Apple, Amazon And Big Tech Showcase Their Earnings Power Once Again

Image: Bigstock

Amazon’s quarterly release made up for the preceding period’s disappointment. The report not only checks all the appropriate boxes for Q2, but it sent a clear all-is-well signal about Q3 as well.

This became doubly important for the market to see after what we heard from Walmart (WMT - Free Report) a few days back. Reading the Amazon release almost feels like they operate in a parallel universe where logistical challenges don’t exist and customers aren’t pressured by inflation.

Among the Big 5 Tech players – Apple (AAPL - Free Report), Microsoft (MSFT - Free Report), Alphabet (GOOGL - Free Report), Meta (META - Free Report), Amazon (AMZN - Free Report) – Amazon, Apple, and Microsoft really stood out for the resilience and stability of their business. No company is completely immune from cyclical forces and we saw some of that with advertising spending trends in the Alphabet and Meta quarterly reports. But even after conceding that point, it is hard not to be impressed with the strength of the Apple, Amazon, and Microsoft numbers.

Apple made $18.45 billion in earnings on $83 billion in revenues in Q2. Earnings were down -10.6% from the year-earlier level as a result of all-around higher expenses, China troubles, cyclical weakness in product categories like Mac and iPad, and currency translation issues. But Apple was nevertheless able to provide reassuring guidance for the September period even though all of these headwinds will still be very much with us.

As a contrast to Apple and what it had to deal with, we also saw Exxon (XOM - Free Report) come out with $16 billion in earnings on $115.7 billion in revenues. Exxon is the quintessential old-economy operator that is currently enjoying a very favorable commodity-price environment.

Apple brought in $18.4 billion in a seasonally weak quarter; it had earned $25 billion in 2022 Q1 and $34.6 billion in 2021 Q4. Even the ‘cyclically exposed’ Alphabet brought in $16 billion in earnings in Q2.

On an unrelated note, we generally see the likes of Exxon as having ‘more money than god’ when the boundless riches are actually with these Tech titans.

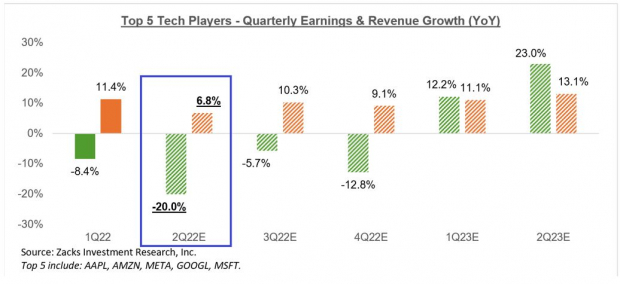

Total Q2 earnings for the ‘Big 5 Tech’ players are down -20% from the same period last year on +6.8% higher revenues and a 585 basis-points (bps) compression in net margins. Q2 net margins are down for each of the 5 Tech leaders, with the biggest declines at Meta and Alphabet at -1255 and -851 bps, respectively.

The chart below shows the group’s quarterly earnings and revenue growth picture, with the group’s Q2 performance highlighted.

Image Source: Zacks Investment Research

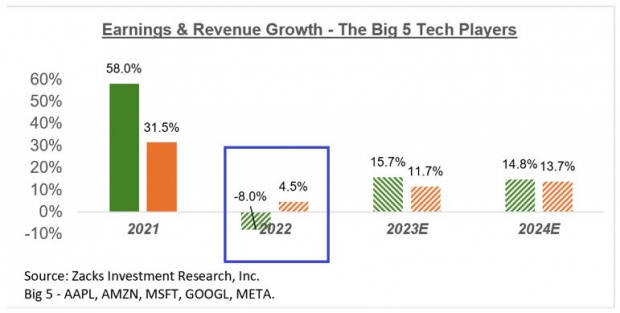

The chart below that shows the group’s earnings and revenue growth on an annual basis.

Image Source: Zacks Investment Research

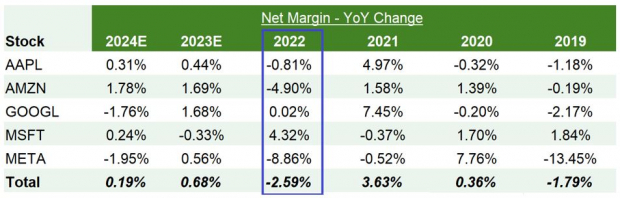

The table below shows the year-over-year change in net margins for the group, on an annual basis. As you can see, Microsoft is the only one in the group whose margins are expected to expand in 2022, with Alphabet keeping them intact.

Image Source: Zacks Investment Research

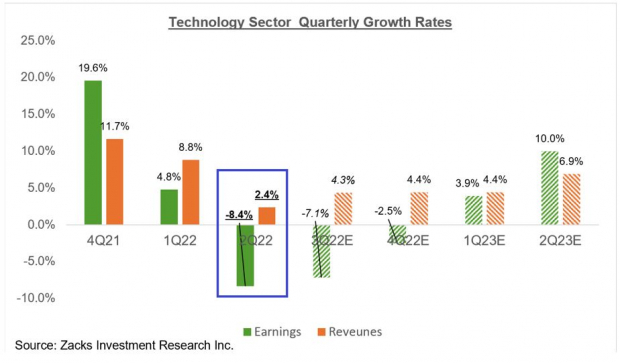

Beyond the big 5 Tech players, total Q2 earnings for the Technology sector as a whole are expected to be down -8.4% from the same period last year on +2.4% higher revenues.

The dramatic looking chart below shows the sector’s Q2 earnings and revenue growth expectations in the context of where growth has been in recent quarters and what is expected in the coming four periods.

Image Source: Zacks Investment Research

This big picture view of the ‘Big 5’ players as well as the sector as a whole shows a decelerating growth trend. That said, unlike this ‘quarterly view’, the annual picture shows a lot more stability, as the chart below shows.

Image Source: Zacks Investment Research

For those of you out there on the ‘recession watch’, please note that the sector’s 2022 earnings growth rate has come down from +2.7% from three months back. Growth estimates for 2023 have come down +13.1% over the same time period.

Q2 Earnings Season Scorecard

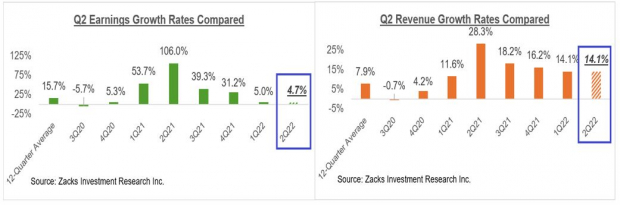

Through Friday, July 29th, we have seen Q2 results from 279 S&P 500 members or 55.8% of the index’s total membership. Total earnings for these companies are up +4.7% on +14.1% higher revenues, with 75.6% beating EPS estimates and 65.6% beating revenue estimates.

The comparison charts below put the Q2 earnings and revenue growth rates for these index members in a historical context.

Image Source: Zacks Investment Research

The Finance sector has been a big drag on the ‘headline’ year-over-year growth rate for the companies that have reported already. Q2 earnings growth for the Finance sector companies that have reported already are down -23.5% from the same period last year.

Excluding this Finance sector drag, Q2 earnings growth for the rest of the index improves to +13.8%.

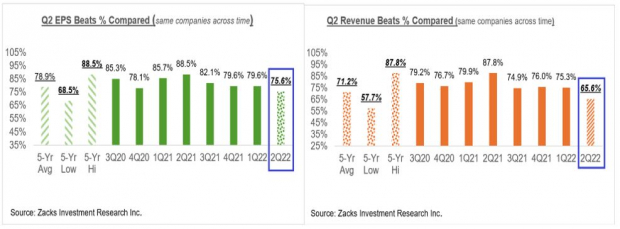

The comparison charts below put the Q2 EPS and revenue beats percentages in a historical context.

Image Source: Zacks Investment Research

The EPS and revenue beats percentages are still tracking on the low side relative to historical periods, as you can see above.

This Week’s Docket

We will have another very jam-packed reporting docket this week, with almost 1,300 companies on deck to report quarterly results, including 151 S&P 500 members. We have a host of reporters from the Energy, Tech, Consumer Staples, and Discretionary sectors this week.

I will be keeping an eye on the evolving guidance picture, with a particular focus on the broader ‘travel’ space, with results from Uber (UBER - Free Report), Airbnb (ABNB - Free Report), Expedia (EXPE - Free Report), Booking (BKNG - Free Report) and others coming out this week.

By this time next week, we will have seen Q2 results from 86% of the S&P 500 members.

The Current Earnings Backdrop

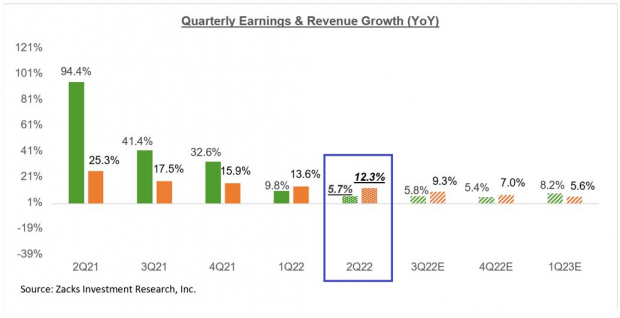

The chart below shows current expectations (and actuals) on a quarterly basis.

Image Source: Zacks Investment Research

Please note that the +5.7% earnings growth expected in 2022 Q2 is solely due to strong gains in the Energy sector. On an ex-Energy basis, Q2 earnings growth drops to a decline of -4.2%.

The chart below presents the earnings picture on an annual basis.

Image Source: Zacks Investment Research

More By This Author:

Previewing Big Tech Earnings Ahead Of A Huge Week For Wall Street

Breaking Down JPMorgan, Citi & Big Bank Earnings

Q2 Earnings Season Gets Underway

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more