USDCHF Continues To Rise, Trading Above 0.94000 Level

USDCHF pair continues the upward movement following the Swiss National Bank’s (SNB) surprise decision to cut interest rates by 0.25% last week.

This has led to the Swiss Franc's depreciation against the other major currencies including the US dollar.

The depreciation comes despite still-ongoing uncertainty regarding the Fed’s decision on Interest rates.

Higher for longer US interest rates may translate into stronger USD, potentially pushing the USDCHF pair higher.

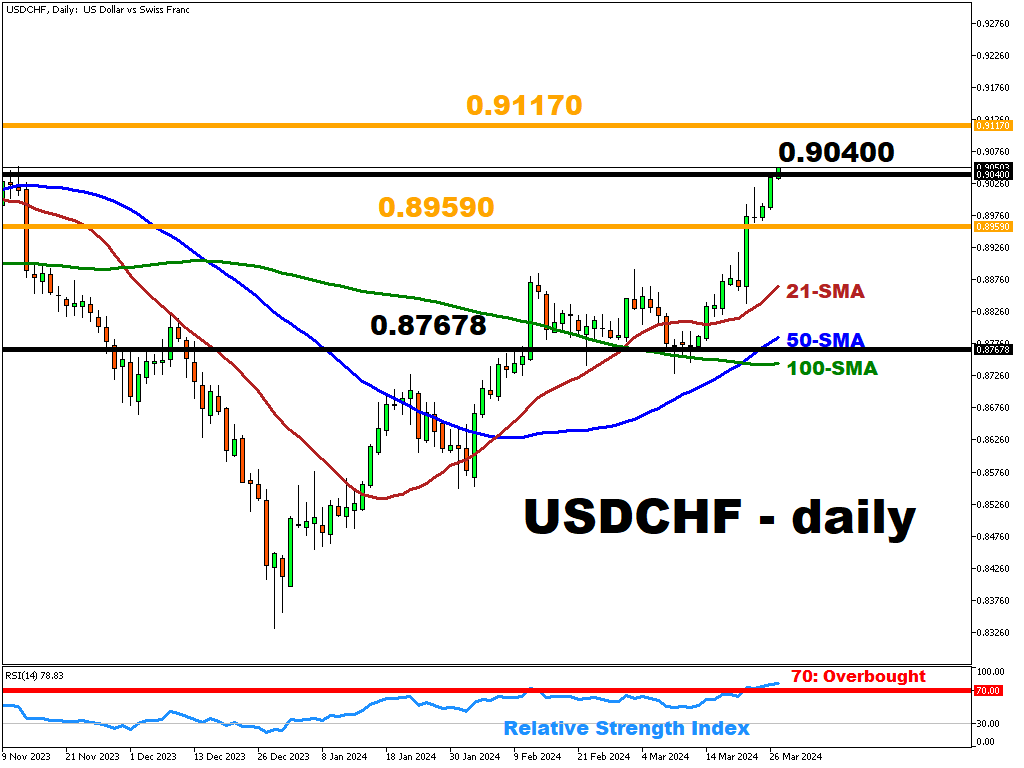

Swiss Franc bears are now attempting to gain a foothold above the 0.90400 key resistance level.

What to expect?

The SNB’s recent dovish move might be continued, with the new incoming president potentially continuing rate cuts, given that the inflation will stay in check.

The continuation of the rate cuts by the SNB may further weaken CHF.

On the technical side …

CHFUSD is trading well above the key simple moving averages (21,50 & 100-period SMAs), underscoring a strong bullish momentum.

However, the RSI is in overbought territory at 78.83 (>70 – overbought; <30 – oversold), signaling a potential for a technical pullback.

To the upside, the ~0.90400 may prove to be a strong resistance, while to the downside the 0.89590 may provide support if the CHF bulls try to regain the initiative.

According to Bloomberg’s FX model, USDCHF has a 77% chance of trading within 0.89590-0.91170 during the next 7 days.

More By This Author:

Ethereum: Bullish Test At 21-Day SMA

XAUUSD Steadies After Briefly Touching An All-Time High

BRN Has Slightly Rebounded, Trading Above $85/bbl

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more