How Far Have Q3 Earnings Estimates Fallen?

Image: Bigstock

The overall corporate profitability picture emerging from the Q2 earnings season, with a little over 90% of S&P 500 results out, continues to show stability and resilience in key earnings drivers like consumer and business spending.

While this stability and resilience run contrary to worries of an imminent economic slowdown or even a recession, we are starting to see tell-tale signs of emerging weakness in both consumer and business spending. The Walmart (WMT - Free Report) pre-announcement is probably not solely due to weakness in lower-income households, but that consumer segment is nevertheless feeling the squeeze as we heard from companies in a variety of industries, including AT&T (T - Free Report). Other households seem to be doing just fine, as we heard from banks, credit card operators, and others.

With respect to business spending, we have started seeing a squeeze on advertising budgets and hiring plans, but Microsoft (MSFT - Free Report) and others didn’t see anything disconcerting with respect to spending on software and other services. That said, it is reasonable to expect some moderation in demand trends going forward as the full extent of the Fed’s tightening cycle permeates through the broader economy.

A slowdown has gotten underway, but there is nothing in the earnings data, management commentary, and guidance that would suggest the U.S. economy heading into a major economic downturn.

That said, estimates have started coming down, with the overall revisions trend turning negative even after accounting for the persistent favorable revisions trend enjoyed by the Energy sector.

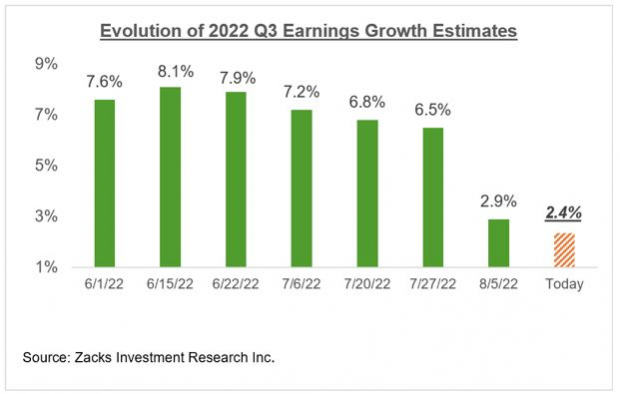

You can see this in the revisions trend to Q3 estimates in the chart below.

Image Source: Zacks Investment Research

If we look at the evolution of Q3 earnings growth expectations on an ex-Energy basis, the expected growth rate has dropped from +2.1% on July 6th to -4% today. The chart below shows the expected aggregate total earnings for full-year 2023 have evolved on an ex-Energy basis.

Image Source: Zacks Investment Research

As you can see above, aggregate S&P 500 earnings outside of the Energy sector have declined -3.3% since mid-April, with double-digit percentage declines in Retail (down -14.5%) and Construction (-11%), and high single-digit percentage declines for the Tech (-9.1%), Industrial Products (-8.7%) and Consumer Discretionary (-8.9%).

The Overall Earnings Picture

Beyond Q2, the growth picture is expected to modestly improve, as you can see in the chart below that provides a big-picture view of earnings on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

As strong as the full-year 2022 earnings growth picture is expected to be, it’s worth remembering that a big part of it is due to the unprecedented Energy sector momentum. Excluding the Energy sector, full-year 2022 earnings growth for the remainder of the index drops to only +0.1%.

There is a rising degree of uncertainty about the outlook, reflecting a lack of macroeconomic visibility in a backdrop of Fed monetary policy tightening. The evolving earnings revisions trend will reflect this macro backdrop.

More By This Author:

3 Key Takeaways From Q2 Earnings Season

How To Make The Most Of Today's Market

Apple, Amazon And Big Tech Showcase Their Earnings Power Once Again

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more