Central Banks Dig In Their Heels As Recessionary Forces Build

As central bankers take their battle against inflation to the wider public, there is a growing chorus warning against too much monetary tightening engendering a recession. While central bankers do acknowledge, ever so reluctantly, that their actions could contribute to recession, they continue to maintain their righteousness on rate hikes as they pursue their 2% inflation target. Fed Chairman Jay Powell’s speech at Jackson Hole laid out a scenario in which reducing inflation is likely to require a sustained period of below-trend growth and the real possibility future job losses. He followed up this assessment and warned about consumers and businesses will experience “pain”.

Vice-Chair, Lael Brainard, feeling some heat from critics, warns that the central bank must stay the course in tackling inflation. She is echoing other Fed members who remain vigilant, even if growth slows and is accompanied by higher unemployment and further declines in financial markets. But very notably, she acknowledged that “at some point in the tightening cycle, the risks will become more two-sided’. (Brainard) . In other words, there is the prospect of overtightening to the point where the economy slumps badly.

The Bank of Canada is also taking a hardline stance towards getting inflation down to the universally accepted level of the 2%. In its September policy statement, the Bank “still judges that the policy interest rate will need to rise further”. (Bank of Canada)

It was only about a two months ago, the central bankers believed that they could deliver a soft landing from their tightening stance. Now, the talk is about the need to “get the job done”, regardless of the consequences to the job market or to corporate returns. And, we are now seeing evidence that there will likely be no “soft landing”, to wit:

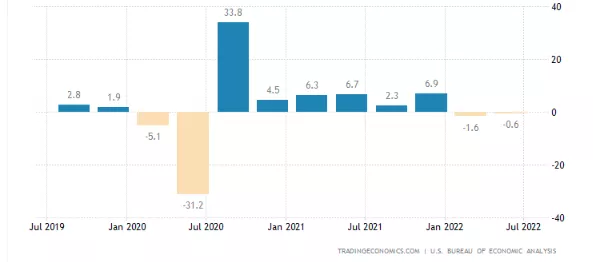

- US GDP for Q1 and Q2 was negative as the economy contracted by 1.6% and 0.6% (annualized) respectively; the consumer sector, the bulwark of the economy, is holding back as discretionary expenditures are being curtailed in response to the rising prices of necessities; real wages are declining; and, retailers are in subdued mood as they enter fall and holiday seasons.

- YTD, the S&P is down 15% and the Nasdaq nearly 25%; the financial markets are adjusting to an outlook of lower profits and overall softening of aggregate demand.

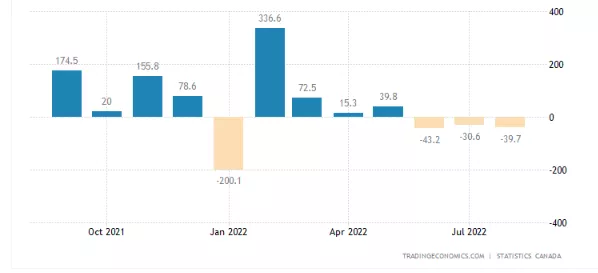

- Canada has experienced three straight months of job losses, totaling more than 115,000 workers and the unemployment rate climbed in August to 5.4%.

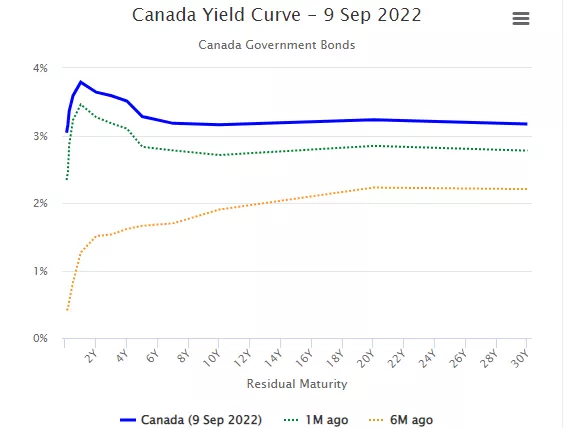

- The Canadian yield curve has significantly inverted as investors expect a recession with the 10yr-2yr spread at minus 50bps; more importantly, the 5yr-2yr spread is 40bps, signaling that mortgage rates are not about increase further.

So, for the time being, the central bankers remained unpersuaded that recessionary forces are building as they continue to apply the brakes. But now we are entering a criterial stage in the economic cycle, featuring a significant slow down worldwide----- the EU is already reeling from crushing escalating energy prices, climate change droughts, and declines in output; China continues to weaken from the impact of COVID lockdowns and a huge real estate slump. North American economies cannot escape worldwide developments. It will not be long before the central bankers are faced with the consequence of overshooting in their zealousness to slay the inflation dragon.

More By This Author:

Is The Canadian Economy Vulnerable To Higher Interest RatesWhat Are The Canadian Banks Going To Do With All These Deposits?

Comparing The 1970s Stagnation To Today’s Economic Conditions

Disclosure: None.

The question in my mind now becomes whether central bankers' actions HAVE contributed to (present tense) recession, rather than if they could (future tense). That's assuming the definition of recession hasn't or won't be modified again.