US Dollar Short-Term Headwinds For The PM Complex?

Image Source: Unsplash

We are currently at an interesting juncture right now in regards to time. Wednesday was Fed day, with no change in interest rates, which should be bullish for the stock markets. It means they think the economy and inflation are under control. Normally, when they start to lower interest rates, it’s a sign the economy may be in trouble.

Thursday is also the end of the month, when there is some window dressing as the month of July comes to a close. And generally, there is a day or two of whipsawing after a Fed meeting, so we’ll get a better handle on things starting next week.

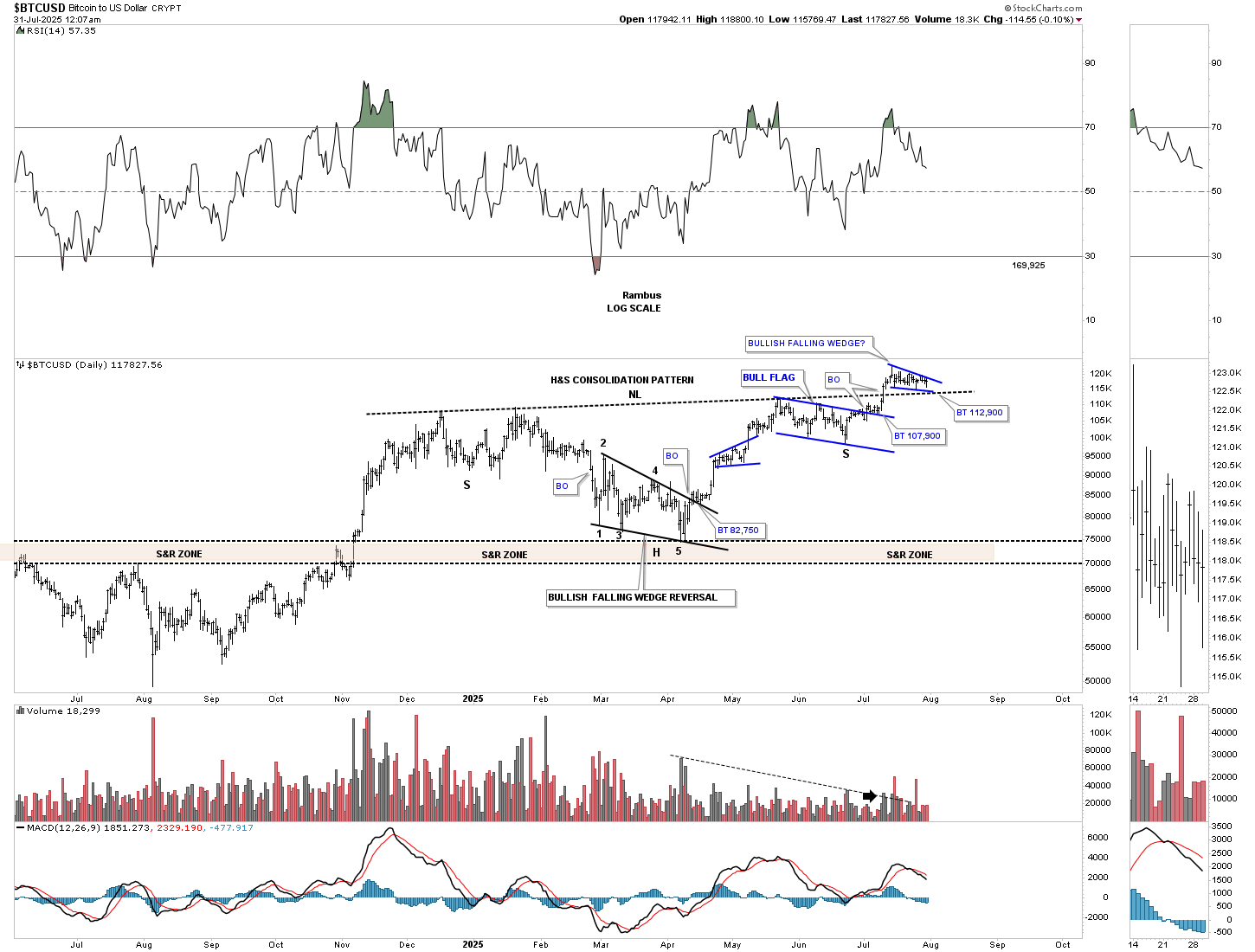

Yesterday, BTCUSD traded within the boundaries of its falling wedge backtest.

This daily chart for the CDNX shows the price action touching the bottom of a possible small consolidation pattern that may be starting to build out at the 770 area, which is a 38% retrace from the 4th reversal point low on the blue flat-top expanding triangle. There is still another gap a bit lower, which may come into play.

More By This Author:

Can Big Chart Patterns Lead To Even Bigger Chart Patterns?Quick Markets Update: Tuesday, July 22

US Stocks Poised For Breakout As PM Complex Takes A Pause