US Dollar Is Making An Intraday Corrective Pullback Within Downtrend

Image Source: Pixabay

Hey traders! Stocks keep pushing higher along with yields, so it looks like 10Y US Notes could still see lower support levels, and that’s why US Dollar is in a bigger intraday correction. What we want to say is that while the 10Y US Notes are still searching for support, the DXY can stay in recovery mode or at least sideways. In the meantime, stocks can easily see even higher levels.

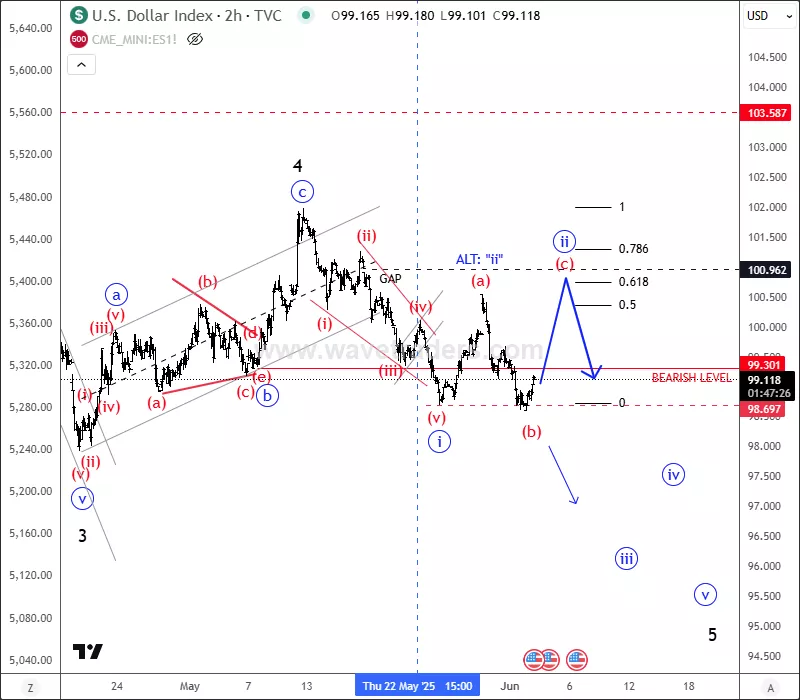

Looking at the intraday US Dollar Index (DXY) chart, we observe a potential leading diagonal formation, followed by an ongoing intraday abc correction. This correction may complete before a bearish continuation resumes. Keep an eye on the May 18 gap around the 101 level, which could be filled and act as resistance.

DXY 1H Chart

DXY is currently breaking below previous intraday lows, but an irregular abc flat correction in wave ii remains possible, with the gap fill still in play before wave iii lower unfolds. Alternatively, DXY may consolidate sideways within a larger bearish triangle pattern.

Also note that DXY is bouncing after a typical "fake" Monday move, which often gets retraced. So, despite testing recent lows, the potential for a broader abc flat correction remains, with wave c possibly filling the May 18 gap before the bearish trend resumes.

More By This Author:

Crypto Market Is Finishing A Correction Within Uptrend

Litecoin Is Forming A Bullish Pattern

Kiwi Consolidates Within A Flat Correction Before Further Rally