One Way Or Another

Oh what a tangled web we weave...

When first we practice to deceive

—Sir Walter Scott

Last week brought news that the stock market had gone up... a little. A photo showed a happy face on Wall Street, and a smile on the face of the newscaster. Rising stock prices are always accompanied by smiles.

The back of our envelope tells us that investors are about $250 billion richer today than they were yesterday morning.

But if they got richer, who got poorer? Where are the un-smiling faces?

The winners are almost all in the upper 10% of the population. Now they have, on paper, a quarter of a trillion dollars more. But where did it come from? The feds didn’t print up so much money overnight. Foreigners don’t come on airplanes... their suitcases crammed with US dollars.

Stocks are only valuable because they can be readily exchanged for money. And money is only valuable because it can be readily exchanged for products and services that have value.

But when the stock market goes up by $250 billion in twenty-four hours, there is not magically $250 billion more in goods or services — or cash money — available. The amount of real, valuable ‘stuff’ remains more or less the same.

So, if the top 10% of the population should feel happy about gaining a quarter of a trillion... shouldn’t the bottom 90% feel sad? Haven’t they just lost the same amount?

Whoa!

“What are you saying, Bill? That can’t be right. You make it sound like the stock market is a zero-sum game. But Henry Ford got rich in the stock market... and so did people who bought his stock. And nobody got poorer as a result. In fact, the whole nation got richer.”

We’re happy to answer that objection, because it goes right to the heart of what we’re talking about.

Ford stockholders made gains because Ford made cars. Even with no tax incentives or subsidies available, people bought them.

Say’s Law tells us that the cars were the real wealth. The people who made them sold them for money... and then were able to use the money to buy other ‘stuff.’ The stock price rose as the money flowed... from the sales of automobiles.

Obviously, this was a long-term trend. And sometimes the stock market anticipates the trend, raising its prices ahead of real output. No problem there.

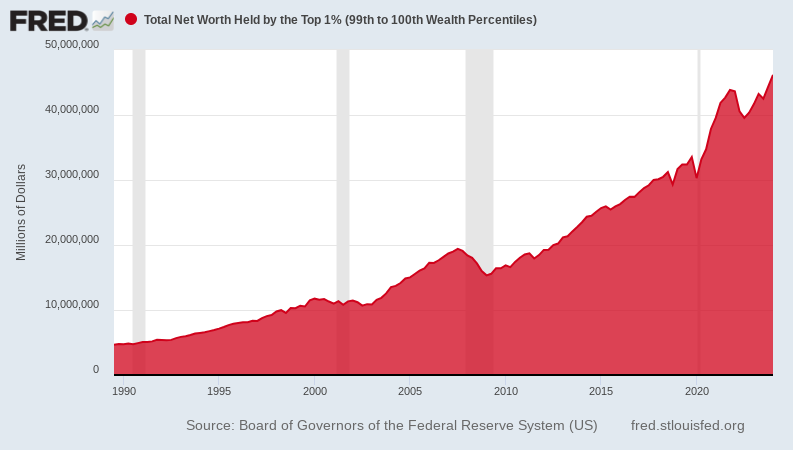

But just look at what has happened. In the ’60, ‘70s, and ‘80s the value of all US stocks was equal to between 40% and 60% of GDP. Output rose... people earned money... they spent it... business sales and profits rose. Stocks went up or down, depending on the businesses beneath them.

But then something funny happened. Beginning in the early ‘90s, stocks rose... with no corresponding increase in the stuff you could buy with your stock market gains (GDP). And today, the stock market is said to be worth 200% of GDP. Where did that money come from? From the feds, of course... they hoodwinked the whole system with their fake credit-dollars and artificially low interest rates.

Again, the back of our envelope tells us that today, we have roughly $30 trillion worth of stock market gains with no offsetting increase in ‘stuff’ to spend it on. (Stock prices rose more than twice as fast as GDP.) This $30 trillion therefore has to be an additional claim on already existing output. Which can only mean that the 90% of the people who aren’t substantial holders of financial assets have lost $30 trillion in purchasing power.

But wait. It’s not that simple. The stock gains gave an additional $30 trillion to investors. But they did not take $30 trillion away from the 90% without substantial stock market wealth. The two groups now compete for the same goods and services. A few big companies, with access to the Fed’s ultra-low-interest-rate financing, for example, were able to outbid ordinary families and buy up thousands of houses. BlackRock alone is said to have purchased $60 billion worth of them.

Hold on. The web of deception is even more tangled than we realized. Another complication: the rich have their marked-up stocks. They don’t have cash in hand. And when a sizeable number of them go to convert their $30 trillion in market gains into spendable cash... the value of the gains will collapse. Stock market wealth is readily convertible into cash for the individual, not for the whole group.

No one understands exactly how this plays out. Including us. But that $30 trillion is fake wealth. Crash... bear market... bankruptcy... default... inflation — one way or another, it has to go away.

More By This Author:

Time To Get Serious

The Rest Of The Story

In The National Interest