed from the requirement of filing income taxes. Of course, the government needs taxes to operate, but corporate income tax is truly a farce. The most successful and highest-earning corporations employ an army of accountants and tax lawyers, such they often will pay little or no tax. In addition, they “incentivize” legislators to enact tax provisions which allow specific deductions or exclusions which reduce tax liability. Of course, corporations price their products to earn a profit, and we can rely on their competence that products are priced to be profitable. So to collect a proper tax from corporations, revenues not profits should be taxed. The easiest and fairest way to collect these taxes would also come from collecting sales taxes. As an advantage, it would provide a continuous inflow of tax revenues to the state.

Decentralized finance, where financial transactions can be conducted on a platform through computer code without any person being in charge, is difficult or impossible to regulate by a government. Politicians and regulators want to impose and collect taxes on cryptocurrencies. But if crypto is currency then no taxes should apply – we pay no taxes if the dollar appreciates in value, nor do we deduct from our taxable income as the dollar has lost value over decades. As an example, the country of El Salvador in adopting Bitcoin as its legal tender announced that no capital gains taxes will be due from the rise of Bitcoin’s price. Satoshi Nakamoto, the mysterious developer of Bitcoin calls his invention “electronic cash”. He should know. The only reason to label this electronic cash or other e-currencies as securities is for legacy leaders and owners of our present financial system to retain control, as they provide an inducement to government with regulation - a means for government to collect taxes. But as governments have demonstrated their ability to print trillions of dollars, there should be little reason for it to collect just a few billions in taxes through nefarious innovation-stifling regulation.

Volatility of cryptocurrencies

Electronic currencies have been criticized as being highly volatile in price to the extent that they cannot be used in trade as a unit of account. This criticism has certainly been true to date. However, Bitcoin’s price has risen from a few pennies per Bitcoin ten years ago to about $48,000 per coin currently (after having risen to $63,109 earlier this year)! In addition, its 2021 price has dropped and risen by more than 50% in a few short months. So it is volatile. Clearly, far wider adoption and a topping out of its ultimate market price is necessary in order to stabilize its market value. But most buyers of Bitcoin see it as a store of value, and will hold it long term; therefore, little will be available for trading – meaning that it is likely to remain relatively volatile.

For context, it may be important to review the relative volatility of other vessels of value. Gold, through trade competition and testing over thousands of years, has been accepted as the best money. So the idea that governments or banks could simply issue paper currencies without gold backing is historically false. Governments first required gold money against which to issue paper currency. Gold was the money, and paper currencies at one time were the “receipts” for deposited gold.

So one might ask what has been the volatility of gold? If we are to measure this volatility, we must first determine what measuring stick we are to use for this purpose. Since additional paper currency can always be printed which changes its value, it is clear that no paper currency can be used as the measuring stick to determine gold’s value. Very quickly it becomes apparent that gold itself is the measuring stick against all paper currencies – instead of the dollar being a measure of gold’s value. Indeed, all paper currencies have self-destructed; therefore they cannot measure the value of gold.

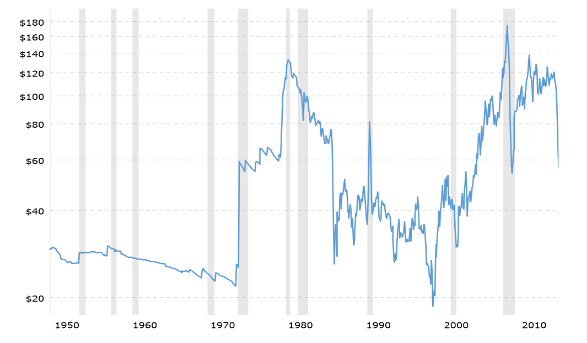

Oil has been the most persistent and largest commodity in global trade over decades. Therefore, arguably it could be a model for price stability when compared to newer and growing cryptocurrencies. The following table shows the price of oil since the 1940s. One should observe that this chart is a chart of pure volatility. That is, the price of oil rises and falls without long-term direction or trend – that is real volatility.

Chart: Courtesy of Macrotrends

The preceding chart suggests that the price of oil has been extremely volatile – perhaps in a way even more volatile than the price of Bitcoin. We should be reminded that oil was not simply an economic or even a monetary asset; more importantly – it was our geopolitical asset. In the past, when the United States was the uncontested and respected global leader, America’s geopolitics simply trumped market prices, and we experienced oil price volatility.

We now look at Bitcoin’s historical price chart. Because Bitcoin’s price has multiplied between 2011 and 2021 by about 50,000 times (compared to oil’s price multiplying twice in a 75 year period), a log chart is necessary to more accurately represent Bitcoin’s price volatility. A log chart depicts equal vertical axis increases for the same percentage gains in price. This chart shows a price history of a growth asset – and one is forced to conclude that Bitcoin, rather than being a highly speculative and volatile coin, is a simply rapidly growing asset with commensurate price corrections.

Chart: Courtesy of Coindesk

It is also worth noting that in 2018 when the price of Bitcoin dropped from about $19,300 to about $3,900 per coin roughly a year later, the decline started on the day that Bitcoin derivative contracts became available for trading – insistently suggesting that this price decline was the result of leveraged price manipulation. This is similar to derivatives creating false price signals for gold – manipulation for which banks have paid numerous fines.

Cryptocurrency adoption

Since the invention of e-currencies, its market has grown exponentially. Because blockchain can disintermediate banks making them obsolete, banks have been scrambling to keep themselves relevant. As a result, they are building services to offer e-currencies and blockchain platforms directly to bank account customers. Likewise, money management firms are rapidly developing products in order to sell them to the growing wave of global customers. There is just too much money flowing to the e-currency, cryptocurrency, space for banks to pass by this profit opportunity.

There are many countries in the South American continent, and other countries elsewhere, which have been dominated by a dollar policy that has not benefited its citizens. Many of these countries understandably will embrace Bitcoin and cryptocurrencies, as Ukraine and Cuba have already announced. If El Salvador’s experiment at using Bitcoin as a legal tender currency proves to be successful, many more countries will innovate or adopt. Despite the lack of present regulatory clarity as to whether cryptos are currencies or securities, major banks, and investment funds are all gearing up to sell them. Therefore, the controlling legacy institutions can be depended on to both fight and utilize this financially empowering event to the extent of their self-preservation capabilities. Given their involvement, global adoption and growth of this new asset class is assured.

Possible future of e-currency

The Federal Reserve and government surely want no competition today for the issuance of currency. However, prior to the founding of the Federal Reserve, every bank in the United States could, and many did, issue their own currency. So the dollar, side by side with e-currency would not be a historical outlier. Indeed, e-currencies could possibly save the United States from debt default, or even the eventual collapse of the dollar-based financial system!

First, consider that our global dollar system is complex and consists of several important parts. After WWII, the dollar was used throughout Europe to rebuild from war devastation. The build-up of dollars overseas gave rise to the Eurodollar, which the Fed could not control. In the 1970s as we successfully negotiated with Saudi Arabia to have them sell their oil globally exclusively for dollars, over time this gave rise to a pool of money known as Petrodollars. The continued issue of debt-based dollars to satisfy global markets has made the US the largest creditor nation in the history of the world. The debt is so huge that we are not be able to repay this debt, while Janet Yellen, US Treasurer, is reminding Congress to approve the increase in the Federal debt ceiling as a means to avoid the nation from defaulting.

The alternative to one nation increasing its currency and debt for perceived global use is to use a supranational currency as the bridge between national currencies. Thus, in the case of international trade, which requires ultimate settlement between nations, such settlement would not need to involve dollars. Presently, as an example, a trade settlement between Korea and Sweden would require Korea’s won being exchanged for dollars, and the dollars being exchanged for Sweden’s krona or vice versa. This requires dollars to exist in nostro/vostro accounts which tie up trillions of dollars in global capital.

With the suspicion that the USD could lose confidence and value, Eurodollar, Petrodollar, and other US dollar holders are worried. An abrupt reduction in USD exchange values could bring global trade to a drastic stop, and implode banks around the world. If the holders of these dollars could exchange their USD for a supranational currency at a full value which is not debt-based, whereby this new currency could continue to be used in global trade, then this would be a great solution to the growing USD debt problem. See: New Global Reserve Currency? It is an elegant solution to our national Triffin dilemma of increasing debt to issue more currency as a means to facilitate global trade.

In the new electronic currency world, there are a number of coin platforms dedicated to working with banks to solve peer-to-peer payments, international trade settlements, and remittances. The exchange of Treasury bonds for such electronic currencies could be structured such that Treasury bonds do not need to be reissued upon their maturity. This means that as the supranational trade currency is built up in value to handle the immense international trade, US Treasury bonds could be retired – drastically reducing America’s debt.

So now we come full circle to the regulation of cryptocurrencies. Will politicians and regulators continue to support the withering legacy systems by deeming electronic currencies to be securities for the simple purpose of taxing them? The world is changing, in fact, it has already changed. America’s leaders can try to stem the global tide of technological evolution – this will fail. It would be best for this former democratic and free-market leader of the world to be also leading this new technological evolution which promises to inclusively liberate the citizens of our world.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and ...

more

Both very educational and ratgher disturbing. And how would the US ever repay the neational debt??

One thing I point out is that to intentionally incurr debt knowing that one has no means of repaying that debt is criminal fraud. Ordinary folks go to jail for doing it.