Budget Deficit Hits Record $3 Trillion As US Spends 100% More Than It Collects YTD

Those who have been following the record surge in US public debt (excluding the roughly $100 trillion in off-balance sheet obligations), which exploded by $3 trillion in the three months following the COVID shutdowns and which hit an all-time high $26.7 this week, will be all too aware that the US budget deficit this year - and every year after - will be staggering.

(Click on image to enlarge)

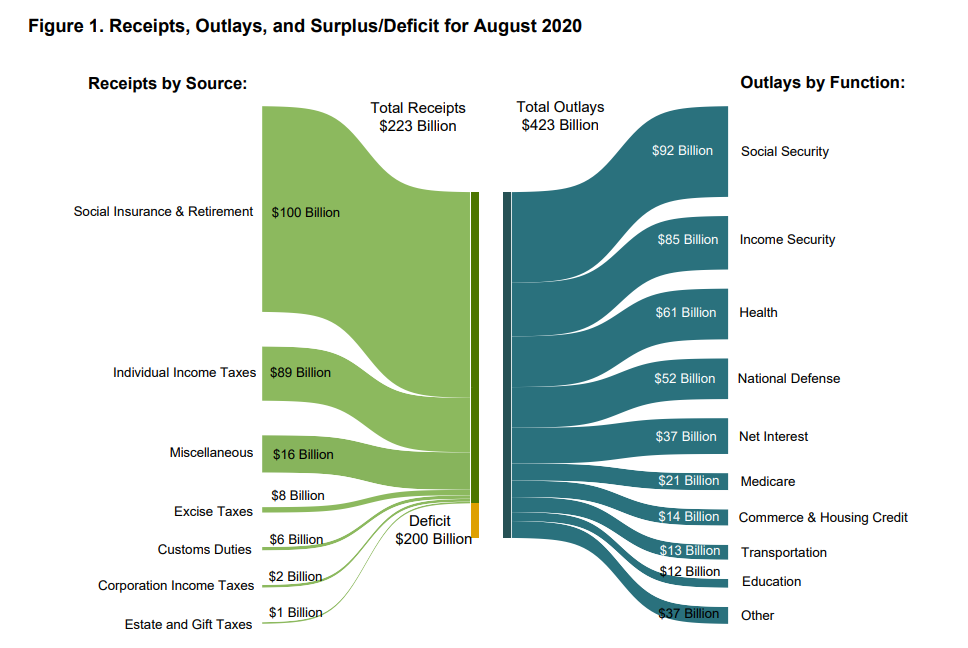

Sure enough, in the latest just released deficit report, the Treasury announced that in August the US burned through another $200BN, which was a sharp increase from the $62.9 billion deficit in July when government receipts soared thanks to the July 15 tax date even as spending remained in the stratosphere. That said, the number was an "improvement" from the record $862 billion deficit recorded in June.

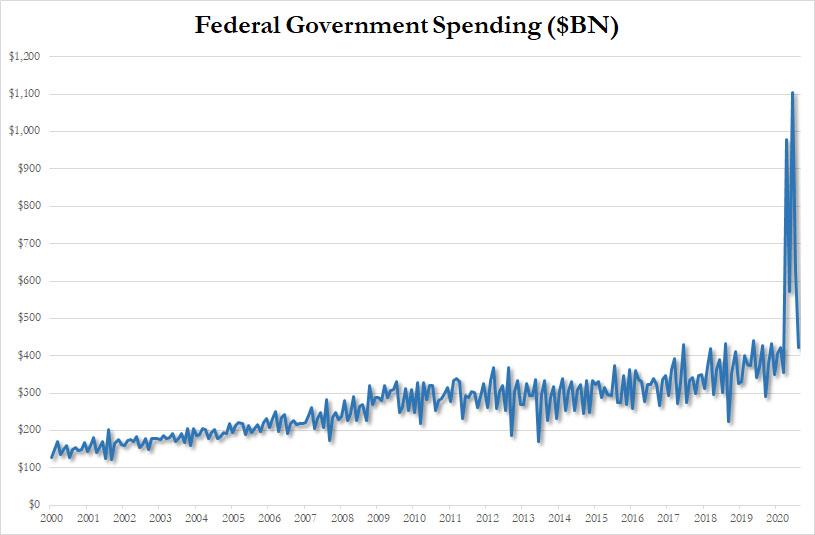

Specifically according to the Treasury, in August, government outlays were $423.3 billion, roughly the same as the $428 billion the US spent last July, and an improvement from the record June outlays of $1.1 trillion...

(Click on image to enlarge)

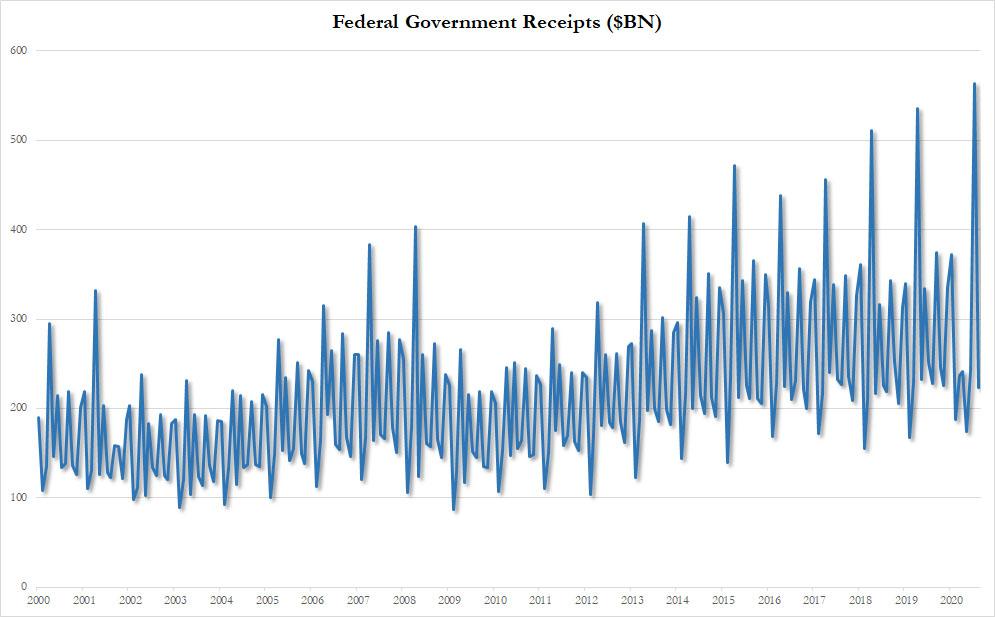

... while receipts slumped from the July record of $563.5 billion - which was a one-time surge thanks to the July 15 tax filing deadline - to just $223.2 billion (the question of why anyone still pays taxes in a time of helicopter money, when the Fed simply purchases whatever debt the Treasury issues, remains).

(Click on image to enlarge)

The chart below shows the July 2020 breakdown between various receipts and outlays.

(Click on image to enlarge)

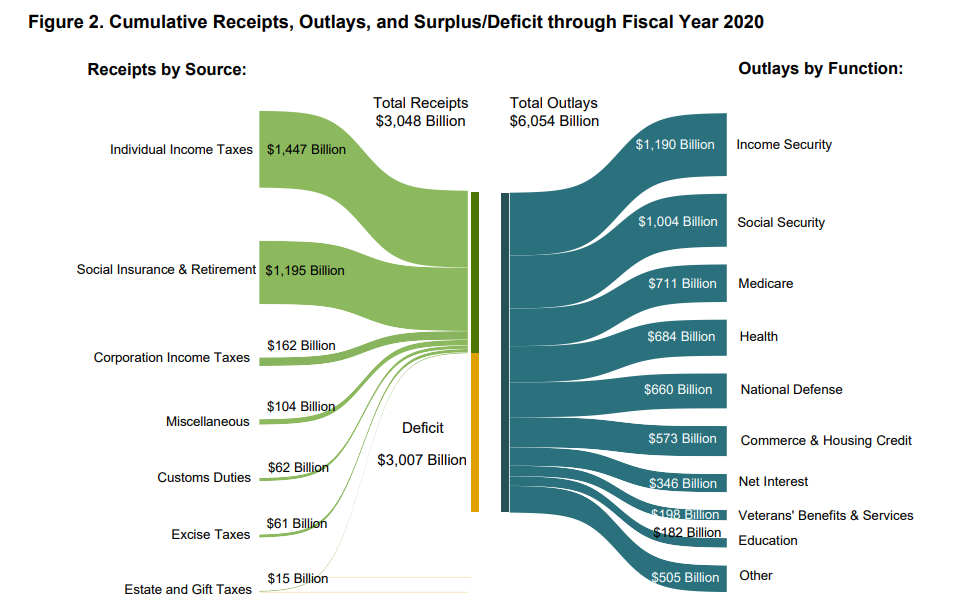

What all this means, is that on a YTD basis, with 1 month left to go in fiscal 2020, the US has spent $6.054 trillion and collected just $3.048 trillion, which means outlays are a record 100% higher than receipts, which also includes the $8.7BN received last month and $72.2BN YTD in deposits of earnings by the Fed.

(Click on image to enlarge)

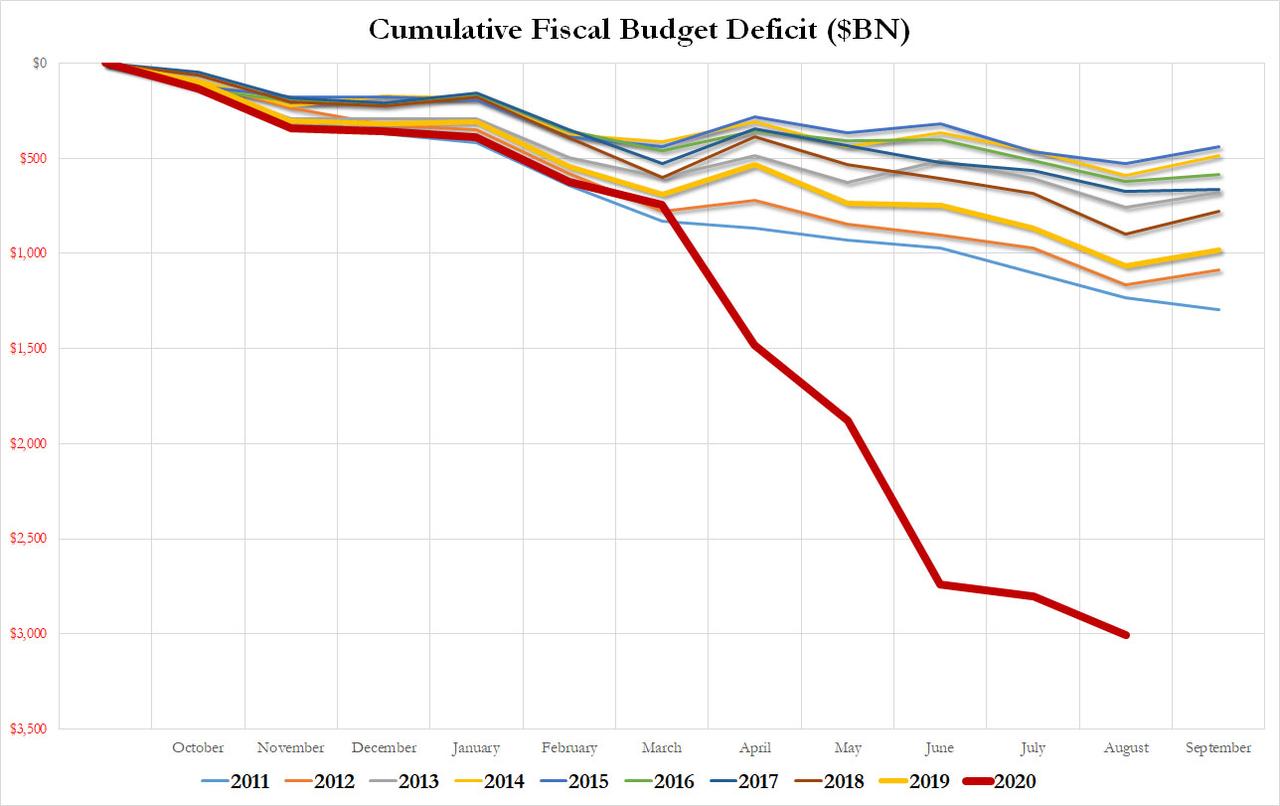

And since outlays equal receipts plus the deficit, it will come as no surprise to anyone that in the first 11 months of fiscal year, the US budget deficit is a record $3 trillion (compared to "just" $866.8 billion in 2019), higher than at any other time in US history and unfortunately due to "helicopter money" it is unlikely that the exploding deficit will ever shrink again until the monetary system is overhauled... or collapses.

(Click on image to enlarge)

At some point the market will realize that this insanity is simply unsustainable. And, in fact, looking at the soaring price of gold recent temporary downdraft notwithstanding, that realization may not take too long.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Running a massive deficit to support the economy and people's well being in a downturn and a crisis is good economics. What is bad is all the other lines which should have cut the deficit or run surpluses during the upturn. What is bad economics is not now but prior to now. Save when the economy is good and spend when its bad to counter the cycle.

100%

Where will it all end? I do not know but it will be catastrophic for sure. This can only happen in the US because of the ability to print unlimited US$, this is both the strength and the weakness of this scenario. Does anyone in power have a solution I guess not just kick the problem further down the road. Only a complete fool like Trump would want to be President for another 4 years? What does it say about the mental ability of the average citizen, if they think he can solve this humungous problem.

Well said Michael.