New Global Reserve Currency?

Politicians and investors regularly claim that “this time it’s different”. But history shows us repeatedly that rarely things are truly or fundamentally different. The power of the Roman Empire two thousand years ago was established by military means. Over time, its government undermined that empire by continuing military campaigns and lavish spending. This ultimately required that their money, the silver Denarius coin, be diluted with other metals which brought its purchasing value down. This in turn reduced people’s trust in the empire’s money and eventually brought the empire into decline. Since then, this history has been repeated many times – only the name of the country and its currency have changed. It is a lesson which neither kings nor politicians have been willing or able to learn – to this day. And this time it is no different.

Starting in the 15th century, Portugal, geographically bounded by the Atlantic Ocean rapidly developed shipbuilding and maritime exploration. Discovering new lands (Brazil) and routes for the spice trade (India) and other commodities (Africa), and by expanding military incursions into Asia, their empire flourished as one of the world’s major economic, military, and political powers. When its king died in battle in Morocco, King Phillip of Spain seized the Portuguese crown, and Portugal was subject to military adventures from the Netherlands, France, and England – who were hostile competitors to Spain. Unable to protect its lands and a vast global network of trading posts, its empire started a long and gradual decline.

This little sketchy outline of Portugal’s rise and fall as a world power could be a template for its successors. Their history demonstrates that this time it is no different as subsequent world powers arise from military power and decline from continuing military campaigns and expenditures that no country can long sustain.

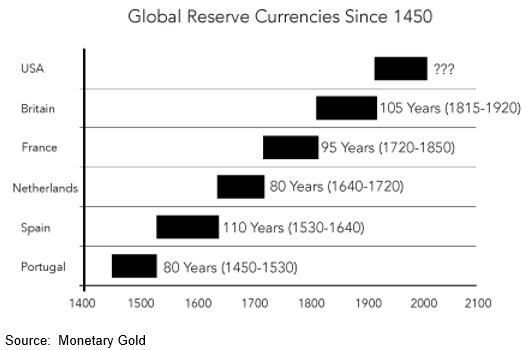

The following chart shows the era during which a particular country had the leading empire of the world. It is likely that the Spanish empire lasted longer than the average because of their discovery of real money (gold and silver) used for jewelry or as artifacts by the indigenous people in South America (which the Spanish pillaged), and the British Empire lasted longer because of their discovery of a new kind of money through a fractional reserve paper currency system in banking. The United States advanced the British monetary system by eliminating any gold backing to that currency by reducing the fractional reserve percentage to zero.

This is an important chart, which includes the actual length of an empire where their money served as a reserve currency. We can see that just by looking at the average length of time for the supremacy of an empire, one could conclude that the United States should be near the end of its dominance. Of course, there is much more fundamental evidence that such a transition should be happening. Since its ascension to global eminence, the United States has been almost constantly involved in wars, the cost of which has bankrupted every previous empire.

For example, according to a study by Watson Institute of International and Public Affairs at Brown University, U.S. wars in Iraq, Afghanistan, Syria, and Pakistan have cost $5.9 trillion since they began in 2001. So, what exactly have these wars accomplished? In addition, America maintains over seven hundred military bases globally that are expensive. By comparison, annual taxes collected in 2019 were $3.5 trillion. We can see that America has practiced a modern version of “clipping coins” - by emitting currency with the attendant growth in national debt currently at $27.9 trillion (which excludes the current additional $1.9 trillion program proposed by President Biden), all at rates not supported by collected taxes. This empire, like all the others before it, is substantially overextended, and like its predecessors, it is ready for a successor.

The Triffin Dilemma

Since the end of WWII, the dollar has been the global reserve currency of the world. For a country to have its fiat money to become accepted as a global reserve currency – quite logically it must emit enough of that money to service the trade requirements of the world. Over years, the United States has emitted trillions of dollars in order to satisfy global trading and financing needs.

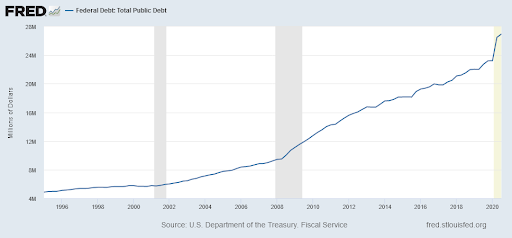

A monetary dilemma was first postulated by economist Robert Triffin when in 1960 he testified in Congress stating that because debt is the basis of currency creation, and since money for international trade requirements could only be produced by the issuance of debt, the United States as the possessor of that global reserve currency would become the world’s largest issuer of debt. His conjecture has been proven as the U.S. has become the largest debtor in the history of the world. Yet despite the record volume of dollars held by foreign central banks, there still appears to be a shortage of dollars – a foreign liquidity shortage. To be the global reserve currency does require an astronomical mountain of debt and currency issuance. This acceleration in the growth of debt, and therefore also money supply, is depicted in the table below. Note the persistent acceleration in debt since 1996.

The possessor of the global reserve currency also confers to that country incredible advantages. In the 1960s, the French Minister of Finance had called it America’s “exorbitant privilege”. Its meaning was that the United States could create new currency at the cost of printing it and use it for payment of actual goods that required real materials and labor to produce. In effect, the United States would issue debt in its own currency to paper over any trade deficits.

Investment Implications

No country can presume that its debt will be continually purchased by other countries for investment. When perceptions of economic decline arise, the interest rate to investors will need to be raised as an inducement for the increased investment risk. Investors could also make the decision simply not to participate in the debt issue of any financially or economically suspect country, making it more difficult, or impossible, to raise the needed funds.

In an environment where additional borrowing in international markets for the U.S. government is restricted, and bond issuance for domestic zombie companies would fail, the bond markets would collapse. Without any pause, the stock market would suddenly require growth in revenues and earnings to sustain its price. Since corporate earnings in total have been flat over the last eight years, even as earnings per share have risen due to corporate share buybacks, we should expect that the market would suddenly adjust to a more realistic valuation.

Also, sometime during the course of 2021, as government economic agencies collect appropriate statistics, they will likely conclude that an economic depression had actually started in 2020. The persistence of this economic malaise in 2021 and beyond, magnified by the global virus epidemic and politician misguided response to it guarantees that economic and investment market recovery will be slow – stretched out over a number of years.

With exponentially rising debt continuing, the value and purchasing power of the dollar will decline. In that scenario equity markets for the short term could actually rise reflecting the cost inflation of all items artificially raising revenues and earnings of companies – before they collapse. See: Monetary and Economic Financial Reset.

Possible Solutions (China, SDR)

Some credible economists have observed that China will surpass the United States as an economic power in less than a decade. Other credible economists have observed that China is already economically ahead of the United States, and it is just a matter by which one measures this global primacy.

China’s currency has been included in the IMF’s basket of leading currencies, and as a result, some have predicted that China’s yuan could replace the US dollar as the world’s reserve currency. There are very practical reasons why the yuan cannot and will not become this global currency. The most important reason is that China is wisely unwilling to open its currency market to full global trade and speculation.

China understands that its currency would be manipulated to the detriment of its economy, and simply will not allow such a plan. In addition, China understands that even if it could become the leading global reserve currency, it comes with a price that China is not likely willing to pay. Namely, to become the global reserve currency it would have to become the world’s largest debtor as proven by the Triffin Dilemma. It is highly likely that China neither seeks to replace the United States nor become the largest issuer of debt securities nor the largest emitter of a global currency. They well understand the problem of issuing the global reserve currency having seen its effects on the United States – and they will prudently avoid it.

The International Monetary Fund (IMF) has a global currency called the Special Drawing Rights (SDR) which could function as money between and among country central banks. The IMF would be quite happy for the SDR to become the global reserve currency because the IMF would control it; and with America’s 16.75% voting power at the IMF, it is the only country with effective veto power – meaning that the U.S. controls the IMF. And, because it would be a supranational currency, it would not suffer from the emission-related to individual countries. However, it is likely that other countries, long under the dominance of the U.S. dollar would not be enthusiastic for such a solution.

Today’s amazing computer technology and brilliant use of programming is making it possible to create a digital currency that can be used not only among banks but for all citizens of the globe.

Deficiencies of the current system

Everyone by now is familiar with Bitcoin, the digital electronic cryptocurrency. That cryptocurrency was first issued in 2009 and had a value of just a fraction of a penny. So what is it that gives it a value of over $50,000 per coin today? Trust has increased for people not just in the United States but around the globe that Bitcoin will not lose all its value – particularly when compared to the ceaseless printing of dollars which have lost 99% of its value since the Federal Reserve started emitting them a century ago. Central bank currencies of other countries likewise have also been issued at rates that has destroyed their purchasing value.

Apparently common, economically unsophisticated people have learned something about the histories of Rome, Portugal, and the other more recent fallen empires. Today, America’s debt is simply astronomical, can not be paid off honestly, and is destroying citizen credibility regarding the value of our dollar currency. It has prompted industrialist Elon Musk, presently the richest man in the world, to state that “the USD is a sinking ship”. In that context, people around the globe are adopting cryptocurrencies in a way that will change the world.

For the process of international money transfer to work, banks must now maintain deposits in targeted foreign correspondent banks so that payouts to the ultimate recipient can be made in the beneficiary’s currency. When the ultimate payout is settled, the amount is netted against the foreign bank's custodial deposit. Thus by establishing reciprocal correspondent bank deposits, called nostro/vostro accounts the cross-border settlements of trade or remittances can be accomplished.

There is an estimated $27 trillion in nostro/vostro accounts globally in this foreign payments and settlement system. That is a lot of capital that is dedicated or trapped in this cross-border payments system. There should be a more efficient system – and there is. The new technology in cryptocurrency provides an elegant solution.

Technology to the Rescue

There are many advisories, development, and other similar organizations that have created thousands of decentralized platforms, which in addition to providing specific use cases, also have a cryptocurrency asset native to that system. Over the last ten years, as digital assets are entering the mainstream, it has become the experience of millions of users around the globe, that owning cryptocurrencies such as Bitcoin or Etherium long-term has largely been very favorable. And banks whose CEOs were willing to fire any employee who would promote cryptocurrencies a year or two ago are now seeking rapid entry into these markets. Major banks such as Citibank, Mellon Bank, and Deutsche Bank are all now rushing into cryptos. The world has quickly changed from skepticism to acceptance and endorsement.

Over the last several years have been many cautionary articles in regards to the mountainous debt and money issuance, interest rates, and unrealistic financial markets. See: U.S. Dollar Has Crossed the “Event Horizon”. The bugle call of “taps” has been sounded for a monetary, bank, and economic collapse worldwide. The fractional reserve and central bank system forced on this nation by deceit and duplicity over a century ago, has lost control and its banks are now failing. In a response to this failure, and rapidly continuing technological development, central banks are looking to eliminate paper currency and substitute digital cash as a means to maintain or regain control.

One particular blockchain company, Ripple Labs, has been working for nearly two decades to develop advances in cross-border payments systems and settlement. It has been engaging and working with foreign central banks worldwide, offering and educating banks and payment system companies about their effective new technology services. As a part of this effort, it created a fast, scalable, and inexpensive blockchain ledger-based decentralized digital currency called the XRP. This platform allows for sending or receiving currencies of any amount between any two nations across the globe in less than five seconds at a cost of fractions of a penny.

In the present money transfer system, the U.S. dollar is used as the bridge between two country currencies, requiring one foreign currency to convert into dollars, and then covert dollars at a correspondent bank into the second currency. Settlement and communication for this transaction can easily take several days and is expensive. In the meantime, people have been able to send emails (information) around the globe in seconds for at least three decades at essentially no cost. Technology finally has ushered us into an age where value can similarly be transferred.

A new global reserve currency?

Imagine a new cryptocurrency-based global payments system where the U.S. dollar is no longer the bridge currency between foreign counterparts. This would relieve the U.S. from being subject to the Triffin Dilemma, from needing to satisfy world trade with its dollars. While that is constructive, the reduction in global demand for the dollar would also substantially reduce its domestic and foreign purchasing value. For Americans, the loss of its “exorbitant privilege” would be quite inflationary.

Imagine also that a decentralized cryptocurrency is used as the bridge currency in international money transfer - not issued not by any nation-state. Specifically, assume that XRP is used as the bridge to transfer between the two foreign currencies. Such a bridge currency would be welcome for banks that do not have a foreign correspondent relationship, and it would eliminate the need for nostro/vostro accounts and unlock trillions of dollars for more productive use than currently provided by such accounts.

However, the total market value of XRP coins is only $25 billion, far short of the trillions of value needed to settle international trade and remittances on a daily basis. Since the U.S. dollar is the global reserve currency, it is widely held by central banks of the world. Relatively little is held by these banks in actual dollar currency, as most value is held through U.S. Treasury bonds, notes, and bills. These Treasury securities represent the indebtedness of the U.S. and have maturity dates. When these securities mature they are paid off with a new Treasury security – another promise to be paid. But as long the dollar lacks gold backing, those debtor notes are simply rolled over rather than truly settled.

If by international agreement as to a price, or by domestic and foreign banks purchasing the cryptocurrency XRP (in the market or through Ripple directly) paid for with Treasury securities, XRP’s price could rise to a level that accommodates global requirements. Clearly, foreign banks likely would welcome to exchange their Treasury securities for an asset such as gold – because it is an asset which has no counterparty liability associated with it. But gold, because of the difficulty in its movement is unlikely to back global settlement. The SDR is basically another fiat issue by a consortium of countries - as members of a supranational organization which necessarily would be used by central banks and exclude individuals. In contrast, XRP is an existing asset, not backed by debt, which derives its value from its utility in cross-border transactions settlement. A total of 100 billion XRP exist, with approximately half of this amount in escrow at Ripple, and approximately the other half available in the marketplace. Thus, if the coins had increased value they could provide the liquidity to accommodate world trade.

Reducing national debt

The very interesting result of banks buying XRP directly from Ripple’s escrow, and paying for them with the U.S. or other country securities would be that these securities upon maturity would not have to be reissued. Trillions in U.S. Treasury securities could be shredded, burned, or otherwise destroyed extinguishing or reducing U.S. national debt. Foreign banks could, at least theoretically, eliminate a large portion of their national debt as well. A win-win for the global debtor nations, including America.

XRP would not be a substitute for another fiat currency, because it does not require debt to issue it. Essentially it becomes a bridge currency to the world – a kind of supranational currency similar to SDRs and gold, but easier to work with and available to everyone. And, if the world banks were concerned about the potential volatility of cryptocurrencies, XRP could issue a stable coin on its ledger that would address such concerns. So the purchase of XRP could lock up global debt securities which would never have to be paid off. Therefore, the higher inflation that the Federal Reserve seeks to bring about to facilitate the payoff or reduction of the national debt is not the only, or best solution. Neither is the SDR.

The Securities and Exchange Commission (SEC) has filed a suit against Ripple and two of its founders for selling unregistered securities. The dimension of these issues is too complex and lengthy to be treated here, but central to the complaint is whether the XRP coin is a security or a currency. Curiously, this suit has been filed seven years after its original violation which now suggests ulterior motives. One possible motive would be for central banks to take over and control Ripple’s coin escrow, and its future disbursement. If, in addition, banks were to become the permissioned transaction validators for the nodes of this platform, they would be in control providing the trust needed to allow for new and efficient global payments and settlement system. Indeed, Ripple itself could be conscripted by regulators to become a part of the global banking network.

One of Ripple Labs' founders, Brad Garlinghouse, has previously stated that “central banks are looking at the open-source XRP ledger for digital currencies to issue stable coins”. Also, Britain’s former governor of the Bank of England, Mark Carney, has stated that “XRP could be a new global stable coin”. Thus, could it be that XRP becomes a new global reserve currency and a part of “the Great Reset”? From the preceding information related to a technologically driven cryptocurrency that could provide for efficient cross-border payments and settlement and possibly deliver a practical reduction in global debt - a global “debt jubilee” of sorts, it could be “a great Global Reset”. That would be “ great” news, but first, we will have to experience “The Greater Depression of 2020”.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and ...

more

Quite interesting, and as an American firmly invested in America, it is also rather depressing.

I have spent some time in China and paid attention to the people, and certainly it will become a huge world power, unless some incredible calamity arises. And there is no possible way that the USA can prevent it, unless somehow all of the factory workers can be unionized and all of the youth can have their attention span reduced to less than two heartbeats, like so much of our younger folks.

Based on this reality it does seem that our government should place far more value on not starting any fights with China.

Certainly the assertion that "there is no entity so grand and successful that mismanagement can not destroy it" is correct, as history has demonstrated. And that more current statement that "You Can't Fix Stupid" may also be shown to be accurate.