Another Bamboozle

Big bankers wanted to be able to make big bets without the risk of going broke. They solved that problem by creating the Fed in 1913. When business is good, they keep the profits. When bad, bailouts.

In her celebrated interview last week — her first! — Ms. Harris managed to answer some questions and not answer others, always in the same way, by giving out a line of talk, much rehearsed and little challenged.

It is “important to find a common place of understanding where we can actually solve problems,” she said.

The gist of our comment today: whatever problems she thinks she is solving... she’s creating much bigger ones.

The most obvious illustration: the US government is on target to run deficits of $2-$3 trillion per year — solving problems... many of them that were supposedly solved long ago. This will bring total government debt to nearly $60 trillion within the next ten years — assuming nothing goes wrong.

But we soar over the big picture today... and splash down into the swamp of details. In addition to trying to get corporations to stop gouging their customers... Ms. Harris proposes to give first-time house buyers a $25,000 gift.

How nice for the buyers! But does that solve a problem?

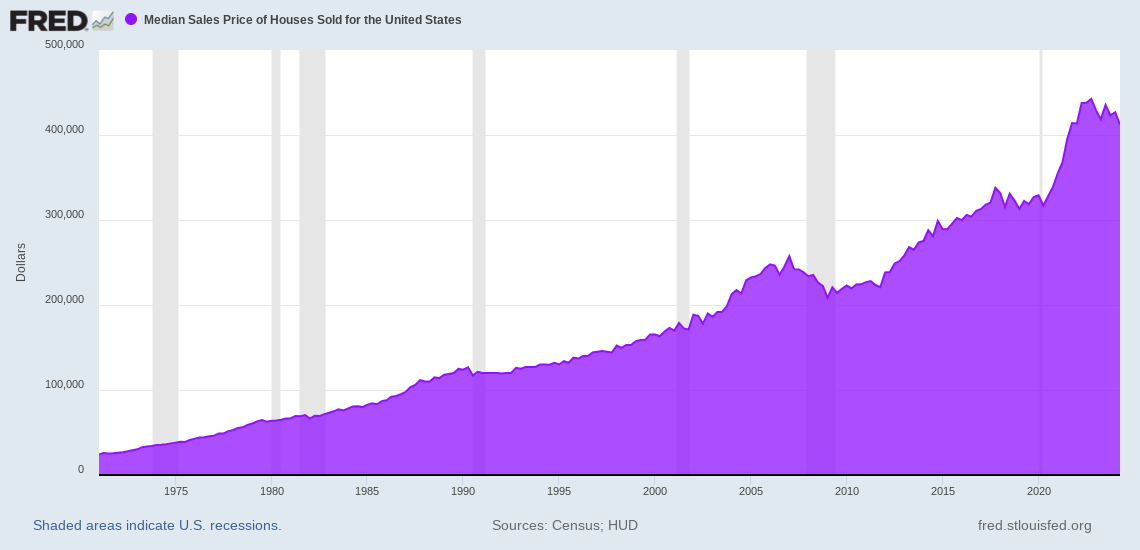

In 1971, the average house sold in the upper $20,000 range. The average wage, meanwhile, was around $10,000 per year. So, it would have taken less than three years’ wages to buy the house. If we recall correctly, no one thought that was a problem.

Today, the average house sells for $412,000. When Ms. Harris came into the White House, the average price was $260,000. So, house prices have gone up by $38,000 per year – the fastest pace in US history — while she was on watch. Now, the typical buyer has to save all of his income for nearly seven years — more than twice as long as 1971.

These outsized price increases during Ms. Harris’s time as VP suggest not a shortage of demand, but too much of it... compared to the supply of houses for sale. Adding more demand (more money) will, most likely, boost prices even further.

But how did they get so high in the first place? Why did house prices shoot up so much right under Ms. Harris’s own nose? If there was too much demand, where did it come from?

She hasn’t asked us. And she needn’t. Anyone with half a brain could tell her: the problem arises from previous efforts at problem solving.

First, the big bankers wanted to be able to make big bets, but without the risk of going broke. They solved that problem by creating the Fed in 1913. Now, when business is good, they keep the profits. When their bets go bad, they get bailed out by the Fed, generously sharing their losses with the public.

Then, in the late ‘60s, the feds spent far too much money on their ‘guns and butter’ programs — the War in Vietnam overseas and the Great Society at home. The solution? In 1971, they created a new kind of dollar — a credit money that they could “print” on demand and never have to settle up in gold. Now, the feds really could ‘just throw money’ at problems.

By the early 2000s, the Fed had become an activist problem solver, manipulating interest rates to stimulate or suppress the economy as needed. So, when the Nasdaq crashed and the economy slowed, it quickly cut its key lending rate by 500 basis points (5%). The lower rates stimulated a massive bull market in the real estate market, peaking in 2007.

This, of course, led to a mortgage finance crisis…which threatened to bankrupt some of the biggest institutions on Wall Street, including Goldman Sachs. But the solution of 1913 worked. Main Street (the real economy) got whacked hard, while Wall Street got a bailout.

The Fed solved the larger problem (falling real estate prices) the way it solved the last one — with lower lending rates.

This time, it put its key rate below zero in real terms, and left it there for the better part of the next ten years. By the time Harris was sworn into the VP role, the average mortgage rate was less than 3.5% and it looked like rates would stay low forever. Naturally, housing prices kept going up.

And now houses are once again so expensive that young families cannot afford them. And once again, Ms. Harris proposes to throw more money — the very thing it least needs — into the housing market.

This is all so obvious that it makes us wonder: does Ms. Harris really want a solution? Or just another bamboozle?

Regards,

Bill Bonner

Market Note, by Tom Dyson

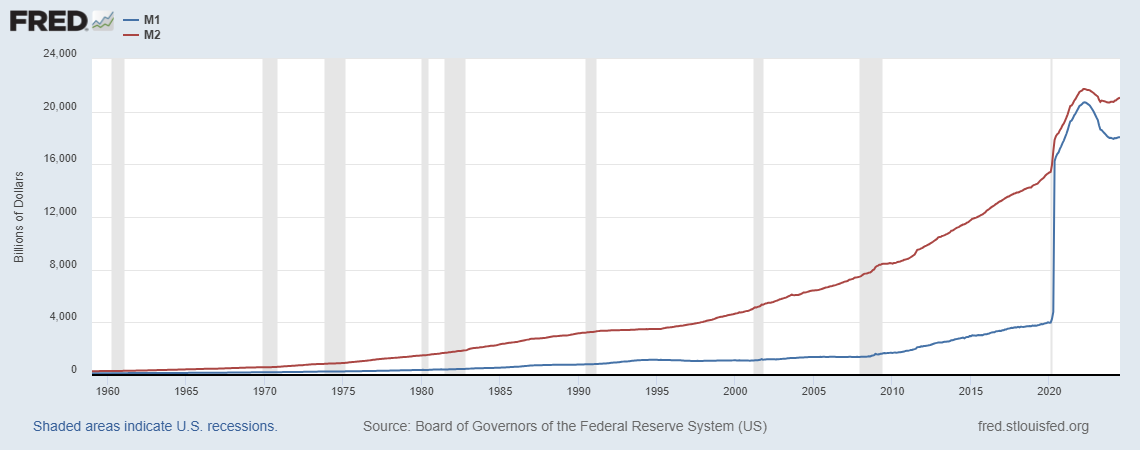

Money supply is the fuel of inflation and currency debasement. One of the reasons I insisted, two years ago, that we begin holding a big pile of cash was because I saw the feds choking the money supply to fight inflation. I wanted our readers to have a hedge against any deflation or falling prices that could result. The stock market fell about 20% from peak to trough and then, late last year, the Feds started gently inflating the money supply again. The chart below shows the policy pivot.

Now that the Feds aren't reducing the money supply any more, I assume the deflation risk is largely removed and the debasement risk is now even greater. Based on this insight, in this month's Strategy Report (September edition, published last week) we reduced our allocation to cash and increased our allocation to gold and precious metals.

More By This Author:

One way or another

Time To Get Serious

The Rest Of The Story