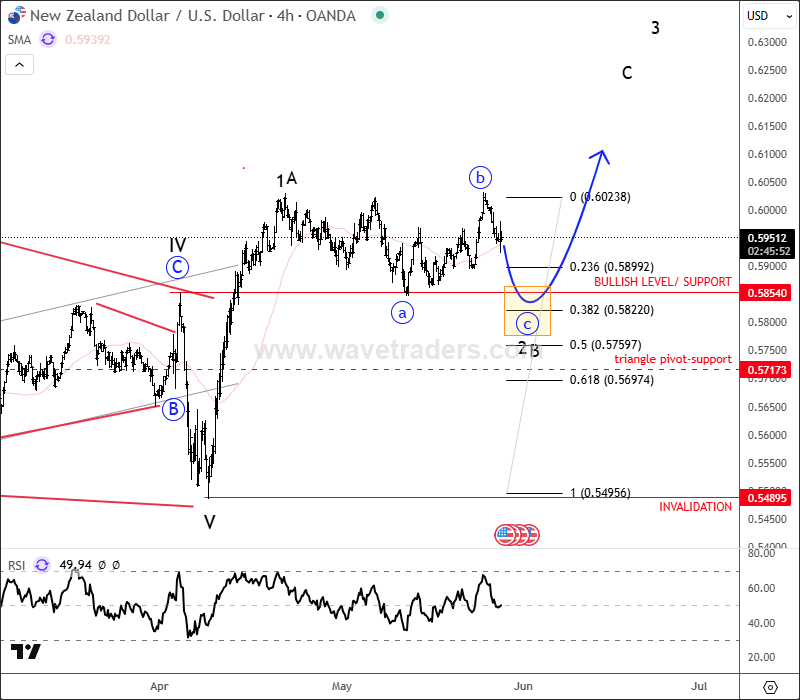

Kiwi Consolidates Within A Flat Correction Before Further Rally

Photo by Thomas Coker on Unsplash

The Kiwi (NZDUSD) made a very strong recovery, clearly in an impulsive price action from the recent 2025 lows at 0.55485, and this impulse suggests the pair has likely bottomed, especially with a decisive move above the 0.5854 bullish level which we see it as a first leg A/1. So, after a corrective retracement in wave B/2, which looks to be still in progress as a larger abc flat correction that can retest 0.58 support area, we certainly expect much higher prices within wave C or 3, possibly even up to 0.62, particularly as the daily chart shows a clean breakout from an ending diagonal.

NZDUSD 4H Chart

RBNZ cuts cash rate by 25bp vs. 25bp expected, so the Kiwi(NZDUSD) can be still looking lower within wave »c« down to 0.58x support area to a complete an abc flat correction on the intraday basis before bulls show up again.

NZDUSD 2H Chart

More By This Author:

USDJPY Faces An Intraday Corrective Recovery: Elliott Wave Intraday Analysis

Crypto Market Slows Down For A Pullback Within Bullish Trend

Theta Token Is In A Larger Flat Correction