USD/JPY Yielding To A Revitalized Dollar As The BoJ Offers No Help

The Bank of Japan today left all monetary policy levers untouched, as expected, and confirmed that it would continue to control JGB yields to help boost the ailing Japanese economy, stoke inflation and keep the Japanese Yen depressed. At the same time, the central bank said that it doesn’t see a weak Yen ‘offering a big opportunity for Japan’s economy’ although if the ‘Yen’s decline is steady it would have a positive impact on the economy’. A mixed message but one that likely leaves the Japanese Yen set to drift lower with official intervention to prop up the currency only considered if USD/JPY falls too quickly or too far. There will come a time when markets will ignore further verbal warnings of intervention and fully test the central bank’s resolve to prevent the Yen from collapsing further.

In a further effort to boost the economy, Japanese Prime Minister Kishida announced a $200 billion spending package to help families and businesses with wages, energy costs, and tourism high on the support agenda.

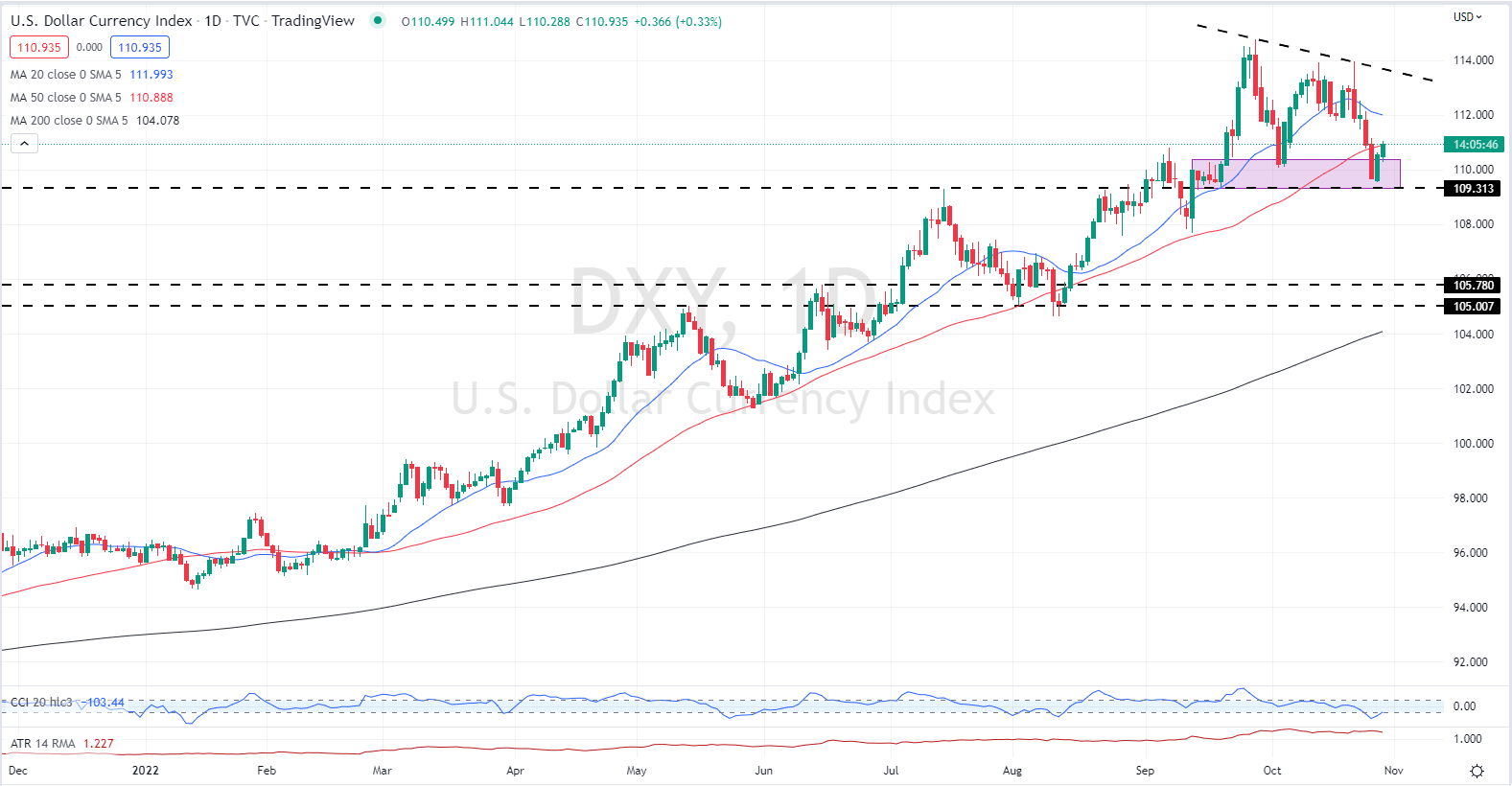

The US dollar is pushing back after slipping over four big figures over the last week. Today’s move higher is aided by the recent rout in the US tech sector that has seen some of the mega-cap companies, including Meta and Amazon, slump by 20%+ after they released their Q3 earnings. The US dollar remains the safety play in times of trouble.

US Dollar Daily Price Chart

(Click on image to enlarge)

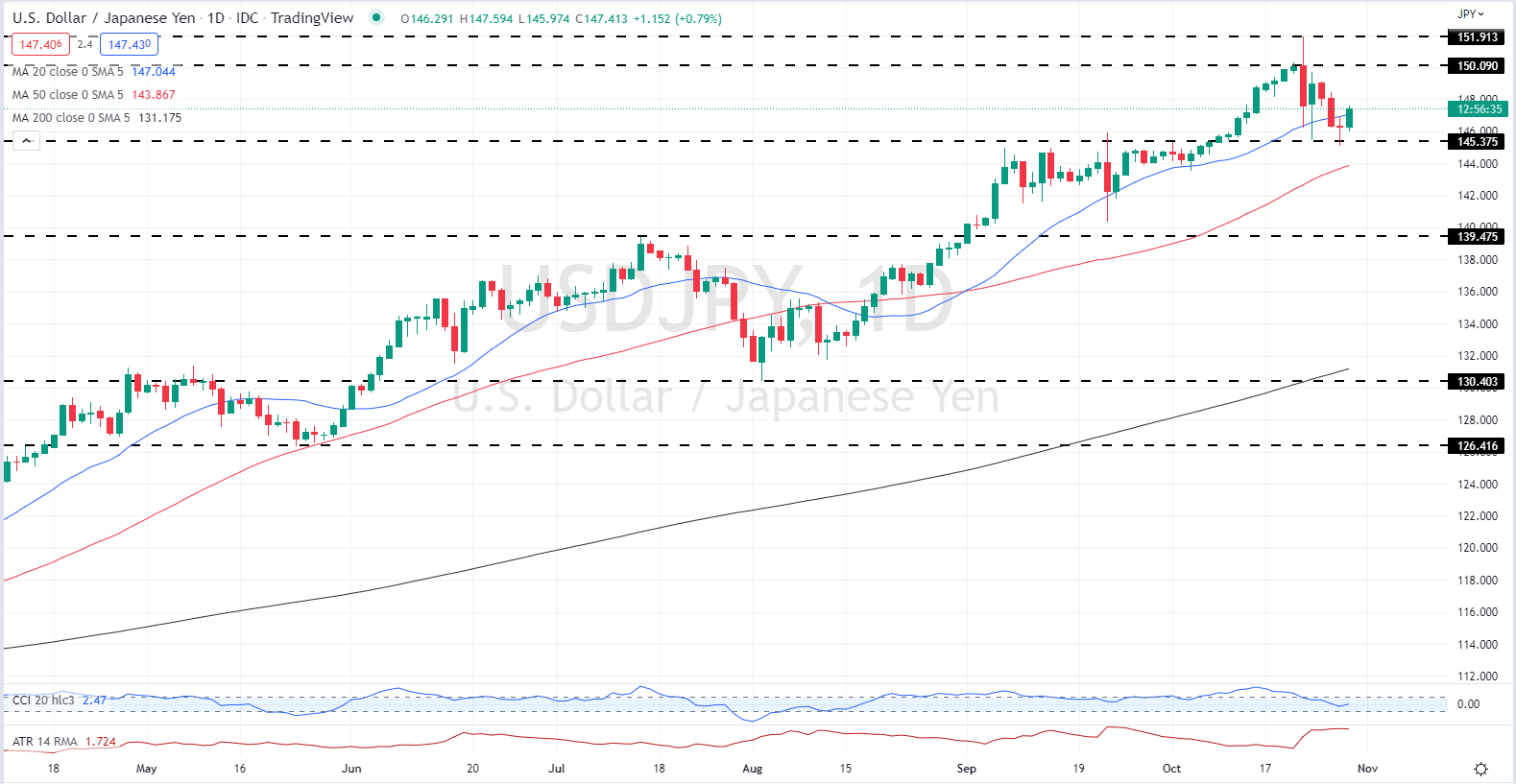

USD/JPY is trading back above 147.00 after last Friday’s intervention sent the pair tumbling to the mid-145s. Today’s move higher, on the back of a dovish BoJ, is muted but with US Core PCE released later today, any beat or miss of expectations, currently, 5.2% y/y and 0.5% m/m, will add volatility into the pair ahead of the weekend. And it was mid-late Friday afternoon last week that the BoJ stepped in and bought the Japanese Yen, so care needs to be taken before the weekend starts.

USD/JPY Daily Price Chart

(Click on image to enlarge)

Retail Traders Boost Net-longs And Cut Net-shorts

Retail trader data show that 29.89% of traders are net-long with the ratio of traders short to long at 2.35 to 1. The number of traders net-long is 14.54% higher than yesterday and 21.61% higher than last week, while the number of traders net-short is 5.67% lower than yesterday and 37.17% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests that USD/JPY prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/JPY price trend may soon reverse lower despite the fact traders remain net-short.

What is your view on the USD/JPY – bullish or bearish?

More By This Author:

British Pound Latest: GBP/USD And EUR/GBP Eye US Data And ECB Meeting

Gold Price Running Back Into Resistance As The US Dollar Slides

Japanese Yen Latest: USD/JPY Consolidating, Further Volatility Ahead

Disclosure: See the full disclosure for DailyFX here.