US Dollar Index: More Upside Likely Amid 20 And 50-Day EMAs Bullish Crossover

- The US Dollar Index falls to near 99.20 amid uncertainty ahead of the long weekend in the US.

- Fed’s Schmid and Bostic argued in favor of a modestly restrictive monetary policy stance.

- The DXY could extend gains if the RSI (14) breaks above 60.00.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.15% lower to near 99.20 during the European trading session on Friday, ahead of an extended weekend in the United States (US), correcting from its six-week high of 99.50 posted the previous day.

On Thursday, the US Dollar (USD) gained sharply after a few Federal Reserve (Fed) officials: Fed officials: Kansas Fed Bank President Jeffrey Schmid and Atlanta Fed Bank President Raphael Bostic, stressed the need to adopt a restrictive monetary policy stance, citing upside inflation risks.

“Monetary policy needs to be modestly restrictive as inflation is too hot,” Schmid said at the Economic Club of Kansas City, warning that more interest rate cuts could worsen the inflation situation.

This week, the US Consumer Price Index (CPI) data for December showed that price pressures remained steady.

US Dollar Index technical analysis

(Click on image to enlarge)

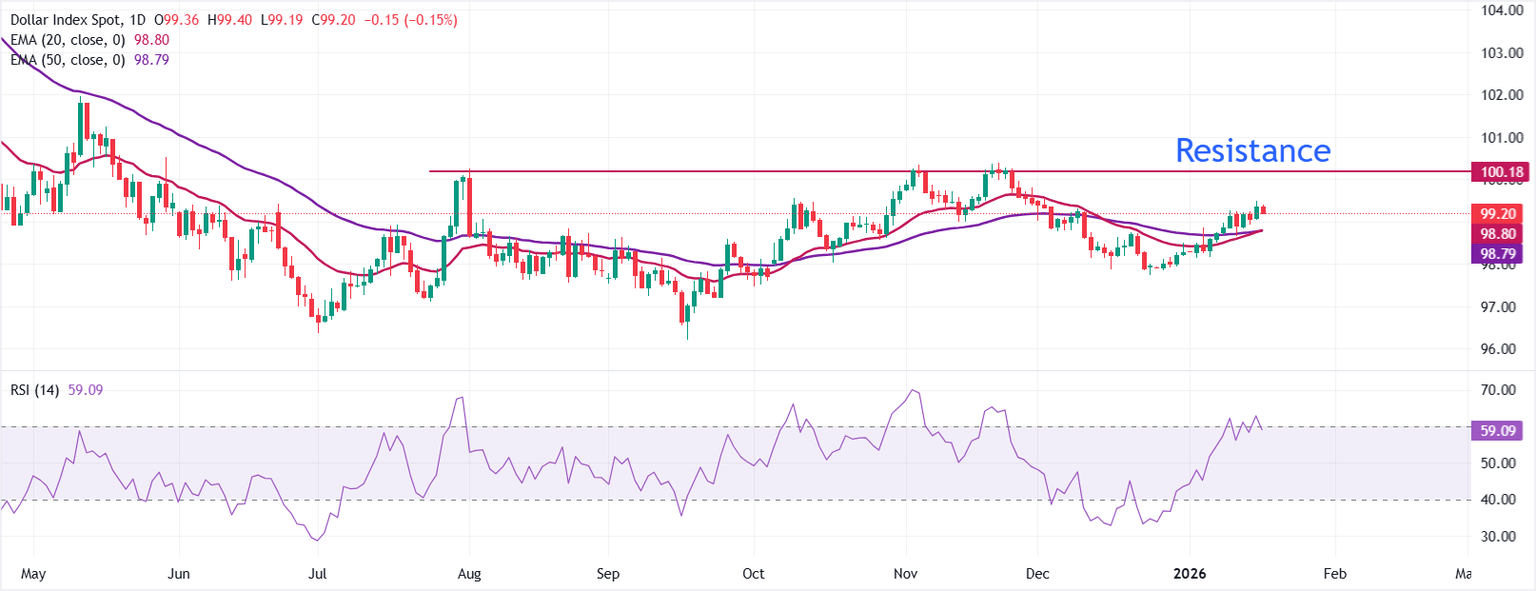

In the daily chart, the Dollar Index Spot trades at 99.20. Price holds above the rising 20-Exponential Moving Average (EMA) at 98.80 and the 50-EMA at 98.79, with these averages acting as immediate supports. The 20-EMA rises marginally above the 50-EMA, reinforcing a positive near-term bias.

The 14-day Relative Strength Index (RSI) at 59 (neutral-bullish) stays above 50, backing the recovery in momentum.

Momentum would stay positive while the index holds above the 20-EMA, and a pullback could test the 50-EMA as first support. RSI eased from 62.92 to 59.10 but remains above the midline, keeping the backdrop supportive. Continued acceptance above the EMA cluster could extend the move, whereas a close below the short-term average would open the way toward the medium-term baseline.

More By This Author:

XAG/USD Rally Hits Pause As US Says No To Tariffs On Critical Minerals

Pound Sterling Rebounds Slightly As UK GDP Returns To Growth

USD/INR Expects Cautious Start On Friday As Oil Price Cools Down

(The technical analysis of this story was written with the help of an AI tool.)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and ...

more