USD/JPY In Need Of Positive US Data To Re-Ignite Rally

Photo by Jason Briscoe on Unsplash

The US dollar has had a mildly volatile couple of sessions, rising at open on Monday on the back of the weekend developments in Venezuela, before easing back down later in the session, and then bouncing back ever since then. Investors have largely ignored geopolitical developments both in Venezuela and Greenland. The focus will return to data with the release of key employment report on Friday which could set the tone for the early parts of January, at least. This week’s other data releases have been largely mixed. After a seasonally weak December, the dollar tends to perform better in early parts of the new year. With much of the Fed’s easing priced in, the dollar bears may find the next couple of months an uphill struggle if economic data doesn’t take a turn for the worse. Any improvement in data therefore should benefit the USD/JPY, with the yen remaining largely under pressure with the BoJ and Japanese government both refusing to show any real commitments in trying to stem the yen’s ongoing weakness.

Muted response from geopolitical noise keeps USD/JPY supported

In response to the weekend’s dramatic developments in Venezuela, we saw the dollar start the first full week of 2026 trading higher, as the likes of the euro and franc gave way, while gold, silver and equity markets all pushed higher. Crude oil prices were volatile before slipping lower on Tuesday amid concerns over more supplies hitting the market. In other words, the market’s initial response has been mixed, but far from defensive, suggesting investors are not expecting any follow-up fireworks as they assess short-term uncertainty against longer-run supply implications for Venezuelan oil production.

The risk of deeper US involvement in Venezuela or military action in Greenland could be more significant, in which case some risk assets may feel some pressure which could see investors gravitate towards the liquidity and safety of the yen. But for the time being, risk appetite hasn’t been dented. That is helping to keep the USD/JPY largely supported.

Focus turns to US non-farm jobs data

Away from geopolitics, the focus for the dollar and the USD/JPY currency pair will remain data. Today we will have weekly jobless claims, and tomorrow is the big one – non-farm payroll. The latter is expected to come in around the 65K mark, similar to the previous print.

It hasn’t been a great start to the year for US macroeconomics following the release of a weaker ISM Manufacturing PMI earlier this week, followed by even softer job openings data. But that came on the back of some forecast-beating data we saw towards the end of 2025, including jobless claims, pending home sales, and Q3 GDP data, while the ISM services PMI was quite strong too. Growth in Q3 was an annualised 4.3%, way higher than 3.3% expected, challenging the idea that the Federal Reserve needs to cut rates aggressively this year. Markets currently don’t price the next 25bp cut until June, with another pencilled in for September, but those expectations could be pared back unless Friday’s labour market data comes in soft. Should US jobs data turn out to be overall better than expected, then this should be a positive influence on the USD/JPY exchange rate.

USD/JPY path of least resistance still to the upside

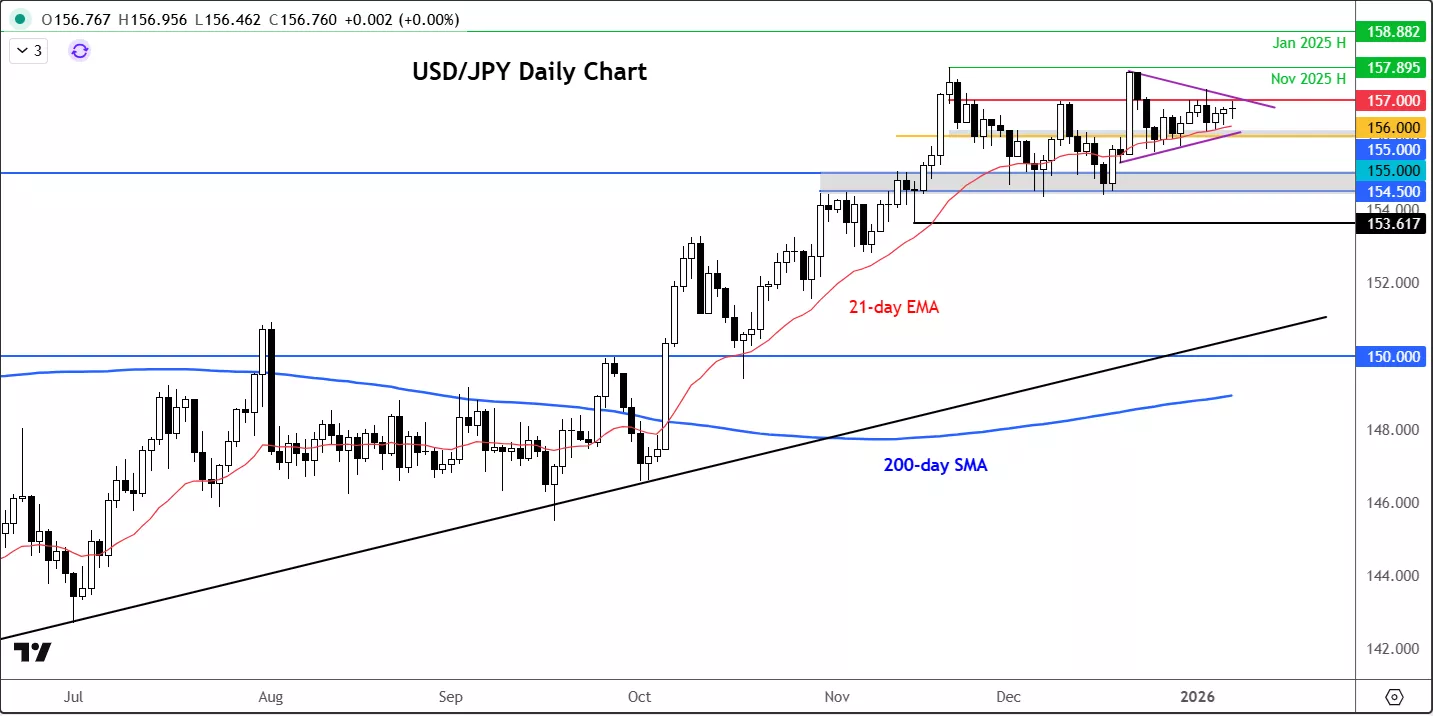

(Click on image to enlarge)

Despite this week’s mini reversal from the 157.00 resistance level, the path of least resistance remains to the upside on the USD/JPY chart. The only bearish thing I could say at this stage is that the UJ failed to achieve a new high for 2025 during the rally that commenced in April, after the rally stalled at just below 158.00 area in November, with January 2025 high of 158.88 remaining intact. But this could be a temporary stop before the potential resumption of the trend. Keep an eye out on the trend support of the currency triangle consolidation pattern and the 21-day exponential average at around the 156.00 area. The bulls will need to defend that level, else a potential drop back to 155.00 area could become a real possibility again.

More By This Author:

Tech Rebound Brings Calm After Bank-Led Wobble

Yen Still Looks Poised To Slide 160 Per Dollar

Will Gold Continue To Make New Highs?