Dealing With Seasonality With 12 Month Changes: The QCEW

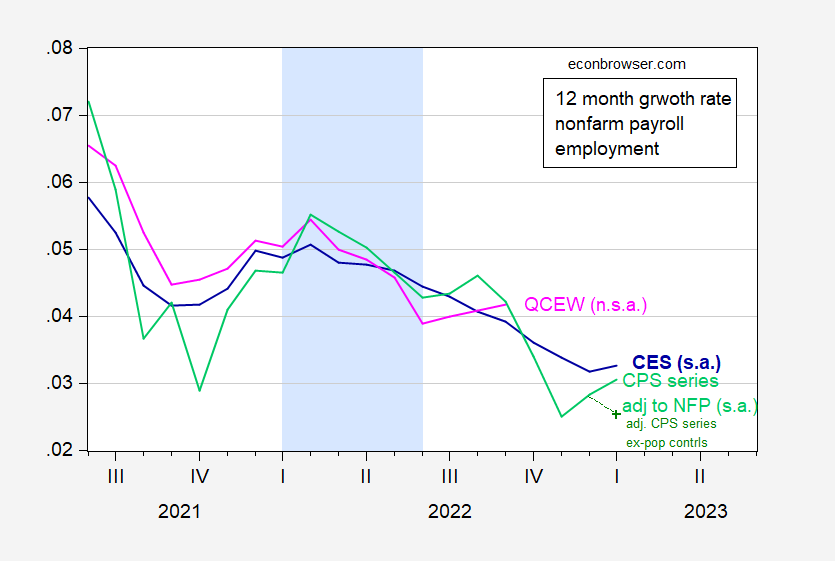

(If you’re wondering about estimating seasonals — and you might be right wonder — then here’s the alternative.) QCEW data are not reported on a seasonally adjusted basis, which makes comparison with the other regularly reported BLS series, based on surveys, difficult. One way to address this issue, while sacrificing a more current perspective, is to use 12 month changes. Here is the QCEW series compared against two others measures of nonfarm payroll growth.

Figure 1: 12 month log difference in nonfarm payroll employment from January 2023 CES release incorporating benchmark revisions, s.a. (blue), household series adjusted to NFP concept (light green), household series adjusted, excluding population controls for January, s.a. (green +), QCEW total covered workers, n.s.a. (pink). Light blue shading denotes a hypothesized 2022H1 recession. Source: BLS (various) and ADP via FRED, BLS QCEW, Philadelphia Fed via FRED, and author’s calculations.

Through September 2022, the 12 month growth rate in the CES NFP is 3.9% (using seasonally adjusted, or using seasonally unadjusted), while that for the QCEW is 4.2%. In numbers, the comparison is 5.9 million vs 6.2 million (CES vs QCEW).

See also this post.

- QCEW is currently registering a larger 12 month change in percentage terms and numbers.

- No series registers a negative entry during the putative 2022H1 recession argued by some.

More By This Author:

Employment Levels And Cumulative Changes: Tales From The QCEWDo Declining Imports Signal And Imminent Recession?

Weekly Macro Indicators Thru 2/11: Up, Up And Away, Or Slow Deceleration?