USD Support Warns Risk-Rally

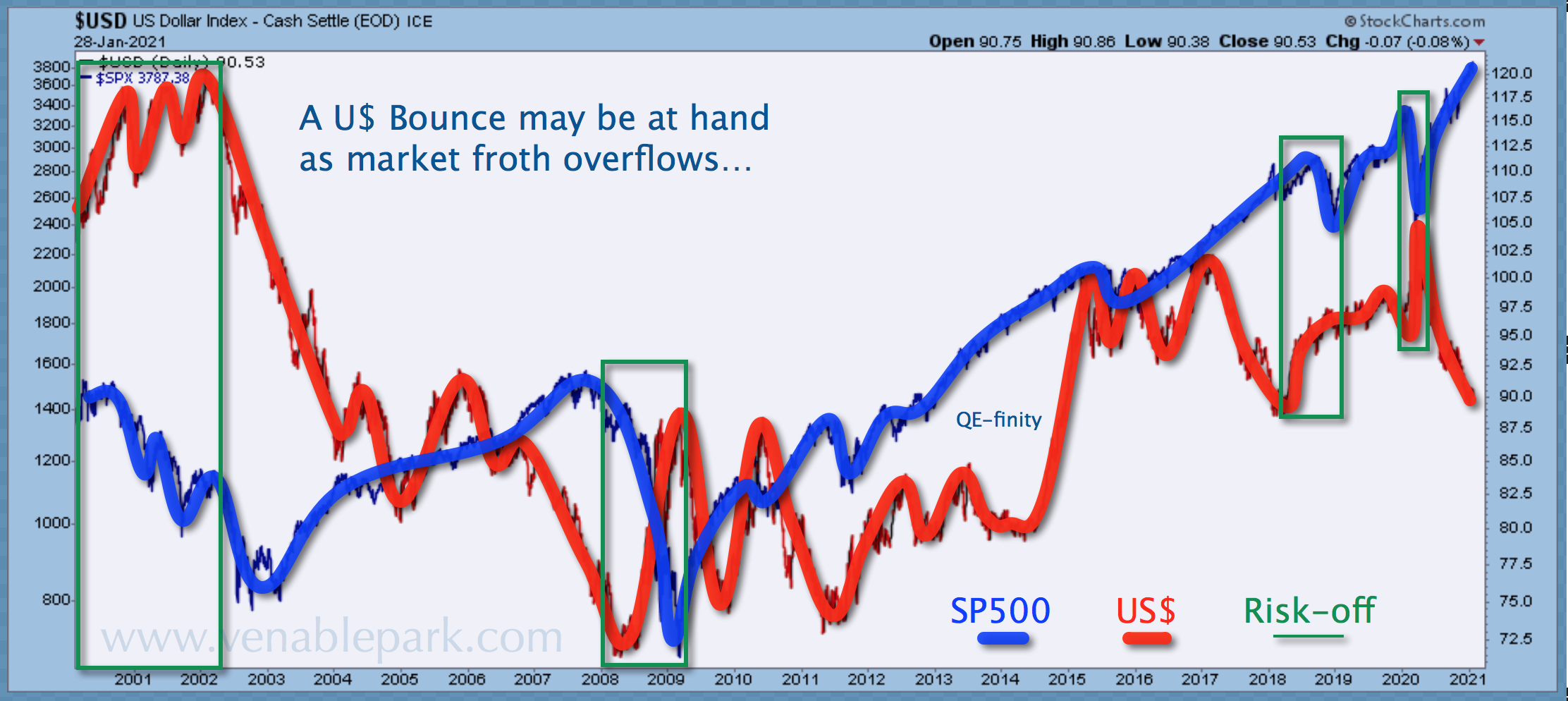

Between March 23, 2020 and January 5, 2021, the US dollar index (greenback versus the Euro, Yen, Pound, Cdn$, Swiss franc, and Swedish krona) fell 13.2% to test long-term support in the $89 area as shown below in my partner Cory Venable’s chart of December 31, 2020.

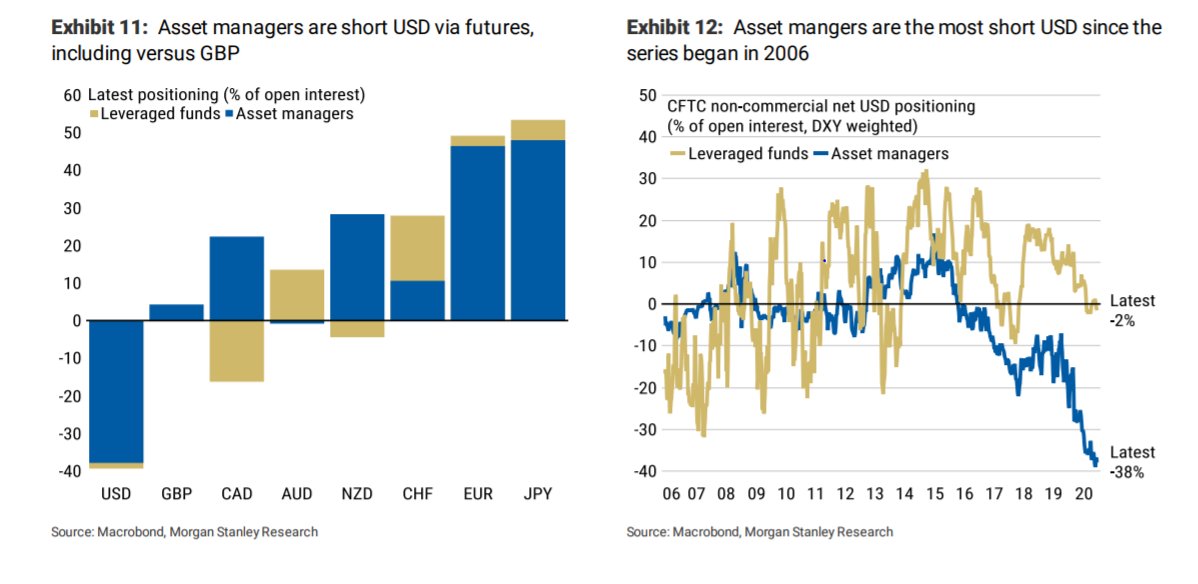

As the dollar fell, risk-assets on the other end of the global teeter-toter rose and dollar bears became ubiquitous with traders and asset managers the most dollar-short coming into January since 2006, as shown below.

When everyone agrees, something else tends to happen, of course, and since January 8, while the dollar index has quietly strengthened, stocks, commodities, and cryptocurrencies have lost ground.

As shown below in Cory’s chart since 2000, at $90.50 starting February, if the oversold dollar (in red) continues to rise for a bit, the risk-on mania that has dominated since March should be in for its next round of comeuppance (S&P 500 price in blue).

Disclosure: None.

I agree with you, and in today's article state that the dollar plunge has to wait a little for now. Yes, regardless of the twin deficits, but it'll march much lower well before the year end