XAUUSD Steadies After Briefly Touching An All-Time High

After briefly reaching an all-time high (~$2222.85) following the Fed’s dovish commentary XAUUSD has retreated towards $2170.

The retreat comes amid strengthening US dollar as the lower-than-expected Initial jobless claims reading posted on Thursday indicated a potential upbeat of the US labor market.

Declining jobless claims numbers may contribute to the Fed’s decision to keep the interest rates elevated for a longer period of time.

Higher for longer interest rates could extend downward pressure on gold prices as investors may seek higher yields from interest-bearing assets.

Geopolitical risks are still at play with any sudden developments in the Middle East having the potential to significantly affect the bullion prices.

On the demand side …

The world’s largest gold ETF (“SPDR Gold Shares”) has gained 1.2% (~$690.7 million) in total net asset value (Mar18 – Mar 21), bringing the total up to $58.5 billion.

On the technical side …

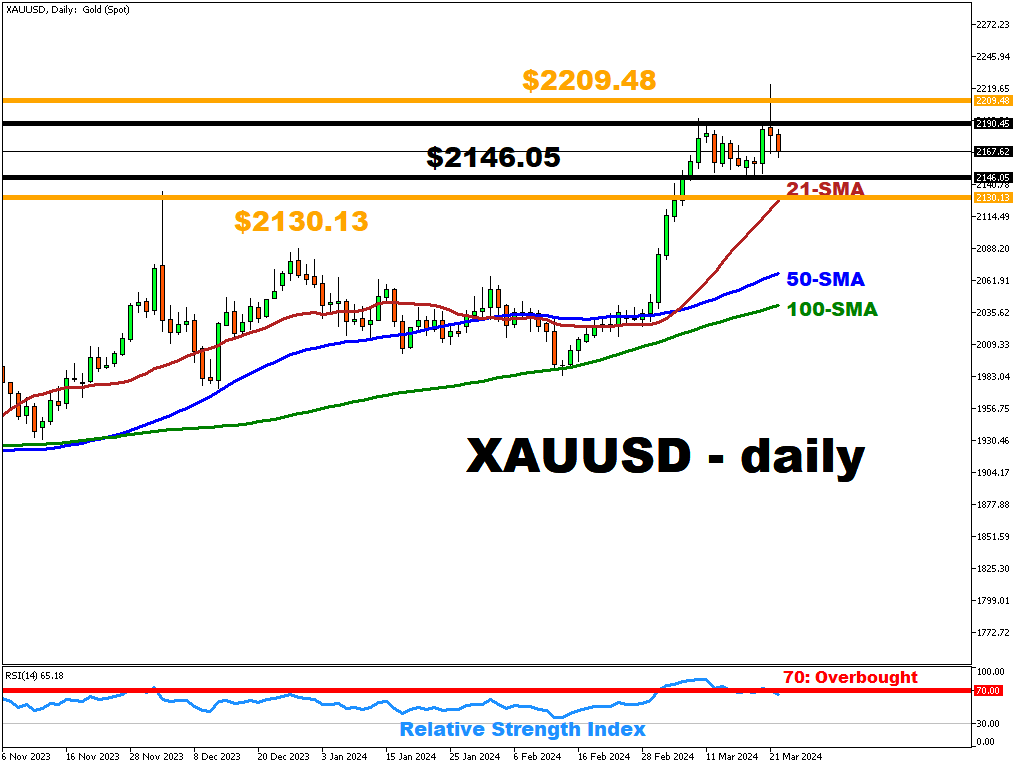

Trading above the key simple moving averages (21, 50 & 100-period SMAs) underscores XAUUSD’s bullish momentum.

To the downside, the immediate resistance level is located at $2152.00 (this week’s low). Moving below it could drag the gold price down towards the next support level at 21-period SMA.

To the upside ~2190.45 is set to act as an immediate resistance level.

According to Bloomberg’s model, there is a 76% chance for XAUUSD to trade within $2130.13-$2209.48 during the next seven days.

RSI (64.64) is neither in the overbought (>70) or in the oversold (<30) condition.

More By This Author:

BRN Has Slightly Rebounded, Trading Above $85/bblEthereum, Is The Pullback Over?

USDJPY Jumps Above 150 Following The BoJ’s Interest Rate Decision

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more